The following list of balances as at 31 July 2016 has been extracted from the books of

Question:

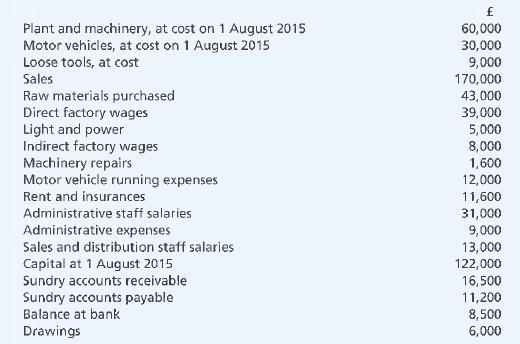

The following list of balances as at 31 July 2016 has been extracted from the books of Jane Seymour who commenced business on 1 August 2015 as a designer and manufacturer of kitchen furniture:

Additional information for the year ended 31 July 2016:

(1) It is estimated that the plant and machinery will be used in the business for ten years and the motor vehicles used for four years: in both cases it is estimated that the residual value will be nil. The straight line method of providing for depreciation is to be used.

(2) Light and power charges accrued due at 31 July 2016 amounted to £1,000 and insurances prepaid at 31 July 2016 totaled £800.

(3) Inventory was valued at cost at 31 July 2016 as follows:

![]()

(4) The valuation of work-in-progress at 31 July 2016 included variable and fixed factory overheads and amounted to £12,300.

(5) Two-thirds of the light and power and rent and insurances costs are to be allocated to the factory costs and one-third to general administration costs.

(6) Motor vehicle costs are to be allocated equally to factory costs and general administration costs.

(7) Goods manufactured during the year are to be transferred to the trading account at £95,000.

(8) Loose tools in hand on 31 July 2016 were valued at £5,000.

Required:

(a) Prepare a manufacturing account and statement of profit or loss for the year ending 31 July 2016 of Jane Seymour.

(b) An explanation of how each of the following accounting concepts have affected the preparation of the above accounts:

• conservatism • matching • going concern

Step by Step Answer:

Frank Woods Business Accounting Volume 1

ISBN: 9781292084664

13th Edition

Authors: Alan Sangster, Frank Wood