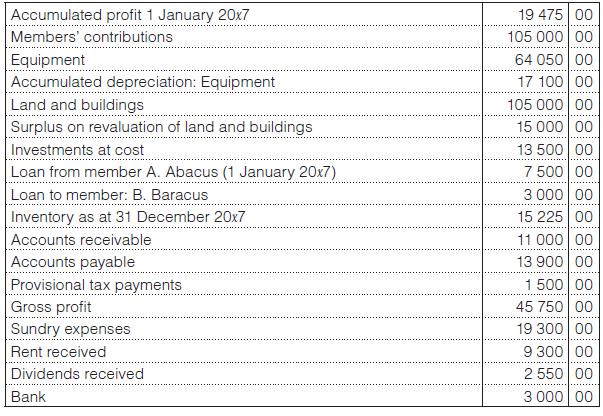

The balances listed below are from the books of Inventive CC as at 31 December 20x7: Additional

Question:

The balances listed below are from the books of Inventive CC as at 31 December 20x7:

Additional information:

• A distribution of R6 000 of the undrawn income for 20x7 is made to the members and credited to the loan accounts.

• Apply a current tax rate of 28%.

• Inventory is valued at the lowest of cost or net realisable value on a FIFO basis.

• Interest of R525 was paid on the member’s loan from A. Abacus and an additional R200 should be accrued. The CC repaid R600 on 30 January 20x7.

• The loan to B. Baracus is interest free. The CC advanced B. Baracus a further R1 050 during the year, and he repaid R1 650 during the year.

• Income for the year comprised net sales to customers and amounted to R290 000.

• The three members of the CC were A. Abacus, B. Baracus and I. Ilias.

– Their members’ contributions were in the same ratio as their interest, being 25%, 50% and 25% respectively.

– The contributions of A. Abacus and B. Baracus were fully paid up, but I. Ilias still owed an amount of R7 500 for his contribution.

• Investments consist of:

– 7 500 ordinary shares in Alto (Pty) Ltd bought for R10 000 during 20x6. (Members’ valuation = R10 000.)

– 3 000 ordinary shares in Efraim Industries (Pty) Ltd bought at a cost of R3 500 during 20x5. (Members’ valuation = R7 000.)

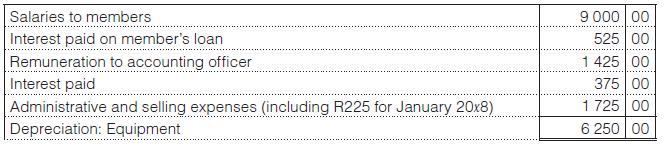

• Sundry expenses consist of:

You are required to:

1 Prepare the statement of financial position and statement of profit or loss & other comprehensive income for Inventive CC for the year ended 31 December 20x7 according to IFRS.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit