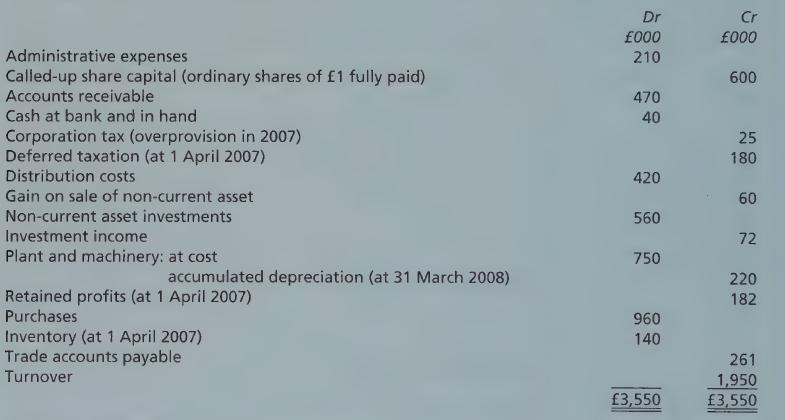

The following trial balance has been extracted from the books of account of Greet plc as at

Question:

The following trial balance has been extracted from the books of account of Greet plc as at 31 March 2008

Additional information:

1 Inventory at 31 March 2008 was valued at £150,000.

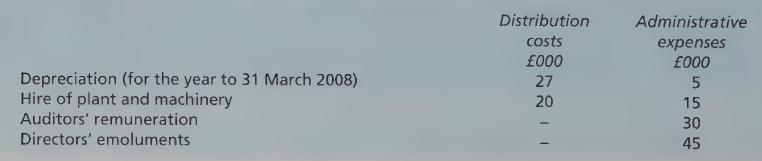

2 The following items are already included in the balances listed in the above trial balance:

3 The following rates of taxation are to be assumed:

4 The corporation tax charge based on the profits for the year is estimated to be 52,000.

5 A transfer of 16,000 is to be made to the credit of the deferred taxation account.

6 The gain made on the disposal of a non-current asset related to a factory in Belgium following the closure of the company's entire operations in that country.

7 The company's authorised share capital consists of 1,000,000 ordinary shares of 1 each.

8 A final ordinary payment of 50p per share is proposed.

9 There were no purchases or disposals of non-current assets during the year.

10 The market value of the non-current assets investments as at 31 March 2008 was 580,000. There were no purchases or sales of such investments during the year.

Required:

In so far as the information permits, prepare the company’s published income statement for the year ending 31 March 2008 and a balance sheet as at that date in accordance with the Companies Acts and with related accounting standards.

Relevant notes to the income statement and balance sheet and detailed workings should be submitted with your answer, but a statement of the company’s accounting policies is not required.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273712138

11th Edition

Authors: Frank Wood, Alan Sangster