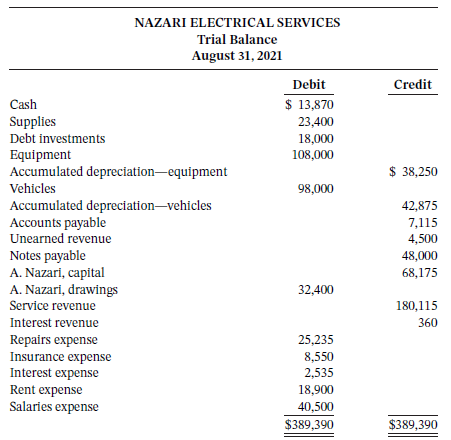

Nazari Electrical Services has an August 31 fiscal year end. The company?s trial balance prior to adjustments

Question:

Nazari Electrical Services has an August 31 fiscal year end. The company?s trial balance prior to adjustments follows:

Additional information:

1. The equipment has an expected useful life of 12 years. The vehicles? expected useful life is eight years.

2. A physical count showed $1,500 of supplies on hand at August 31, 2021.

3. As at August 31, 2021, there was $2,500 of revenue received in advance and the related services have not yet been performed.

4. Nazari Electrical Services has an investment in bonds that it intends to hold to earn interest until the bonds mature in 10 years. The bonds have an interest rate of 4% and pay interest on March 1 and September 1 each year.

5. Accrued salaries payable at August 31, 2021, were $1,850.

6. Interest on the 5% note payable is payable at the end of each month and $8,000 of the principal must be paid on December 31 each year. Interest payments are up to date as at August 31, 2021.

7. The owner, A. Nazari, invested $3,000 cash in the business on December 29, 2020. (Note: This has been correctly recorded.)

Instructions

a. Prepare the adjusting entries and an adjusted trial balance.

b. Calculate profit or loss for the year.

c. Prepare a statement of owner?s equity and a classified balance sheet.

d. Prepare the closing entries. Using T accounts, post to the Income Summary, and Owner?s Drawings and Owner?s Capital accounts. Compare the ending balance in the Owner?s Capital account with the information in the statement of owner?s equity.

Why do you need to know the amount the owner invested in the business this year if it has been correctly recorded?

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 978-1119502425

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak