Data for the investment centers for Kowloon Ltd. are given in BE25.9. The centers expect the following

Question:

Data for the investment centers for Kowloon Ltd. are given in BE25.9. The centers expect the following changes in the next year: (I) increase sales 15%, (II) decrease costs HK$400,000, and (III) decrease average operating assets HK$500,000. Compute the expected return on investment (ROI) for each center. Assume center I has a controllable margin percentage of 70%.

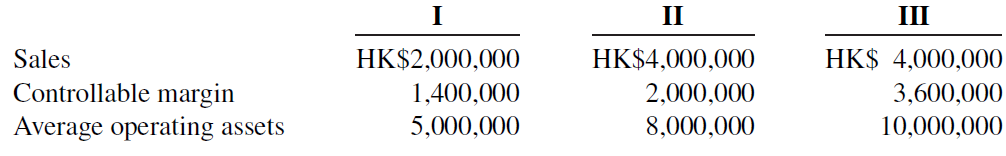

Data from BE25.9:

For its three investment centers, Kowloon Ltd. accumulates the following data:

The expected return is the profit or loss an investor anticipates on an investment that has known or anticipated rates of return (RoR). It is calculated by multiplying potential outcomes by the chances of them occurring and then totaling these...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting Principles

ISBN: 978-1119419617

IFRS global edition

Authors: Paul D Kimmel, Donald E Kieso Jerry J Weygandt

Question Posted: