A Rowlock Ltd was incorporated on 1 October (19 mathrm{X} 8) to acquire Rowlock's mail order business,

Question:

A Rowlock Ltd was incorporated on 1 October \(19 \mathrm{X} 8\) to acquire Rowlock's mail order business, with effect from 1 June 19 X8.

The purchase consideration was agreed at \(£ 35,000\) to be satisfied by the issue on 1 December \(19 \times 8\) to Rowlock or his nominee of 20,000 ordinary shares of \(£ 1\) each, fully paid, and \(£ 15,0007\) per cent debentures.

The entries relating to the transfer were not made in the books which were carried on without a break until 31 May 19X9.

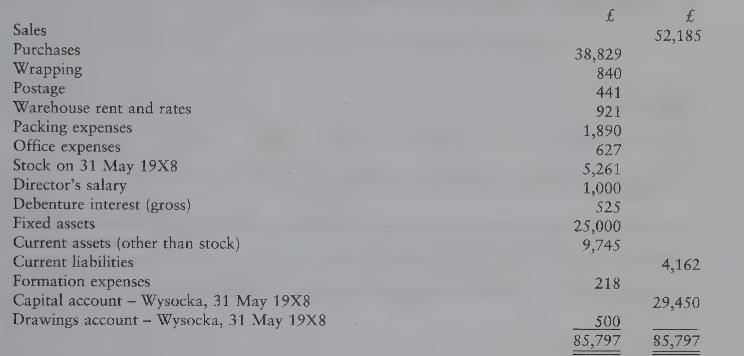

On 31 May 19X9 the trial balance extracted from the books is:

You also ascertain the following:

1 Stock on 31 May 19 X9 amounted to \(£ 4,946\).

2 The average monthly sales for June, July and August were one-half of those for the remaining months of the year. The gross profit margin was constant throughout the year.

3 Wrapping, postage and packing expenses varied in direct proportion to sales, whilst office expenses were constant each month.

4 Formation expenses are to be written off.

You are required to prepare the trading and profit and loss account for the year ended 31 May 19X9 apportioned between the periods before and after incorporation, and the balance sheet as at that date.

Step by Step Answer: