The following trial balance has been extracted from the books of Arran plc as at 31 March

Question:

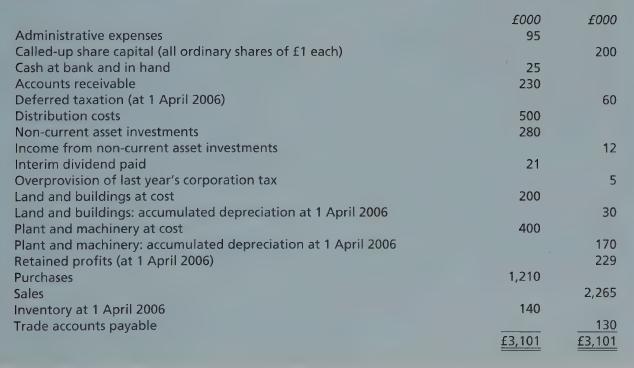

The following trial balance has been extracted from the books of Arran plc as at 31 March 2007:

Additional information:

1 Inventory at 31 March 2007 was valued at £150,000.

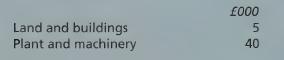

2 Depreciation for the year to 31 March 2007 is to be charged against administrative expenses as follows:

3 Assume that the basic rate of income tax is 30%.

4 Corporation tax of £180,000 is to be charged against profits on ordinary activities for the year to 31 March 2007.

5 £4,000 is to be transferred to the deferred taxation account.

6 The company proposes to pay a final ordinary dividend of 30p per share.

Required:

In so far as the information permits, prepare the company’s income statement for the year ending 31 March 2007 and a balance sheet as at that date in accordance with the Companies Acts and related accounting standards. Note: Income statement and balance sheet notes are not required, but you should show the basis and computation of earnings per share at the foot of the income statement, and your workings should be submitted.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273712138

11th Edition

Authors: Frank Wood, Alan Sangster