XY Ltd provides for depreciation of its machinery at 20% per annum on cost; it charges for

Question:

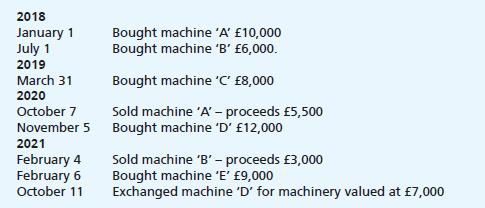

XY Ltd provides for depreciation of its machinery at 20% per annum on cost; it charges for a full year in the year of purchase but none in the year of sale/disposal.

Financial statements are prepared annually to 31 December.

Prepare

(a) The machinery at cost account for the period 1 January 2018 to 31 December 2021.

(b) The accumulated depreciation on machinery account, for the period 1 January 2018 to 31 December 2021.

(c) The disposal of machinery accounts showing the profit/loss on sale for each year.

(d) The balance sheet extract for machinery at (i) 31 December 2020 and (ii) 31 December 2021.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood

Question Posted: