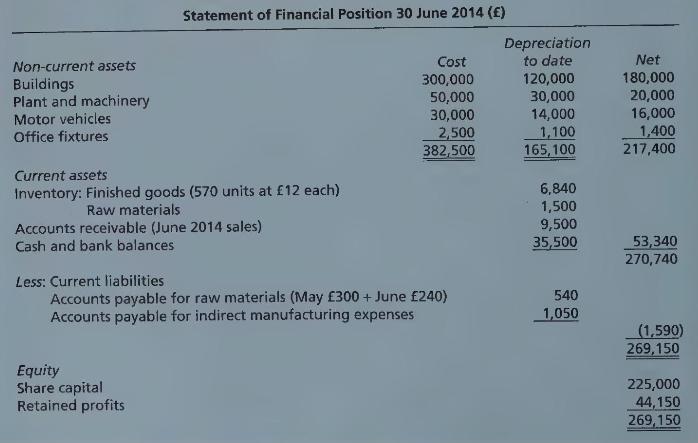

The statement of financial position of Pies and Cakes Ltd at 30 June 2014 was expected to

Question:

The statement of financial position of Pies and Cakes Ltd at 30 June 2014 was expected to be as follows:

The plans for the six months to 31 December 2014 can be summarised as:

(i) Production costs per unit will be:

\begin{tabular}{lr}

Direct materials & $£$ \\

Direct labour & 2 \\

Variable indirect manufacturing expenses & 6 \\

& $\underline{4}$ \\

\hline \end{tabular}

(ii) Sales will be at a price of $£ 20$ per unit for the three months to 30 September and at $£ 21$ subsequently. The number of units sold will be:

$$

\begin{array}{ccccccc}

& \text { Jul } & \text { Aug } & \text { Sept } & \text { Oct } & \text { Nov } & \text { Dec } \\

\text { Units } & 300 & 400 & 500 & 500 & 450 & 350 \end{array}

$$

All sales will be on credit, and debtors will pay their accounts one month after they bought the goods.

(iii) Production will be consistent at 450 units per month.

(iv) Purchases of direct materials - all on credit - will be:

\begin{tabular}{cccccc}

Jul & Aug & Sept & Oct & Nov & Dec \\

$£$ & $£$ & $£$ & $£$ & $£$ & $£$ \\

1,100 & 1,000 & 800 & 700 & 700 & 900 \end{tabular}

Creditors for direct materials will be paid two months after purchase.

(v) Direct labour is paid in the same month as production occurs.

(vi) Variable indirect manufacturing expenses are paid in the month following that in which the units are produced.

(vii) Fixed indirect manufacturing expenses of $£ 450$ per month are paid each month and never in arrears.

(viii) A machine costing $£ 2,500$ will be bought and paid for in July. A motor vehicle costing $£ 10,000$ will be bought and paid for in September.

(ix) Loan notes of $£ 25,000$ will be issued and the cash received in November. Interest will not be charged until 2015.

(x) Provide for depreciation for the six months: Buildings $£ 15,000$; Motor vehicles $£ 4,000$; Office fixtures $£ 220$; Plant and machinery $£ 5,000$.

You are required to draw up as a minimum:

(a) Cash budget, showing figures each month.

(b) Accounts receivable budget, showing figures each month.

(c) Accounts payable budget, showing figures each month.

(d) Raw materials budget, showing figures each month.

(e) Forecast operating statement for the six months.

(f) Forecast statement of financial position as at 31 December 2014.

In addition, draw up any other budgets which show the workings behind the above budgets.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273767923

12th Edition

Authors: Frank Wood, Ph.D. Sangster, Alan