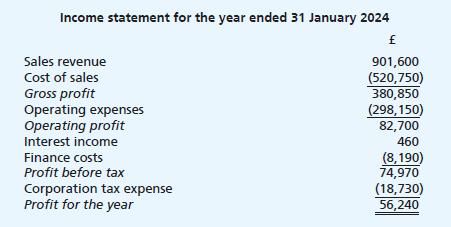

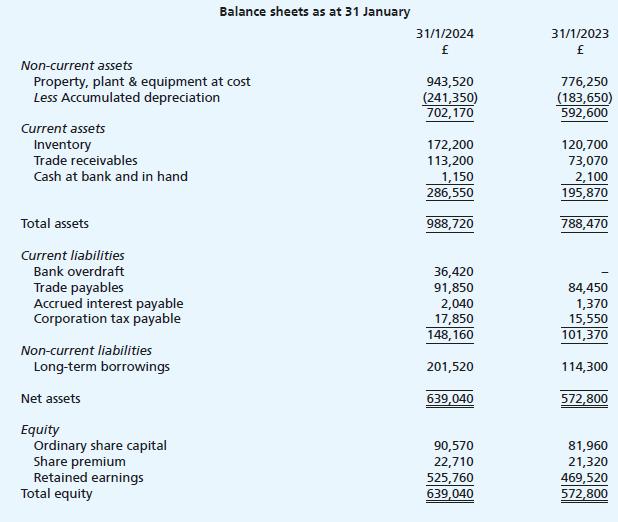

Rabada Ltd needs to prepare its statement of cash flows for the year ended 31 January 2024.

Question:

Rabada Ltd needs to prepare its statement of cash flows for the year ended 31 January 2024.

You are furnished with the following information:

Additional information:

(i) The figure for operating profit above is stated after charging depreciation of £78,030.

(ii) In June 2023, the company disposed of equipment for £75,950 cash. The equipment had a carrying amount of £62,270 as at the date of disposal.

(iii) There were no amounts outstanding in respect of interest receivable as at either year end date.

(iv) The company issued new ordinary shares for cash during September 2023.

Required:

(a) Using the indirect method, prepare the statement of cash flows for Rabada Ltd for the year ended 31 January 2024 in accordance with the requirements of IAS 7.

(b) Comment of the performance of Rabada Ltd on the basis of the statement of cash flows you have produced in a).

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood