Following are selected data from Samsung, Apple, and Google. Required 1. Compute Samsungs return on total assets

Question:

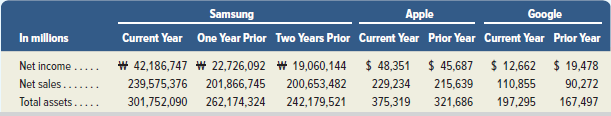

Following are selected data from Samsung, Apple, and Google.

Required

1. Compute Samsung’s return on total assets for the two most recent years.

2. For the current year, is Samsung’s return on total assets better or worse than (a) Apple’s and (b) Google’s?

3. For the current year, compute Samsung’s profit margin.

4. For the current year, compute Samsung’s total asset turnover.

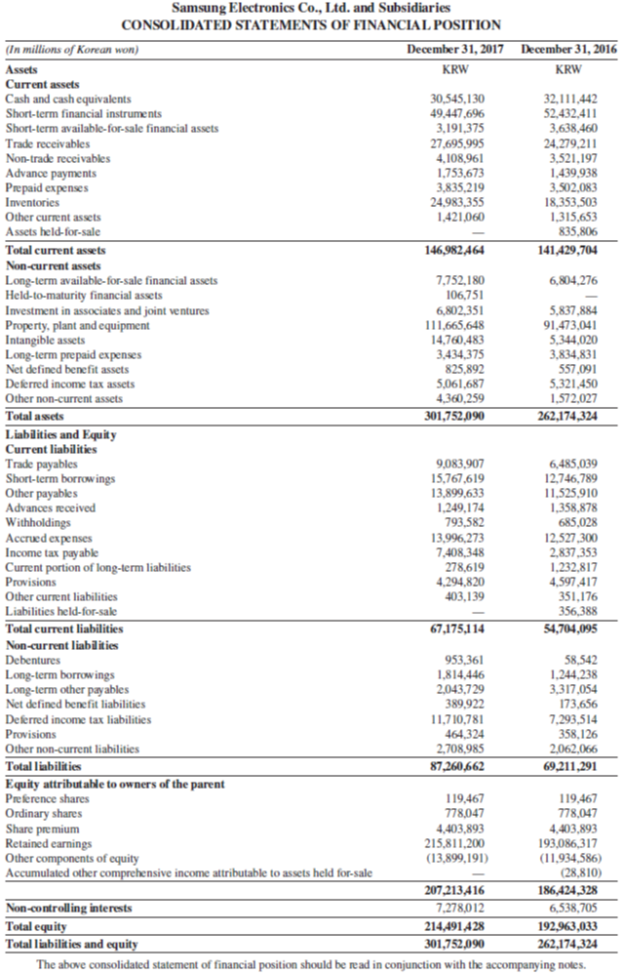

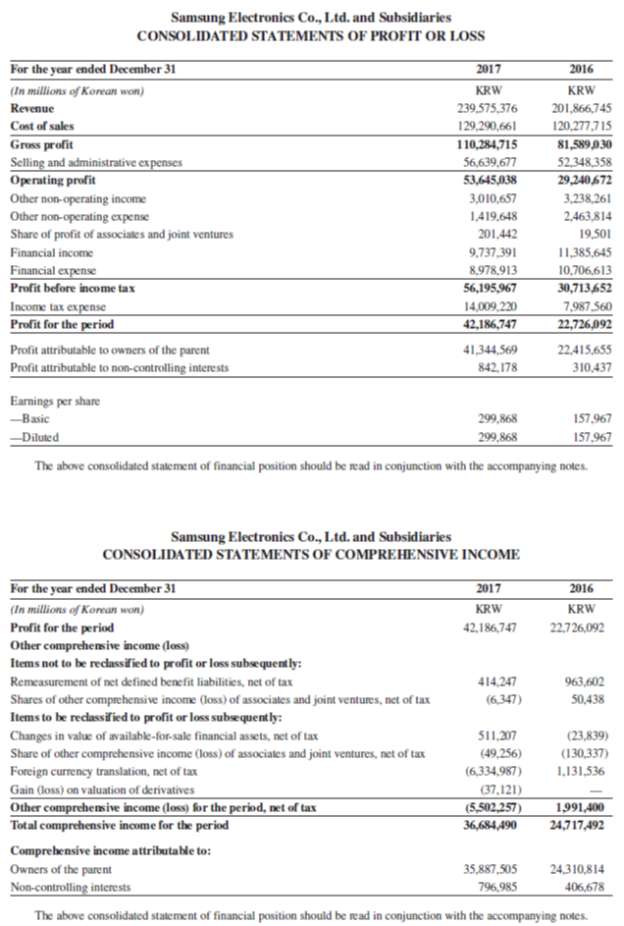

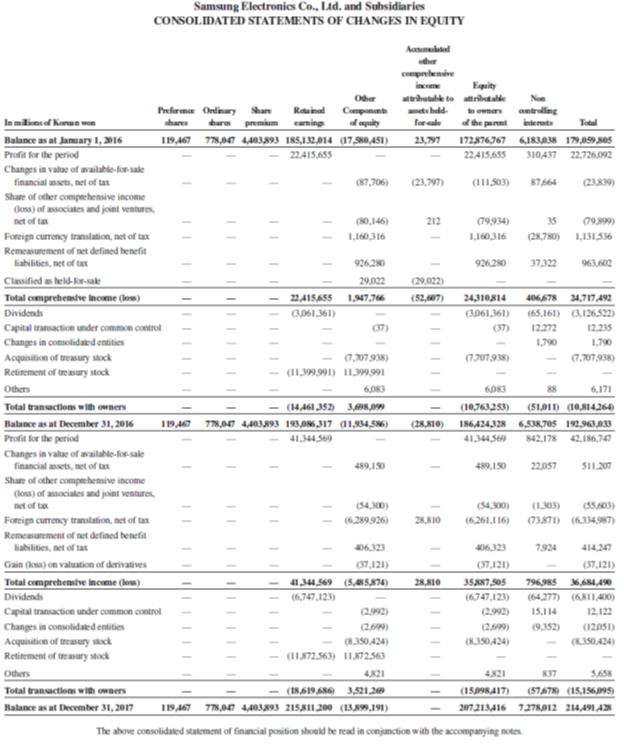

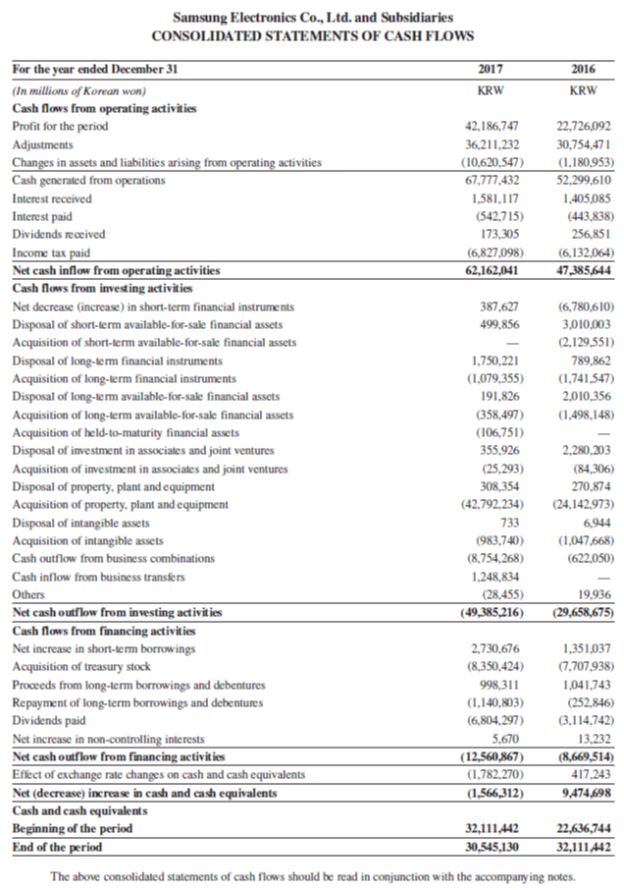

Data from Samsung

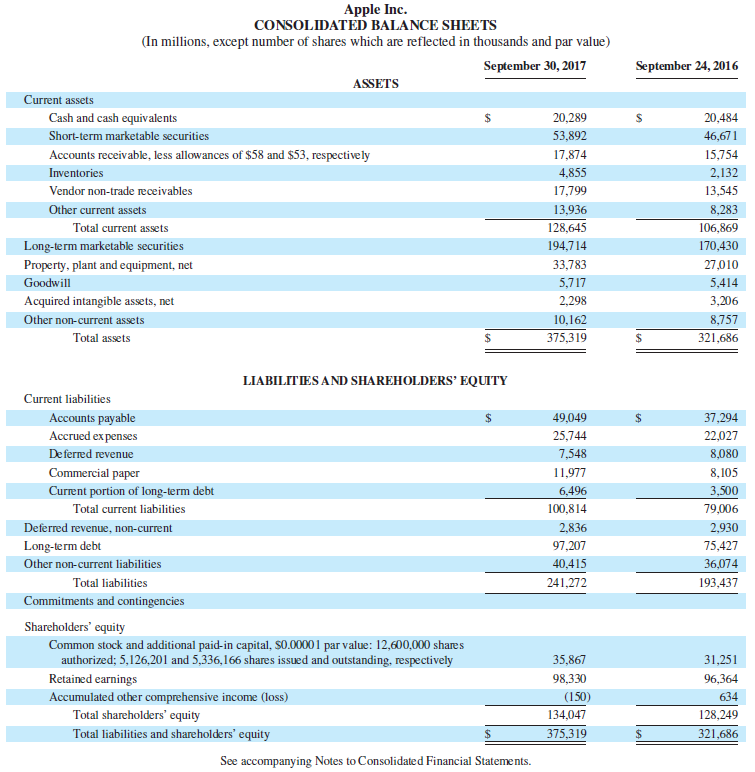

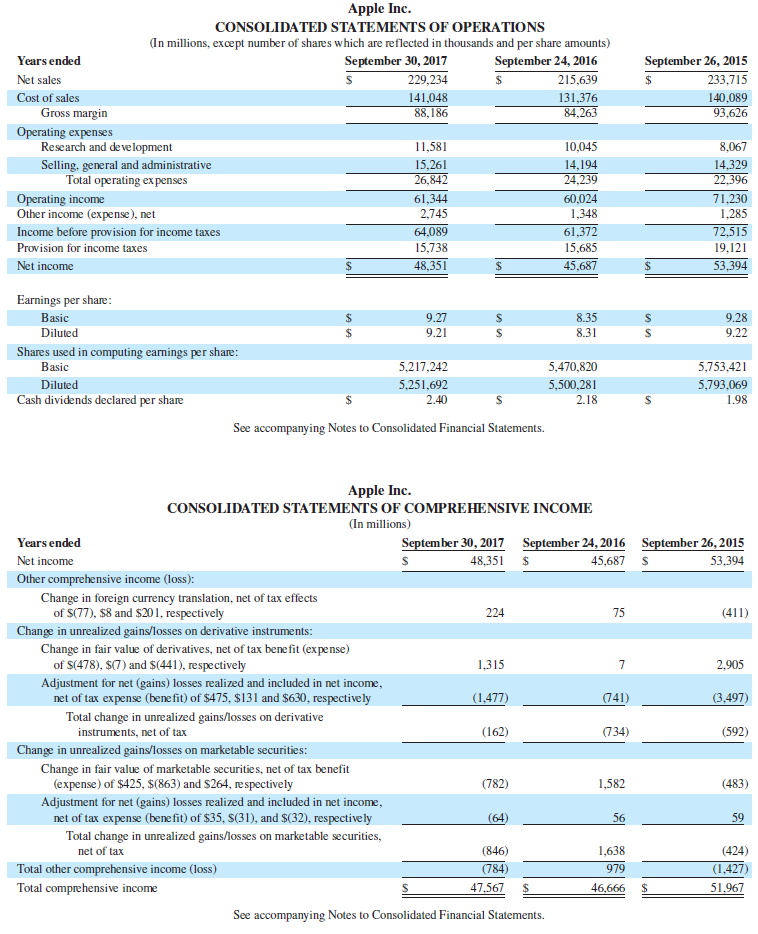

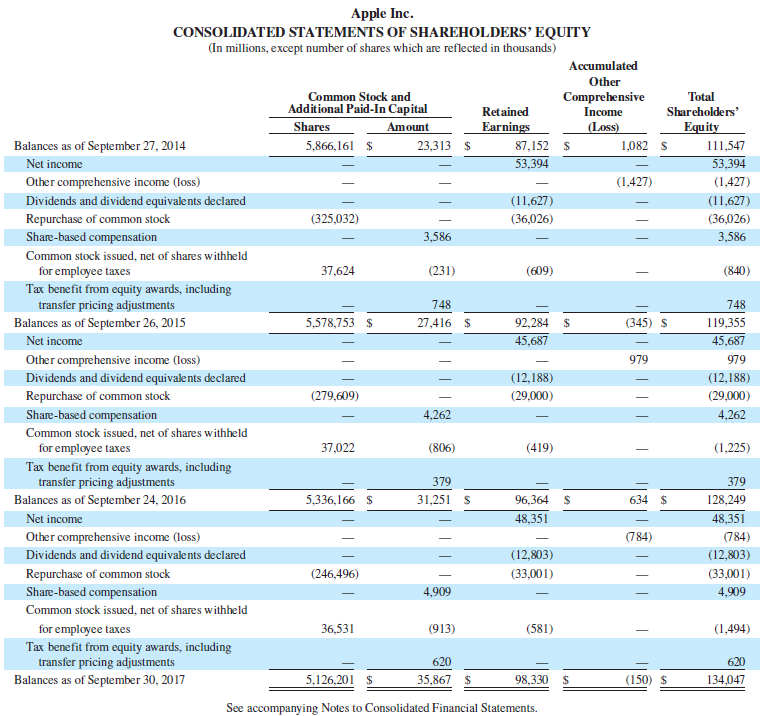

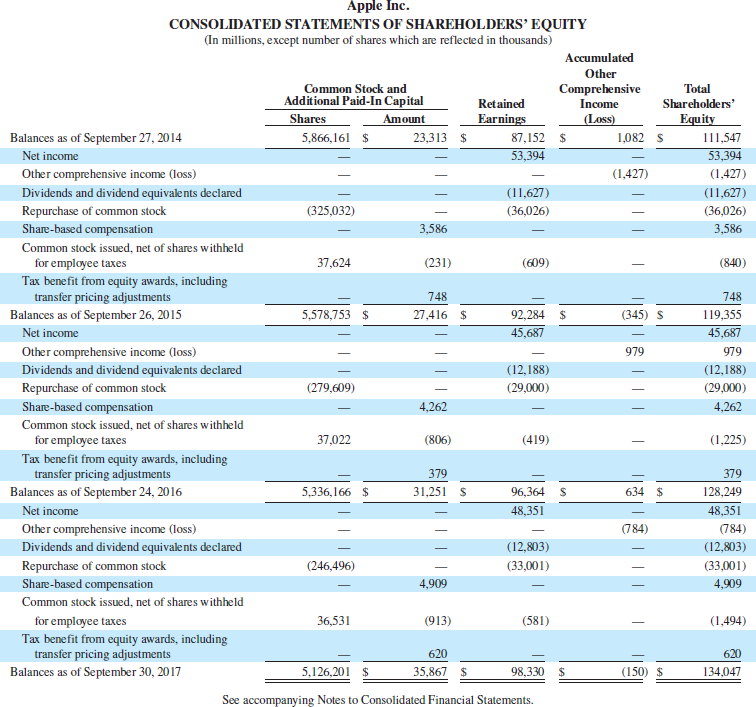

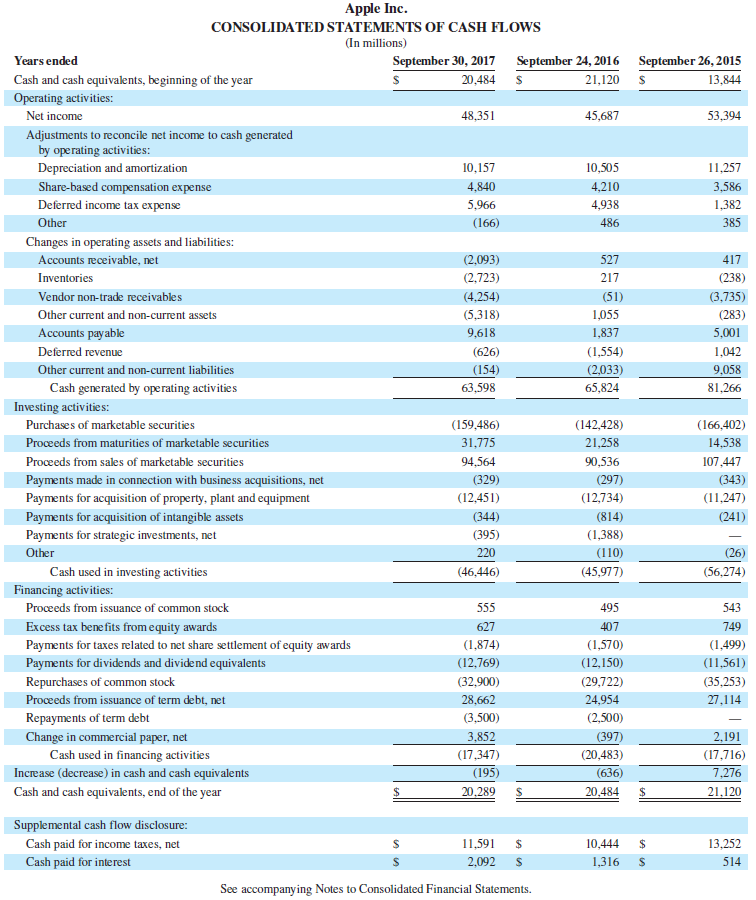

Data from Apple’s

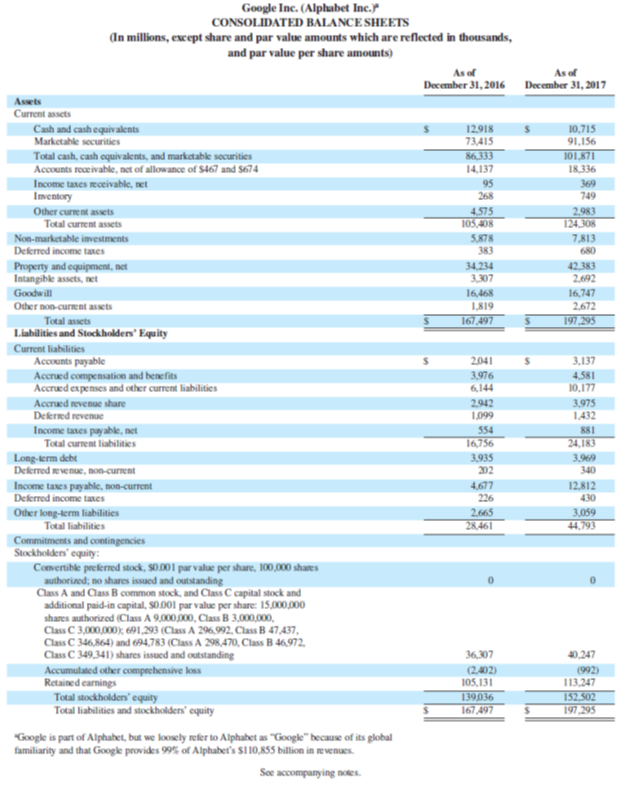

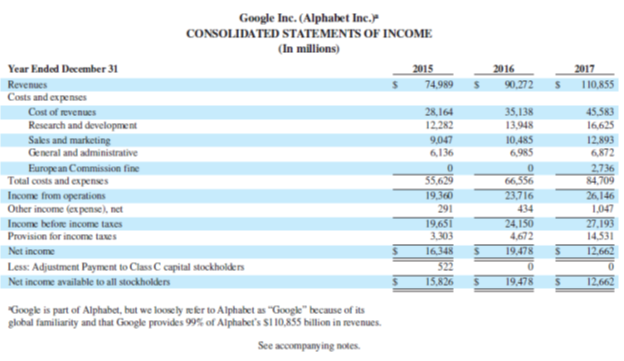

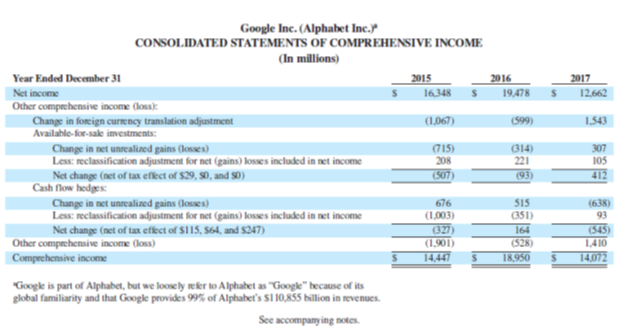

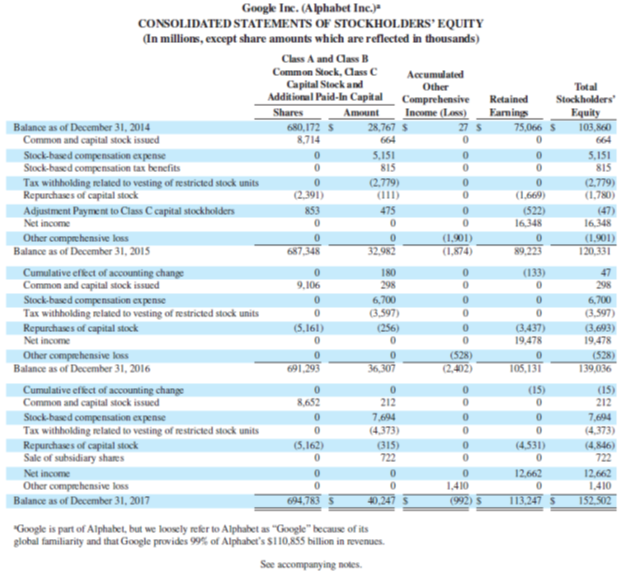

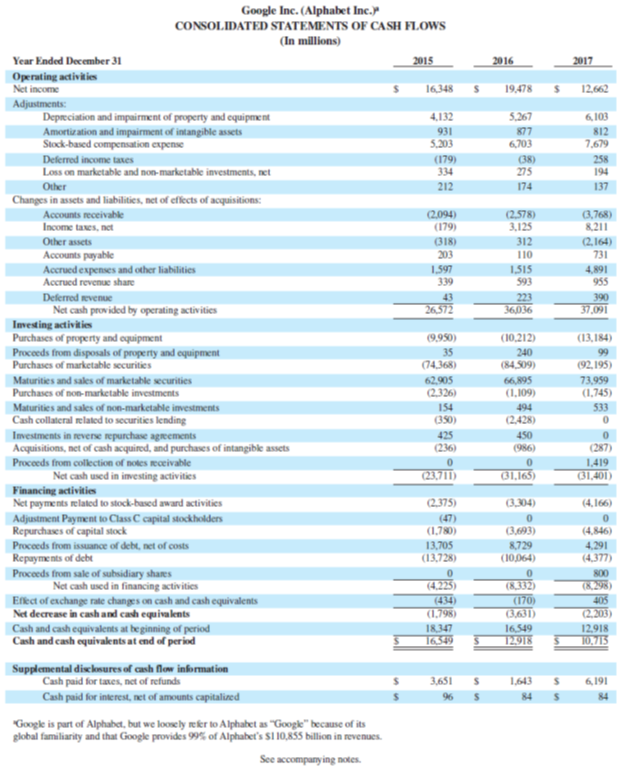

Data from Google's

Apple Samsung Google One Year Prior Two Years Prior Current Year Prior Year Current Year Prior Year In millions Current Year # 42,186,747 w 22,726,092 # 19,060,144 201,866,745 262,174,324 $ 48,351 229,234 375,319 $ 45,687 215,639 321,686 $ 12,662 110,855 197,295 $ 19,478 90,272 167,497 Net income 200,653,482 242,179,521 239,575,376 301,752,090 Net sales Total assets..... Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (In millions of Korean won) December 31, 2017 December 31, 2016 Assets KRW KRW Current assets Cash and cash equivalents Short-term financial instruments Short-term available-for-sale financial assets Trade receivables Non-trade receivables Advance payments Prepaid expenses Inventories 30,545,130 49,447,696 3,191,375 27,695,995 4,108,961 1,753,673 3,835,219 24.983.355 1,421,060 32,111,442 52,432,411 3,638,460 24,279,211 3,521,197 1,439,938 3,502,083 18,353,503 1,315,653 835,806 Other current assets Assets held-for-sale Total current assets 146,982,464 141,429,704 Non-current assets Long-term available-for-sale financial assets Held-to-maturity financial assets Investment in associates and joint ventures Property, plant and equipment Intangible assets Long-term prepaid expenses Net defined benefit assets 7,752,180 106,751 6,802.351 111,665,648 14,760,483 3,434.375 6,804,276 5,837,884 91,473,041 5,344,020 3,834,831 557,091 5,321,450 1,572,027 825,892 5,061,687 4,360,259 301,752,090 Deferred income tax assets Other non-current assets Total assets 262,174,324 Liabilities and Equity Current liabilities Trade payables Short-term borrow ings Other payables Advances received 9,083,907 15,767,619 13,899,633 1,249,174 793,582 6,485,039 12,746,789 11,525,910 1,358,878 685,028 12,527,300 2,837,353 1,232,817 4,597,417 351,176 356,388 54,704,095 Withholdings Accrued expenses Income tax payable Current portion of long-term liabilities Provisions 13,996,273 7,408,348 278,619 4,294,820 403,139 Other current liabilities Liabilities held-for-sake Total current liabilities 67,175,1 14 Non-current liablities Debentures 58,542 1,244,238 3,317,054 173,656 7,293,514 358,126 2,062,066 69,211,291 Long-term borrowings Long-term other payables Net defined benefit liabilities 953,361 1,814,446 2,043,729 389,922 Deferred income tax liabilities Provisions Other non-current liabilities 11,710,781 464324 2,708,985 87,260,662 Total liabilities Equity attribut able to owners of the parent Prekrence shares Ordinary shares Share premium Retained earnings Other components of equity Accumulated other comprehensive income attributable to assets held for-sale 119,467 778,047 4,403,893 215,811,200 (13,899,191) 119,467 778,047 4,403,893 193,086,317 (11,934,586) (28,810) 207,213416 186,424,328 Non-controlling interests Total equity Total linbilities and equity 7,278,012 214,491,428 6,538,705 192.963,033 301.752,090 262,174,324 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. |||||

Step by Step Answer:

1 Samsung Return on total assets Net Income Average Total Assets Curr...View the full answer

Related Video

Financial statements of a business having numerous divisions or subsidiaries are called consolidated financial statements. Companies frequently refer to the aggregated reporting of their entire firm together when using the term \"consolidated\" in financial statement reporting. Consolidated financial statement reporting, on the other hand, is defined by the Financial Accounting Standards Board as the reporting of an entity that is organized with a parent company and subsidiaries.

Students also viewed these Business questions

-

Return on total assets (ROA) is a common measure of profitability. The historical average is about 7.0 percent. The historical yield on corporate bonds is about 6.6 percent. Why is the ROA so low?...

-

The ratio of total liabilities to total assets for the 12 largest bank holding companies for a recent year are shown in the table below. The average ratio of total liabilities to total assets for the...

-

The two most recent monthly balance sheets of Strauss Instrument Company are shown below. Also shown is the most recent monthly income statement. Required From the financial statements presented,...

-

Determine the number of valence electrons for each of thefollowing four elements. Part A Ga _______ Express your answer as an integer. Part B Pb ________ Express your answer as an integer. Part C Cl...

-

Given these data, compute the heat of vaporization of water. The specific heat capacity of water is 4.186 J/(g K). Mass of calorimeter = 3.00 102 g Specific heat of calorimeter = 0.380 J/(g K)...

-

The concentration of pollutants (in grams per liter) in the east fork of the Big Weasel River is approximated by P(x) = 0.04e 4x , where x is the number of miles downstream from a paper mill that the...

-

Does our organizational culture support and promote creativity and innovation?

-

The city of Brownswood is trying to understand its road repair costs. As a starting point, Mark Winston, the city's finance manager, asked public works manager Rachel Morris to gather relevant data....

-

Hirsch Company acquired equipment at the beginning of 2020 at a cost of $157,000. The equipment has a five-year life with no expected salvage value and is depreciated on a straight-line basis. At...

-

Determine Vo and ID for the networks of Fig. 2.153. Si 0 10 mA 2.2 k 6.8 k Si

-

Key figures for Apple and Google follow. Required 1. Compute return on total assets for Apple and Google for the two most recent years. 2. Which of these two companies has the better return on total...

-

Assume that you are Jolee Companys accountant. Company owner Mary Jolee has reviewed the 2019 financial statements you prepared and questions the $6,000 loss reported on the sale of its investment in...

-

How would you try to get individual managers to be more aware of the legal requirements of staffing systems and to take steps to ensure that they themselves engage in legal staffing actions?

-

the assessment include developing gantt chart, work breakdown structure and and all task 3 are related to its respective task 2. all the instructions are given in the assignment itself. Assessment...

-

Mens heights are normally distributed with mean 68.6in. and standard deviation 2.8in. Air Force Pilots The U.S. Air Force required that pilots have heights between 64 in. and 77 in. Find the...

-

Swain Athletic Gear (SAG) operates six retail outlets in a large Midwest city. One is in the center of the city on Cornwall Street and the others are scattered around the perimeter of the city....

-

ACC1810 - PRINCIPLES OF FINANCIAL ACCOUNTING Project 11: Chapter 11 - Stockholders' Equity Part B: Financial Statements The accounts of Rehearsal Corporation are listed along with their adjusted...

-

Match the term to the description. Outcome evaluation Focuses on the accomplishments and impact of a service, program, or policy and its effectiveness in attaining its outcomes set prior to...

-

In Problem is the solution region bounded or unbounded? x + 2y 4 x 0 y 0

-

Gopher, Inc. developing its upcoming budgeted Costs of Quality (COQ) with the following information: Expense Item Budget Raw Materials Inspection $ 15,000 EPA Fine 200,000 Design Engineering 15,000...

-

A company is considering two alternative machines with different net cash flows and salvage values. Present value amounts are calculated using Excel and the results follow. a. Compute the net present...

-

Pardo Company produces a single product and has capacity to produce 120,000 units per month. Costs to produce its current monthly sales of 80,000 units follow. The normal selling price of the product...

-

A segment of a company reports the following loss for the year. All $140,000 of its variable costs are avoidable, and $75,000 of its fixed costs are avoidable. (a) Compute the income increase or...

-

September 1 . Purchased a new truck for $ 8 3 , 0 0 0 , paying cash. September 4 . Sold the truck purchased January 9 , Year 2 , for $ 5 3 , 6 0 0 . ( Record depreciation to date for Year 3 for the...

-

Find the NPV for the following project if the firm's WACC is 8%. Make sure to include the negative in your answer if you calculate a negative. it DOES matter for NPV answers

-

What is the value of a 10-year, $1,000 par value bond with a 12% annual coupon if its required return is 11%?

Study smarter with the SolutionInn App