Peeters Consulting completed these transactions during June 2017: June 2. Trevor Peeters, the sole proprietor, invested $46,000

Question:

June

2. Trevor Peeters, the sole proprietor, invested $46,000 cash and office equipment with a $24,000 fair value in the business.

4. Purchased land and a small office building. The land was worth $268,000 and the building was worth $66,000. The purchase price was paid with $30,000 cash and a long-term note payable for $304,000.

8. Transferred title of his personal automobile to the business. The automobile had a value of $7,000 and was to be used exclusively in the business.

10. Purchased $600 of office supplies on credit.

14. Completed $2,400 of services for a client. This amount is to be paid within 30 days.

18. Paid $1,800 salary to an assistant.

22. Paid the account payable from the transaction on June 10.

24. Purchased $4,000 of new office equipment by paying $2,400 cash and trading in old equipment with a recorded cost of $1,600.

28. Received $1,000 payment on the receivable created from the transaction on June 14th.

30. Withdrew $1,050 cash from the business for personal use.

Required

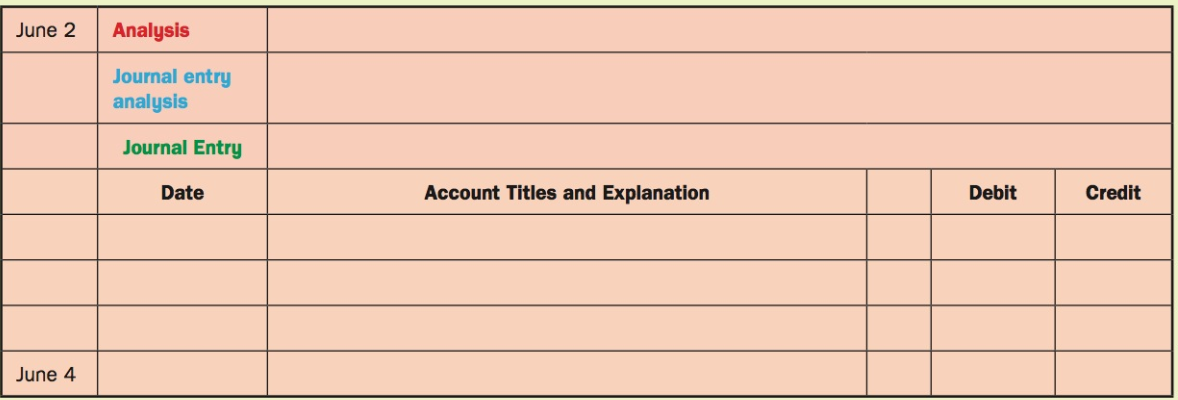

For each transaction,

(1) complete the analysis,

(2) determine the journal entry analysis

(3) record the journal entry. Use the template below.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamental Accounting Principles Volume 1

ISBN: 9781259259807

15th Canadian Edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

Question Posted: