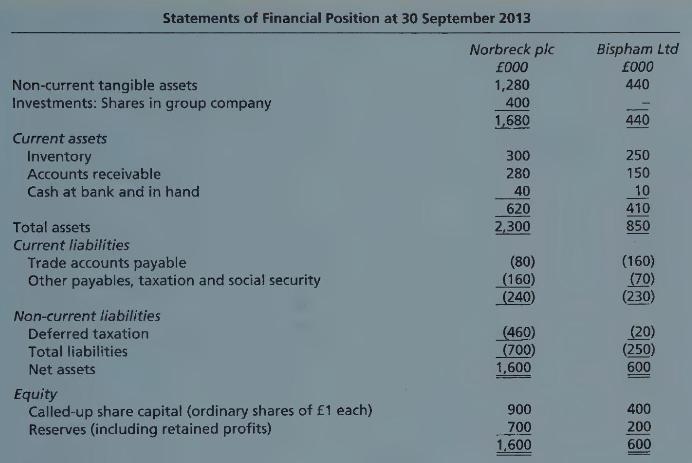

You are presented with the following summarised information for Norbreck pic and its subsidiary, Bispham Ltd: Income

Question:

You are presented with the following summarised information for Norbreck pic and its subsidiary, Bispham Ltd: Income Statements for the year ending 30 September 2013 Norbreck plc Bispham Ltd 000 000 Revenue 1,700 450 Cost of sales (920) (75) Gross profit 780 375 Administration expenses (300) (175) Income from shares in group company 120 - Profit before taxation 600 200 Taxation (30) (20) Profit for the year 570 180

Additional information:

(a) Norbreck plc acquired $80 \%$ of the shares in Bispham Ltd on 1 October 2010. Bispham's retained profits balance as at that date was $£ 10,000$.

(b) During the year, Norbreck paid dividends of $£ 360,000$ and Bispham paid dividends of $£ 150,000$.

\section*{Required:}

Prepare Bispham plc's consolidated income statement for the year ending 30 September 2013 and a consolidated statement of financial position as at that date.

Note: Formal notes to the account are not required, although detailed workings should be submitted with your answer. You should also append to the consolidated income statement your calculation of earnings per share and a statement showing the make-up of 'retained profits carried forward'.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273767923

12th Edition

Authors: Frank Wood, Ph.D. Sangster, Alan