Rowlock Ltd was incorporated on 1 October 2008 to acquire Rowlocks mail order business, with effect from

Question:

Rowlock Ltd was incorporated on 1 October 2008 to acquire Rowlock’s mail order business, with effect from 1 June 2008.

The purchase consideration was agreed at £35,000 to be satisfied by the issue on 1 December 2008 to Rowlock or his nominee of 20,000 ordinary shares of £1 each, fully paid, and £15,000 7 per cent debentures.

The entries relating to the transfer were not made in the books which were carried on without a break until 31 May 2009.

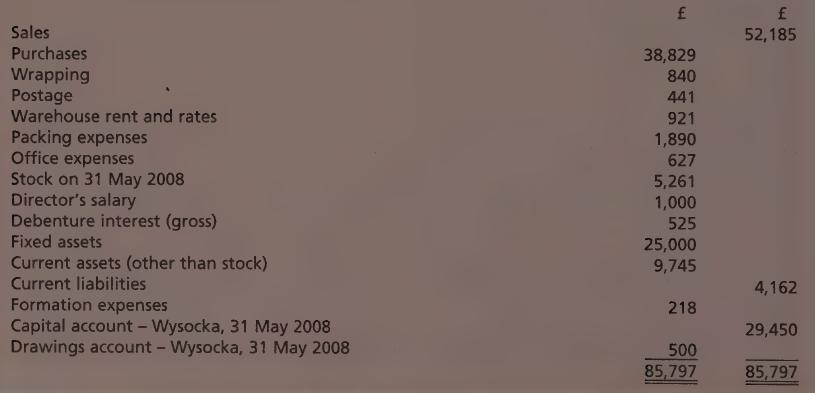

On 31 May 2009 the trial balance extracted from the books is:

You also ascertain the following:

1. Stock on 31. May 2009 amounted to £4,946.

2. The average monthly sales for June, July and August were one- -half of those for the remaining months of the year. The gross profit margin was constant throughout the year. —

3. Wrapping, postage and packing expenses varied in direct proportion to sales, whilst office:

expenses were constant each month.

4. Formation expenses are to be written off.

You are required to prepare the trading and profit and loss account for the year - ending 31 May ~ 2009 apportioned between the periods before and after incorporation, and the balance sheet as at that date.

Step by Step Answer:

Business Accounting Uk Gaap Volume 2

ISBN: 9780273718802

1st Edition

Authors: Alan Sangster, Frank Wood