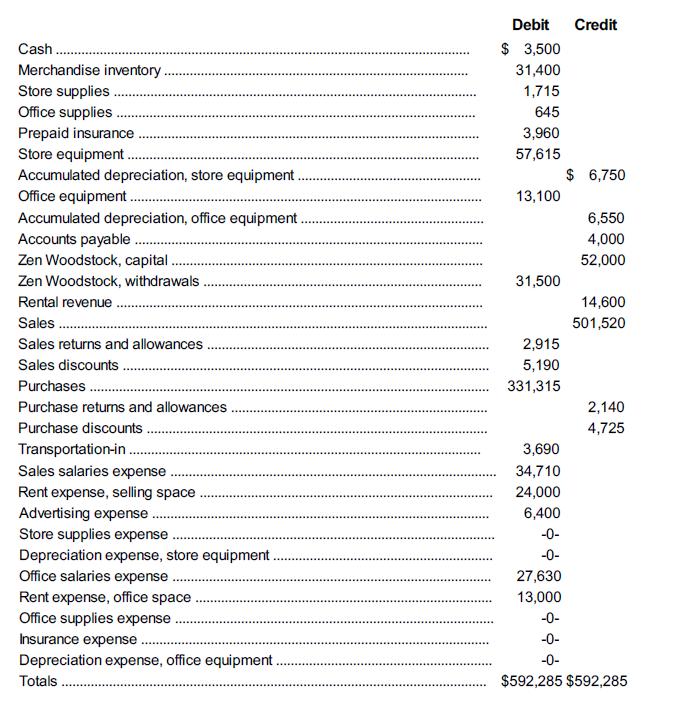

Information from the December 31, 2023, year-end unadjusted trial balance of Woodstock Store is as follows: Additional

Question:

Information from the December 31, 2023, year-end unadjusted trial balance of Woodstock Store is as follows:

Additional information:

1. The balance on January 1, 2023, in the Store Supplies account was $480. During the year, $1,235 of store supplies were purchased and debited to the Store Supplies account. A physical count on December 31, 2023, shows an ending balance of $180.

2. The balance on January 1, 2023, in the Office Supplies account was $50. Office supplies of $595 were purchased in 2023 and added to the Office Supplies account. An examination of the office supplies at year-end revealed that $590 had been used.

3. The balance in the Prepaid Insurance account represents a policy purchased on September 1, 2023; it was valid for 12 months from that date.

4. The store equipment was originally estimated to have a useful life of 12 years and a residual value of $3,615.

5. When the office equipment was purchased, it was estimated that it would last four years and have no residual value.

6. Ending merchandise inventory, $29,000.

Required

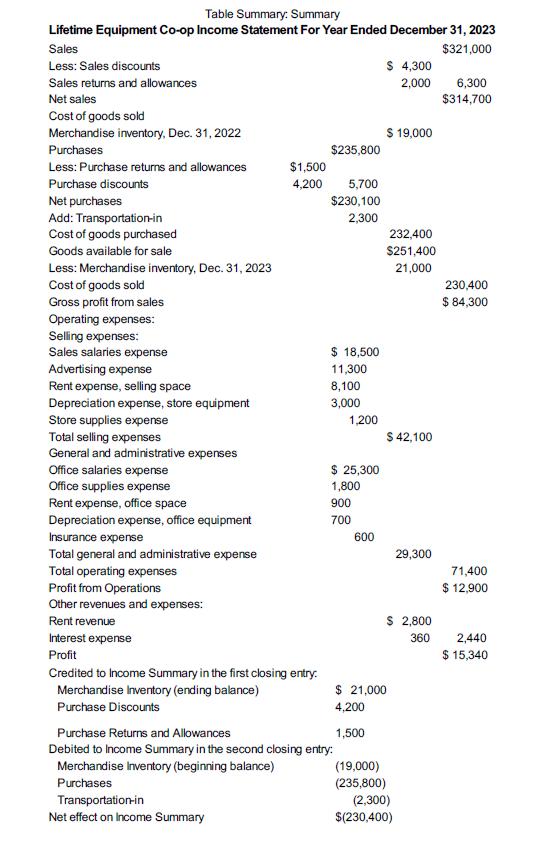

Analyze and determine the impact of the adjustments from (a) to (f) on the unadjusted trial balance numbers. Prepare a classified multiple-step income statement like Exhibit 5A.2 using your adjusted trial balance numbers.

Step by Step Answer:

Fundamental Accounting Principles Volume 1

ISBN: 9781260881325

17th Canadian Edition

Authors: Kermit D. Larson, Heidi Dieckmann, John Harris