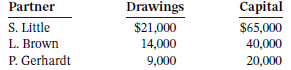

At the end of its first year of operations, on December 31, 2021, LBG Company?s accounts show

Question:

At the end of its first year of operations, on December 31, 2021, LBG Company?s accounts show the following:

The capital balance represents each partner?s initial capital investment on January 1, 2021. No closing entries have been recorded for profi t (loss) as yet.

Instructions

a. Journalize the entry to record the division of profit for the year ended December 31, 2021, under each of the following independent assumptions:

1. Profit is $55,000. Little, Brown, and Gerhardt are given salary allowances of $5,000, $25,000, and $10,000, respectively. The remainder is shared equally.

2. Profit is $25,000. Each partner is allowed interest of 7% on beginning capital balances. Brown and Gerhardt are given salary allowances of $15,000 and $20,000, respectively. The remainder is shared 3:2:1.

b. Prepare a statement of partners? equity for the year under assumption 2 in part (a) above.

Taking It Further

Explain why partnerships such as LBG Company include a salary allowance in their profit- and loss-sharing arrangements.

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 978-1119502555

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak