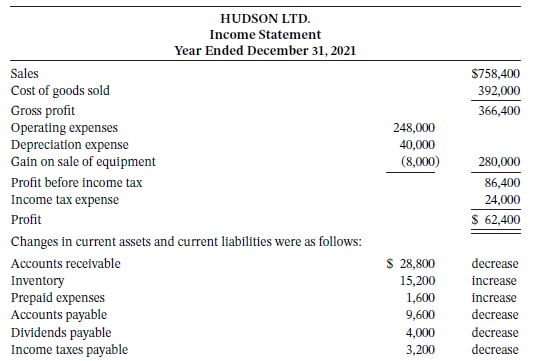

Hudson Ltd. is a private company reporting under ASPE. Its income statement and changes in current assets

Question:

Hudson Ltd. is a private company reporting under ASPE. Its income statement and changes in current assets and current liabilities for the year are reported below:

Instructions

Prepare the operating activities section of the cash fl ow statement using the direct method.

Transcribed Image Text:

HUDSON LTD. Income Statement Year Ended December 31, 2021 Sales $758,400 Cost of goods sold 392,000 Gross profit Operating expenses Depreciation expense Gain on sale of equipment 366,400 248,000 40,000 (8,000) 280,000 Profit before income tax 86,400 Income tax expense 24,000 Profit $ 62,400 Changes in current assets and current liabilities were as follows: Accounts receivable $ 28,800 decrease Inventory Prepaid expenses Accounts payable Dividends payable Income taxes payable 15,200 increase 1,600 increase 9,600 decrease 4,000 decrease 3,200 decrease

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (9 reviews)

HUDSON LTD Cash Flow Statement Partial Year Ended December 31 2021 Operating activi...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Accounting Principles Volume 2

ISBN: 978-1119502555

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Question Posted:

Students also viewed these Business questions

-

Pesci Ltd. is a private company reporting under ASPE. Its income statement and changes in current assets and current liabilities for the year are reported below: Instructions Prepare the operating...

-

Pesci Ltd. is a private company reporting under ASPE. Its income statement and changes in current assets and current liabilities for the year are reported below: Instructions Prepare the operating...

-

Pesci Ltd. is a private company reporting under ASPE. Its income statement and changes in current assets and current liabilities for the year are reported below: Instructions Prepare the operating...

-

Company D is a merchandiser of MLB Hats. One of their biggest customers calls Company D and expresses concerns over their ability to pay the $20,000 owed to Company D. Company D agrees to covert the...

-

Compare and contrast the different techniques for anomaly detection that were presented in Section 10.1.2. In particular, try to identify circumstances in which the definitions of anomalies used in...

-

Analyse the morality of the questionable actions and behaviours described in this case.

-

Assume that Cathedral Enterprises, which is in its first year of operations, entered into the fol lowing transactions. Show how the five transactions affect the accounting equation, and pre pare an...

-

Crimson Tide Music Academy offers lessons in playing a wide range of musical instruments. The unadjusted trial balance as of December 31, 2021, appears below. December 31 is the company?s fiscal...

-

withdrawals in which Financial Statements most appear

-

Part 2: Presentation and Data Work (90 marks) You have been asked to collect company data and to create a final written presentation based on your analysis of the data and the performance measures...

-

Linus Corporation reported the following in its March 31, 2021, fi nancial statements. Calculate the cash payments for operating expenses. 2021 2020 Prepaid expenses Accrued expenses payable...

-

Winter Sportswear Inc. reported the following in its December 31, 2021, financial statements. Calculate (a) The cost of goods purchased, (b) Cash payments to suppliers. 2020 $50,000 55,000 2021...

-

Contrast the market maker system of the CBOE with the specialist system of the AMEX and Philadelphia Stock Exchange. What advantages and disadvantages do you see in each system?

-

What makes a set of objects a vector space? You will no doubt want to refer to notes and the text, but I'd like you to summarize it for starters. If you have identified a vector space, for example...

-

Walla Walla Company is in its planning stage for next year. Walla Walla expects a big Quarter 3 and is creating a production budget to determine if it needs to hire more employees. Walla Walla knows...

-

Task: P9 P9a P9b P9c P9d Describe the principles and applications of electromagnetic induction Describe using a series of bullet point statements, how transformers work and how their operation...

-

Based on the given information, analyse company's financial health and provide future projections. Unit FY16 FY17 FY18 FY19 Sales Rs. Cr 134 245 371 1,159 PAT Rs. Cr (281) (585) (78) (571) Assets Rs....

-

OBJECTIVE QUESTIONS 1. In each of the following only one statement/item is correct. State which. (i) Financial Accounting helps in (a) ascertaining the financial position of the concerned firm, (b)...

-

What are the four cost items that may enter a processing department?

-

The production budget of Artest Company calls for 80,000 units to be produced. If it takes 30 minutes to make one unit and the direct labor rate is $16 per hour, what is the total budgeted direct...

-

On January 31, 2021, Cardston Company had the following payroll liability accounts in its ledger: In February, the following transactions occurred: Feb. 4 Sent a cheque to the union treasurer for...

-

Seaboard Company receives its annual property tax bill of $24,000 for the 2021 calendar year on May 31, 2021, and it is payable on July 31, 2021. Seaboard has a December 31 fiscal year end....

-

Scoot Scooters has four employees who are paid on an hourly basis, plus time and a half for hours in excess of 40 hours a week. Payroll data for the week ended February 17, 2021, follow: Instructions...

-

If the risk-free rate is 1.0% and the expected market return is 6.6%, what is the WACC of the company with the following characteristics? Answer in percent, rounded to two decimal places. Market...

-

List and describe some of socioeconomic items in a government retirement pension plan. (actuarial report

-

Explain the difference between necessary and optional expenses.

Study smarter with the SolutionInn App