A From the following information you are required to prepare a statement apportioning the unappropriated profit between

Question:

A From the following information you are required to prepare a statement apportioning the unappropriated profit between the pre-incorporation and post-incorporation periods, showing the basis of apportionment:

VU Limited was incorporated on 1 July 19 X9 with an authorised share capital of 60,000 ordinary shares of \(£ 1\) each, to take over the business of \(\mathrm{L}\) and Sons as from 1 April 19 X9.

The purchase consideration was agreed at \(£ 50,000\) for the net tangible assets taken over, plus a further \(£ 6,000\) for goodwill.

Payment was satisfied by the issue of \(£ 30,0008\) per cent debentures and 26,000 ordinary shares both at par, on 1 August 19 X9. Interest at 10 per cent per annum on the purchase consideration was paid up to this date.

The company raised a further \(£ 20,000\) on 1 August \(19 \mathrm{X} 9\) by the issue of ordinary shares at a premium of \(£0.25\) per share.

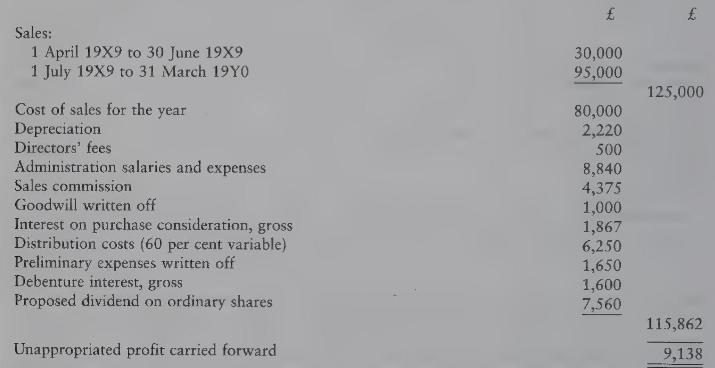

The abridged profit and loss account for the year to 31 March \(19 \mathrm{X} 0\) was as follows:

Unappropriated profit carried forward The company sells one product only, of which the unit selling price has remained constant during the year, but due to improved buying the unit cost of sales was reduced by 10 per cent in the post-incorporation period as compared with the pre-incorporation period.

Taxation is to be ignored.

Step by Step Answer: