You are presented with the following balance sheets of S. Ahmeds business as at 31 March: Further

Question:

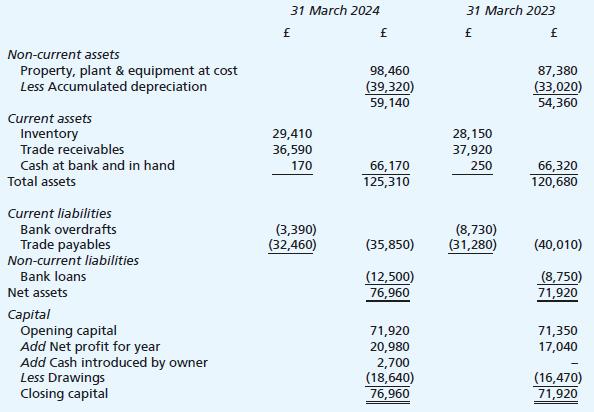

You are presented with the following balance sheets of S. Ahmed’s business as at 31 March:

Further information:

(i) The depreciation expense for the year ended 31 March 2024 was £7,490.

(ii) In February 2024, a piece of equipment was sold for £1,900 cash, realising a profit on disposal of £230.

(iii) The figures given for trade receivables in the balance sheets are stated after the deduction of the allowance for doubtful debts.

Required:

In accordance with the requirements of IAS 7, prepare the statement of cash flows for the year ended 31 March 2024 using the indirect method.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood

Question Posted: