Pepper Corporation, a public company, reported the following on its July 31, 2020, balance sheet. Investments at

Question:

Pepper Corporation, a public company, reported the following on its July 31, 2020, balance sheet.

Investments at fair value through other comprehensive income

Hegal Ltd. (5,000 common shares) ................................................... $36,000Baudillard Company (8,000 common shares) ................................... 18,000Investments at fair value through profit or lossLocke Systems Ltd., $70,000 par value, 4% bonds, dueJune 30, 2025 (originally purchased at par) ....................................... 68,000Truman Manufacturing Co. (6,000 common shares) ....................... 14,000Investments at amortized costAquinas Filtering Corp., $100,000, 5% bonds, due June 1,2022, interest payments annually(originally purchased at 98) ................................................................. 99,000Investment in associate, Lincoln Corporation

(3,000 common shares) ....................................................................... 25,000

The following transactions took place during 2021:

1. Dividends were received from Hegal Ltd.

2. Sold the Locke Systems bonds at a loss.

3. Dividends were received from Lincoln Corporation.

4. Annual interest payment was received from Aquinas Filtering.

5. Dividends were received from Baudillard.

6. Paid dividends to shareholders of Pepper Corporation.

7. Sold the 1,500 Hegal common shares at a loss.

8. Received the financial statements from Lincoln Corporation reporting a profit for the year.

9. Purchased 4,000 additional shares of Baudillard Company.

10. Accrued interest on the Aquinas bonds at year end.

11. Received the financial statements from Aquinas Filtering Corp. reporting a profit for the year.

12. The fair value of Baudillard Company?s shares was greater than the carrying amount at year end.

13. The fair value of the Aquinas Filtering bonds was less than the carrying amount at year end.

14. The fair value of Truman Manufacturing?s shares was greater than the carrying amount.

15. The fair value of the remaining Hegal common shares was less than the carrying amount at year end.

Instructions

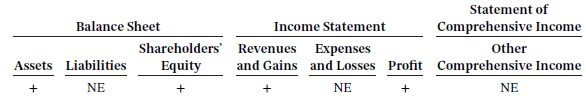

Using the following table format, indicate whether each of the above transactions would result in an increase (+), a decrease (?), or no effect (NE) in each category. The first one has been done for you as an example.

Taking It Further Assume instead that Pepper Corporation is a private company. How would your response to the question differ if the company reported under ASPE? What choices would the company have for reporting the investment in an associate?

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 978-1119502555

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak