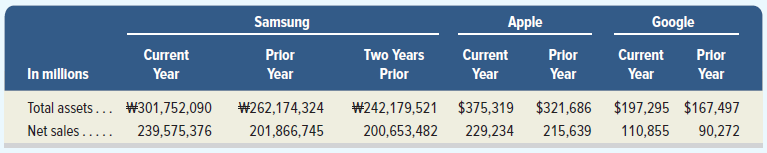

Comparative figures for Samsung, Apple, and Google follow. Required 1. Compute total asset turnover for the most

Question:

Comparative figures for Samsung, Apple, and Google follow.

Required

1. Compute total asset turnover for the most recent two years for Samsung using the data shown.

2. Is Samsung’s asset turnover on a favorable or unfavorable trend?

3. For the current year, is Samsung’s asset turnover better or worse than the asset turnover for

(a) Apple

(b) Google?

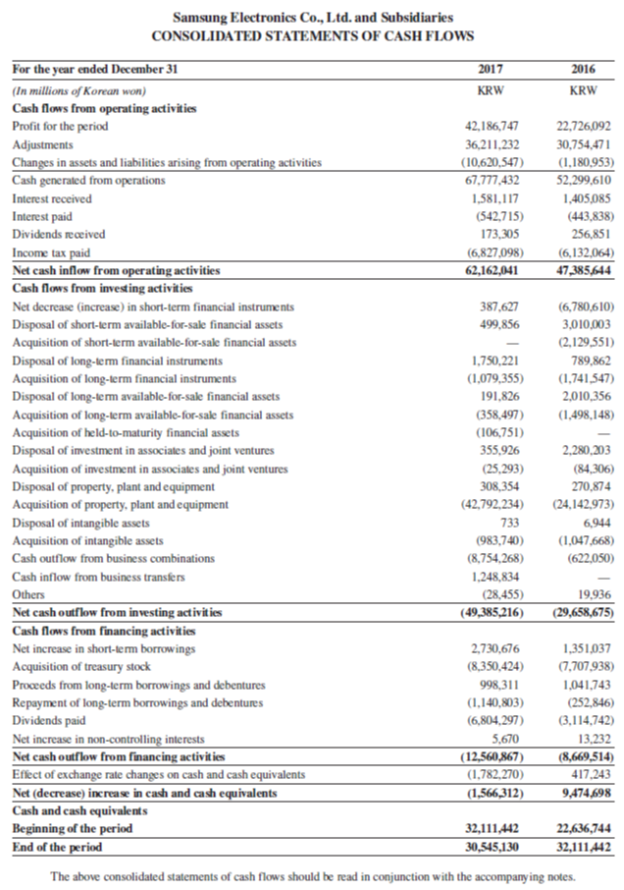

Data from Samsung

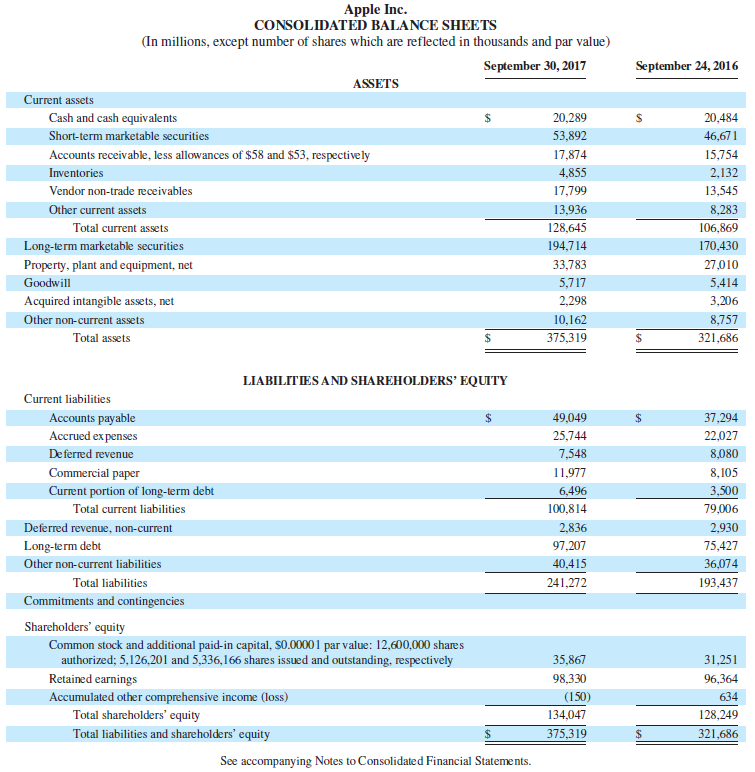

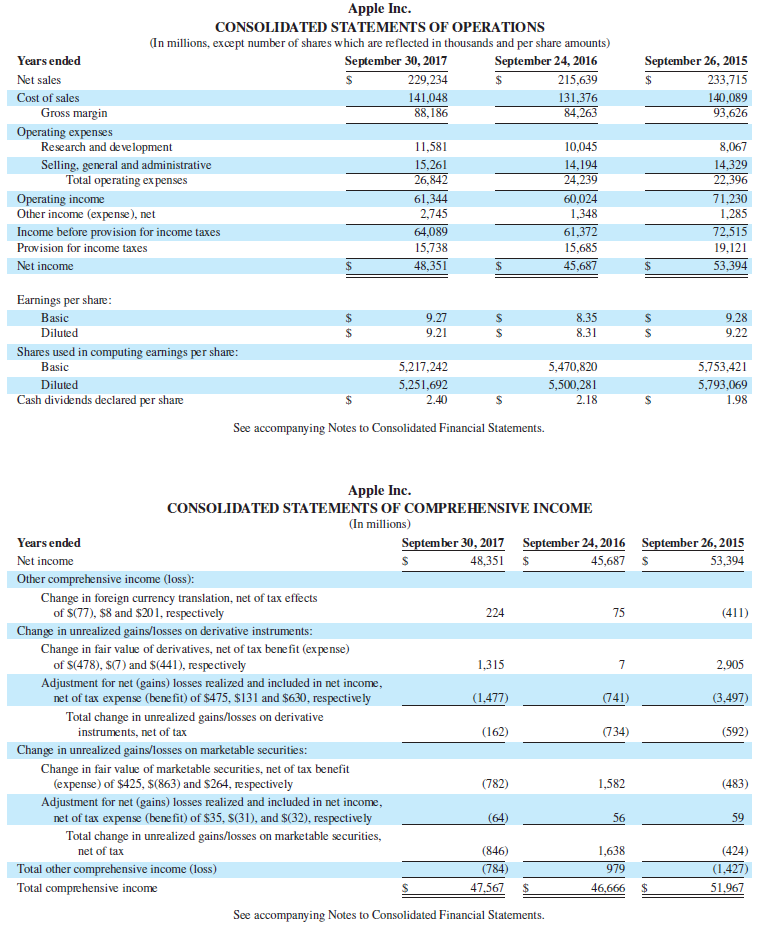

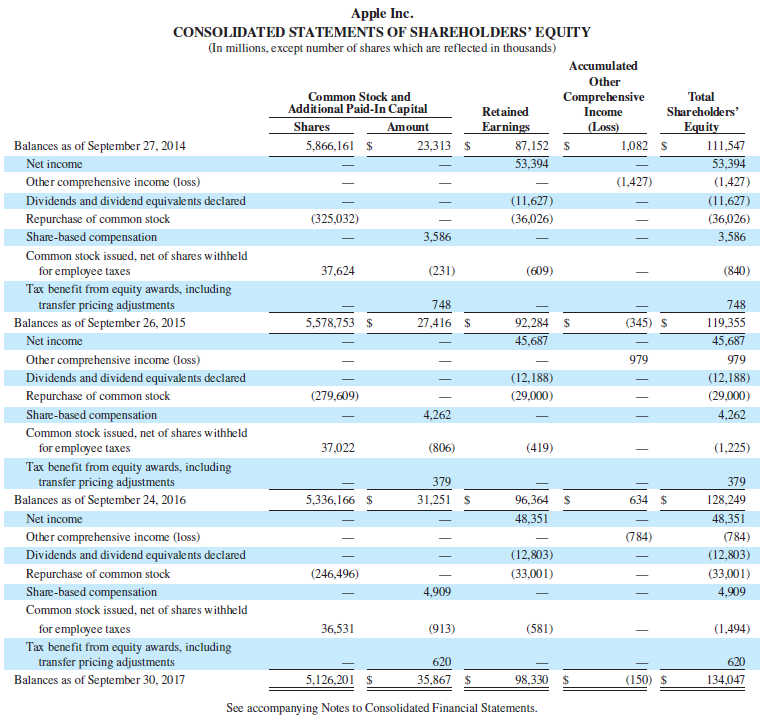

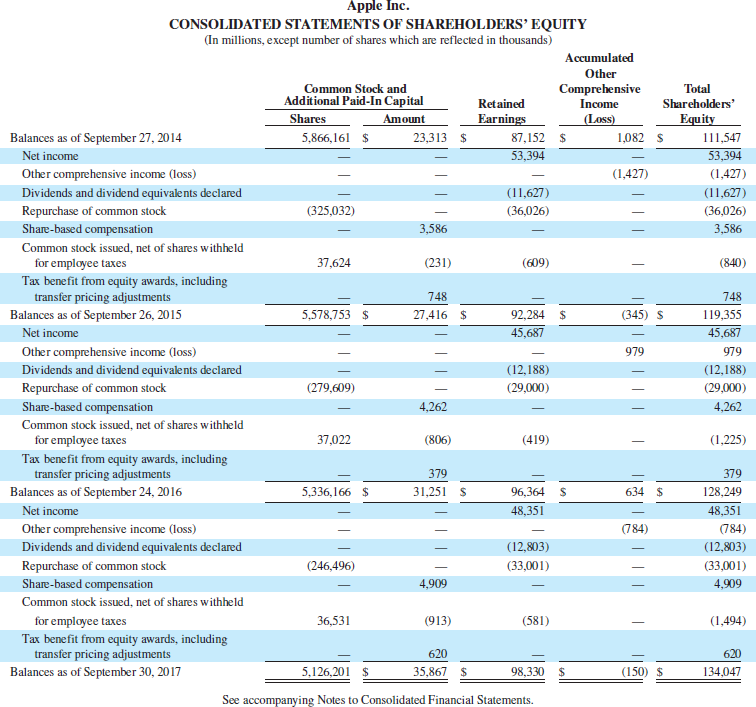

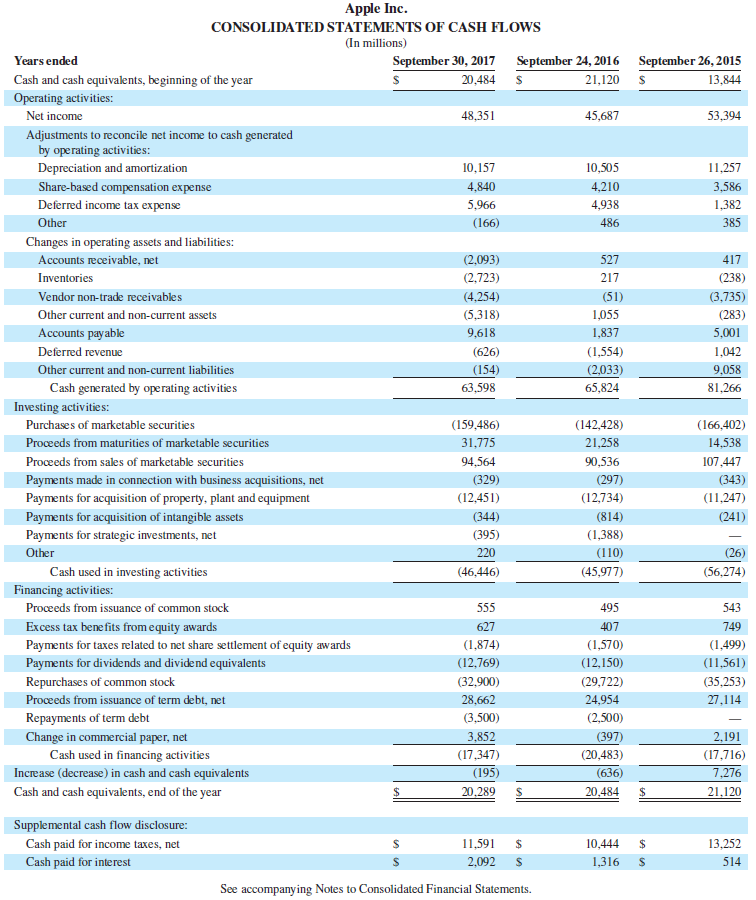

Apple’s

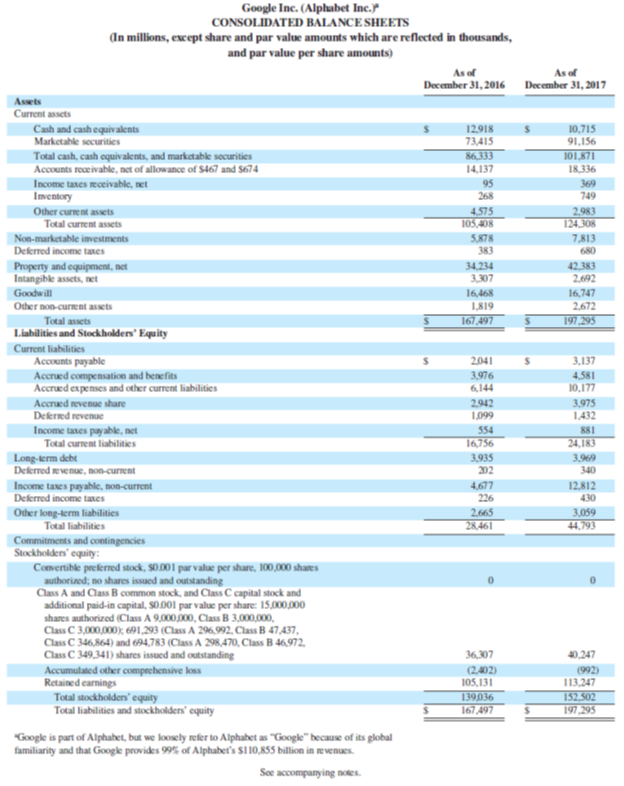

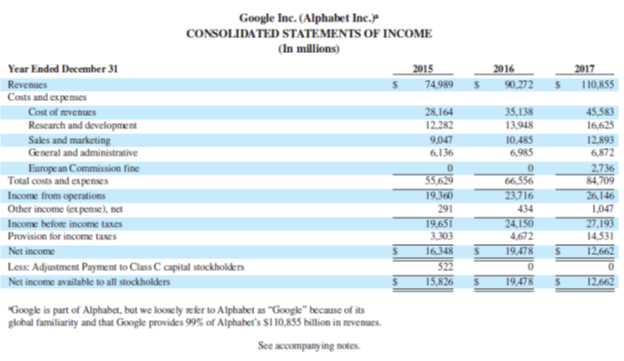

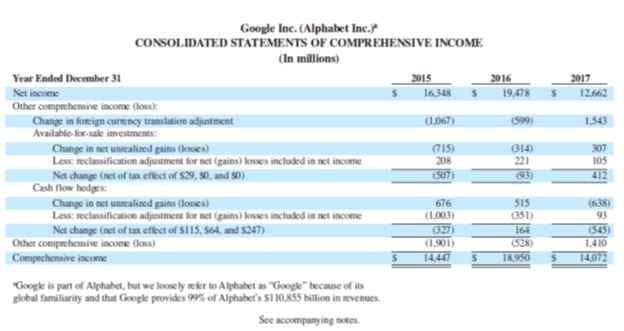

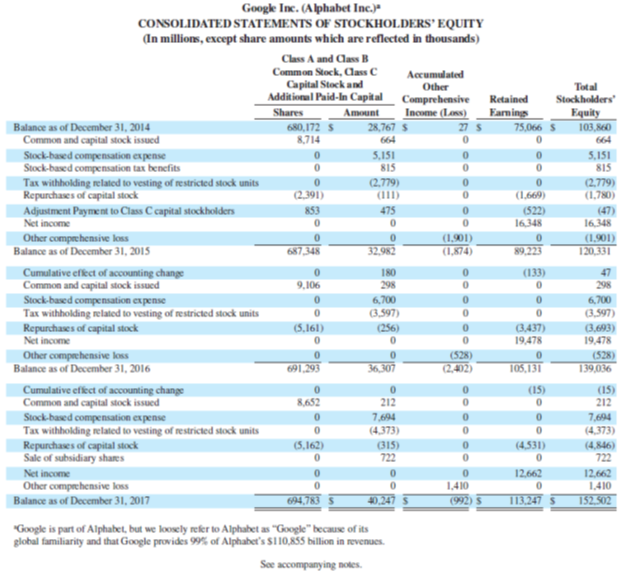

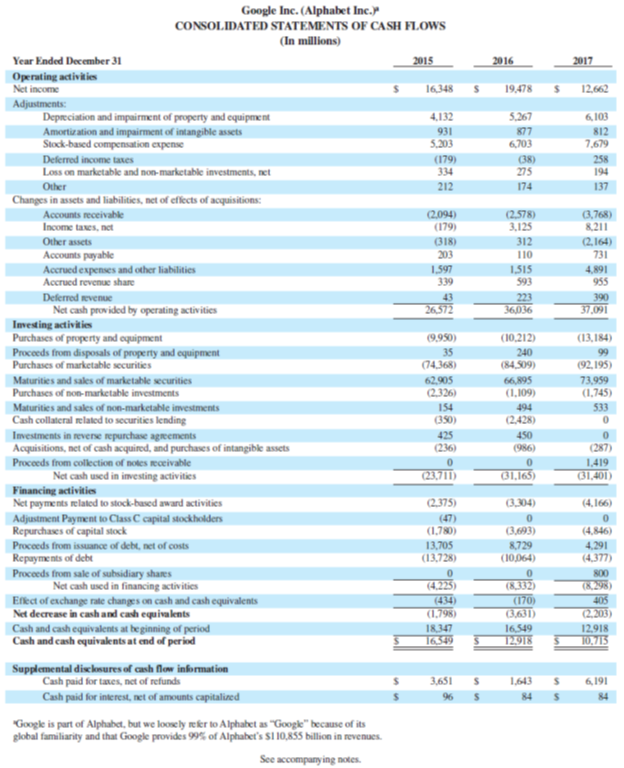

Data from Google's

Asset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio.

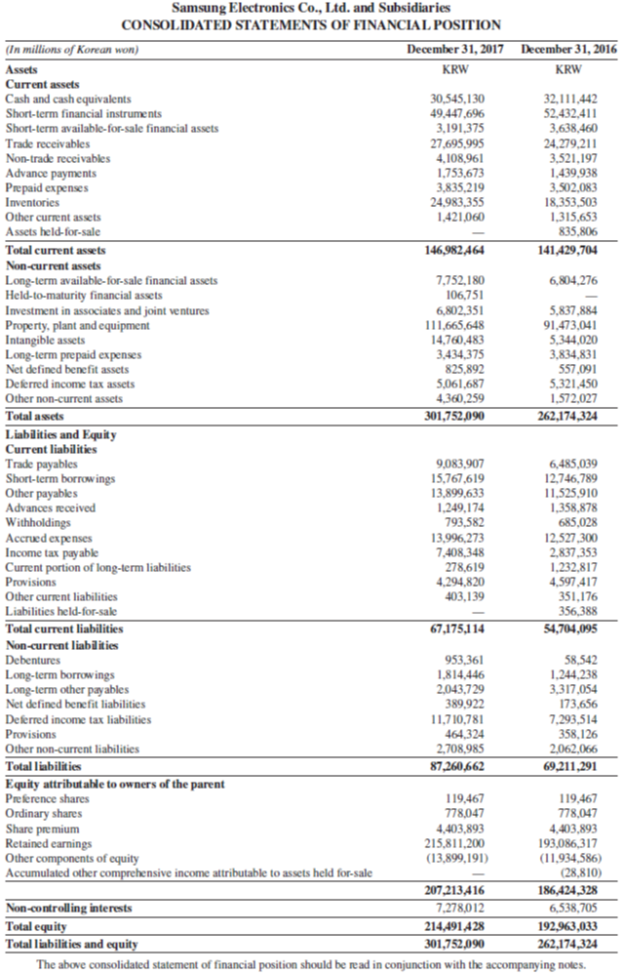

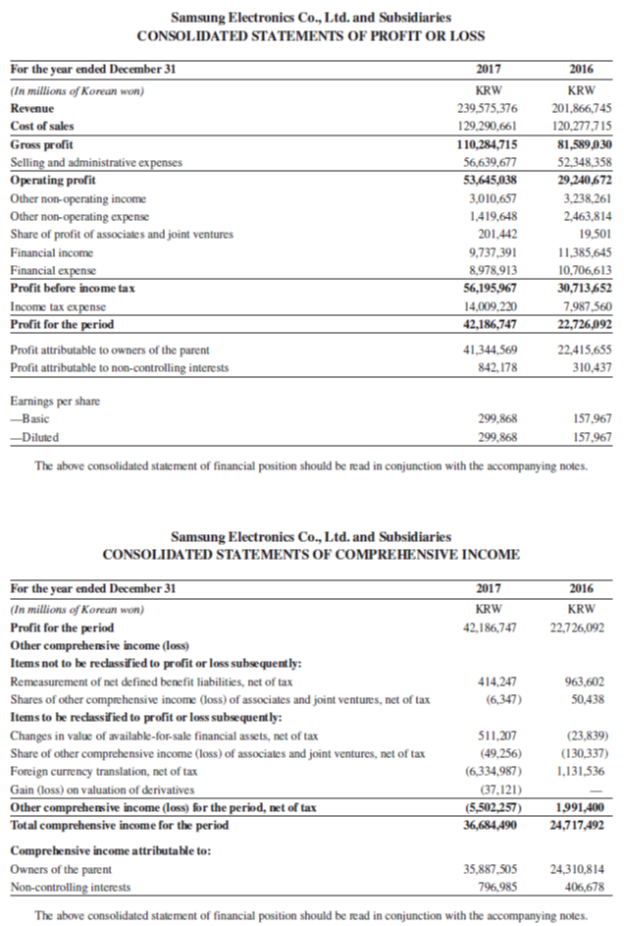

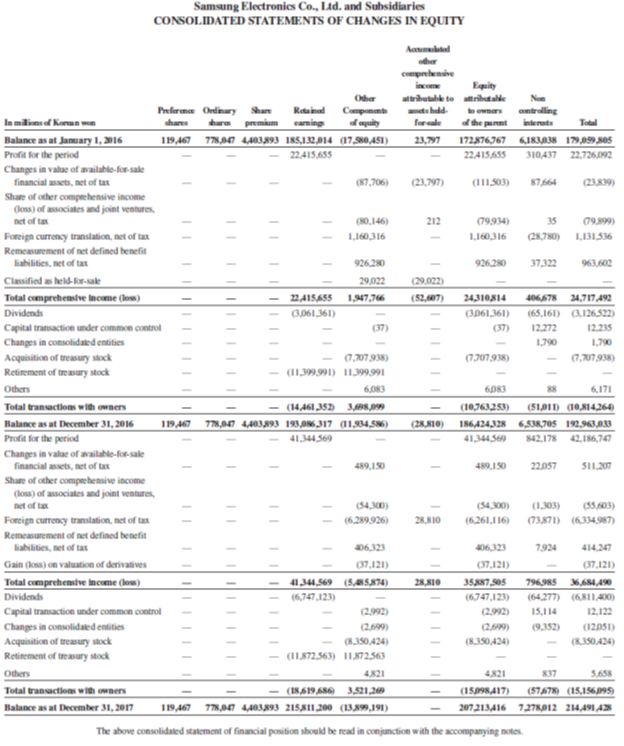

Samsung Google Current Year Apple Two Years Prior Prior Year Prior Year Current Year Current Year Prior Year In millions #262,174,324 201,866,745 $321,686 215,639 Total assets... W301,752,090 Net sales .... 239,575,376 $197,295 $167,497 $375,319 229,234 #242,179,521 200,653,482 110,855 90,272 Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (In millions of Korean won) December 31, 2017 December 31, 2016 Assets KRW KRW Current assets Cash and cash equivalents Short-term financial instruments Short-term available-for-sale financial assets Trade receivables Non-trade receivables Advance payments Prepaid expenses Inventories 30,545,130 49,447,696 3,191,375 27,695,995 4,108,961 1,753,673 3,835,219 24.983.355 1,421,060 32,111,442 52,432,411 3,638,460 24,279,211 3,521,197 1,439,938 3,502,083 18,353,503 1,315,653 835,806 Other current assets Assets held-for-sale Total current assets 146,982,464 141,429,704 Non-current assets Long-term available-for-sale financial assets Held-to-maturity financial assets Investment in associates and joint ventures Property, plant and equipment Intangible assets Long-term prepaid expenses Net defined benefit assets 7,752,180 106,751 6,802.351 111,665,648 14,760,483 3,434.375 6,804,276 5,837,884 91,473,041 5,344,020 3,834,831 557,091 5,321,450 1,572,027 825,892 5,061,687 4,360,259 301,752,090 Deferred income tax assets Other non-current assets Total assets 262,174,324 Liabilities and Equity Current liabilities Trade payables Short-term borrow ings Other payables Advances received 9,083,907 15,767,619 13,899,633 1,249,174 793,582 6,485,039 12,746,789 11,525,910 1,358,878 685,028 12,527,300 2,837,353 1,232,817 4,597,417 351,176 356,388 54,704,095 Withholdings Accrued expenses Income tax payable Current portion of long-term liabilities Provisions 13,996,273 7,408,348 278,619 4,294,820 403,139 Other current liabilities Liabilities held-for-sake Total current liabilities 67,175,1 14 Non-current liablities Debentures 58,542 1,244,238 3,317,054 173,656 7,293,514 358,126 2,062,066 69,211,291 Long-term borrowings Long-term other payables Net defined benefit liabilities 953,361 1,814,446 2,043,729 389,922 Deferred income tax liabilities Provisions Other non-current liabilities 11,710,781 464324 2,708,985 87,260,662 Total liabilities Equity attribut able to owners of the parent Prekrence shares Ordinary shares Share premium Retained earnings Other components of equity Accumulated other comprehensive income attributable to assets held for-sale 119,467 778,047 4,403,893 215,811,200 (13,899,191) 119,467 778,047 4,403,893 193,086,317 (11,934,586) (28,810) 207,213416 186,424,328 Non-controlling interests Total equity Total linbilities and equity 7,278,012 214,491,428 6,538,705 192.963,033 301.752,090 262,174,324 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. |||||

Step by Step Answer:

Total asset turnover Net sales Average total assets 1 Tot...View the full answer

Related Video

Financial statements of a business having numerous divisions or subsidiaries are called consolidated financial statements. Companies frequently refer to the aggregated reporting of their entire firm together when using the term \"consolidated\" in financial statement reporting. Consolidated financial statement reporting, on the other hand, is defined by the Financial Accounting Standards Board as the reporting of an entity that is organized with a parent company and subsidiaries.

Students also viewed these Business questions

-

Comparative figures for Apple and Google follow. Required 1. Compute total asset turnover for the most recent two years for Apple and Google using the data shown. 2. In the current year, which...

-

Find the amounts of the most recent two dividends paid by the (main) stock of Microsoft. Calculate the implied growth rate. Find the closing stock price that occurred three months prior to the...

-

Comparative figures for Apple and Google follow. Required: 1. Compute the accounts receivable turnover for Apple and Google for each of the two most recent years using the data shown. 2. Using the...

-

Consider the following independent situations found during audit testing of Faran Ltd, which has a balance date of 30 June 2019. Assume that all the situations are material. (i)Recent industrial...

-

A light bulb filament is made of tungsten. At room temperature of 20.0Cthe filament has a resistance of 10.0 . (a) What is the power dissipated in the light bulb immediately after it is connected to...

-

The two following separate cases show the financial position of a parent company and its subsidiary company on November 30, 2024, just after the parent had purchased 90% of the subsidiarys stock:...

-

How will you know whether the CMC plan to increase healthcare value is a success?

-

Briefly describe some of the similarities and differences between GAAP and IFRS with respect to the accounting for stockholders equity.

-

The Commercial Division of Galena Company has income from operations of $166,540 and assets of $514,000. The minimum acceptable return on assets is 9%. What is the residual income for the division?...

-

Observe someone performing an everyday task( ideally, you should choose a task for which you can observe different users performing the task repeatedly) identify frustrations and difficulties...

-

Comparative figures for Apple and Google follow. Required 1. Compute total asset turnover for the most recent two years for Apple and Google using the data shown. 2. In the current year, which...

-

What is the combined amount (in percent) of the employee and employer Social Security tax rate? (Assume wages do not exceed $128,400 per year.)

-

If f and g are increasing on an interval l, then f + g is increasing on l.

-

Mijka Company was started on January 1, Year 1. During Year 1, the company experienced the following three accounting events: 1. earned cash revenues of $32,500 2. paid cash expenses of $14,500 3....

-

Q2. Find the equations of the tangent and normal to the curve x3 + y = 2 at (1, 1). Q3. Find if y dx y= :xsinx + (sinx)cosx [10] [10]

-

Assume you have been given $400,000 CAD with access to all listed stocks, bonds, futures, and options worldwide. You can trade in options and futures, in combination with the underlying asset....

-

The formula weight (FW) of a gas can be determined using the following form of the ideal gas law FW = g R T / PV where g is the mass in grams, R is the gas constant, T is the temperature in Kelvin, P...

-

Consider a game in which a fair die is thrown. The player pays $5 to play and wins $2 for each dot that appears on the roll. Define X = number on which the die lands, and Y = player's net profit...

-

Two coins are flipped 1,000 times with the following frequencies: (A) Compute the empirical probability for each outcome. (B) Compute the theoretical probability for each outcome. (C) Using the...

-

Create a data model for one of the processes in the end-of-chapter Exercises for Chapter 4. Explain how you would balance the data model and process model.

-

Mead Inc. began operations in Year 1. Following is a series of transactions and events involving its long-term debt investments in available-for-sale securities. Year 1 Jan. 20 Purchased Johnson &...

-

Identify investments as an investment in either debt securities or equity securities. a. U.S. Treasury bonds b. Google stock c. Certificate of deposit d. Apple bonds e. IBM corporate notes f. German...

-

Assume that you are Jolee Companys accountant. Company owner Mary Jolee has reviewed the 2021 financial statements you prepared and questions the $6,000 loss reported on the sale of its investment in...

-

Difference between Operating Leverage and Financial Leverage

-

bpmn diagram for misc purchases

-

You have $55,000. You put 15% of your money in a stock with an expected return of 10%, $38,000 in a stock with an expected return of 18%, and the rest in a stock with an expected return of 22%. What...

Study smarter with the SolutionInn App