Poundmaker Company just had a fire in its warehouse that destroyed all of its merchandise inventory. The

Question:

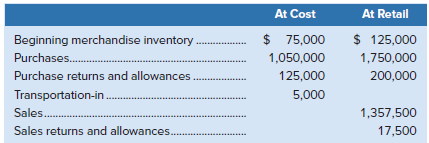

Poundmaker Company just had a fire in its warehouse that destroyed all of its merchandise inventory. The insurance company covers 80% of the loss. The following information is available regarding the year ended March 31, 2020:

Required

Prepare an estimate of the company?s loss using the retail method.

Transcribed Image Text:

At Retail At Cost $ 75,000 1,050,000 125,000 5,000 $ 125,000 1,750,000 Beginning merchandise inventory Purchases.. Purchase returns and allowances 200,000 Transportation-in. Sales. 1,357,500 17,500 .... Sales returns and allowances.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (10 reviews)

At Cost At Retail Goods available for sale Beginning i...View the full answer

Answered By

Kainat Shabbir

i am an experienced qualified expert with a long record of success helping clients overcome specific difficulties in information technology, business and arts greatly increasing their confidence in these topics. i am providing professional services in following concerns research papers, term papers, dissertation writing, book reports, biography writing, proofreading, editing, article critique, book review, coursework, c++, java, bootstarp, database.

5.00+

184+ Reviews

255+ Question Solved

Related Book For

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

Question Posted:

Students also viewed these Business questions

-

The following information is available regarding the outstanding accounts receivable of Mufu Contracting at September 30, 2014: AII services are performed on terms of n/30. Assume all sales occurred...

-

The following information is available regarding the total manufacturing overhead of Bursa Mfg. Co. for a recent four-month period: a. Use the high-low method to determine: 1. The variable element of...

-

The following summary information is available regarding Robinson Sports Gear. The income statements are for the respective fiscal years, and the balance sheets are as of the end of each fiscal year....

-

2. C. b. d. e. a. A proposed public project would produce the following pattern of individual benefits and costs. Revise only the cost shares of individuals C and E to meet the Pareto Criterion. (7...

-

The response of a circuit or other oscillatory system to an input of frequency Ï ("omega") is described by the function Both Ï0 (the natural frequency of the system) and D (the damping...

-

What is an average accounting rate of return (AAR)?

-

What are the socio-cultural impacts associated with events?

-

The following information relates to the 2014 debt and equity invesm1ent transactions of Wildcat Ltd., a publicly accountable Canadian corporation. All of the investments were acquired for trading...

-

Applied factory overhead is 1,650,000 and actual labor costs totaled $1,100,000. How much is the companys predetermined overhead rate to the nearest cent? a. $1.45 b. $1.31 c. $1.50 d. $1.37

-

Locate all the instantaneous centres for the crossed four bar mechanism as shown in Fig. 6.28. The dimensions of various links are : CD = 65 mm; CA = 60 mm ; DB = 80 mm ; and AB = 55 mm. Find the...

-

Mixon Company showed the following selected information for the years ended December 31, 2020, 2019, and 2018: For the years ended 2020 and 2019, calculate: a. Days? sales in inventory b. Inventory...

-

Huff Company and Puff Company are similar firms that operate within the same industry. The following information is available. Required Based on the information provided, which company is managing...

-

Illinois Soy Products (ISP) buys soybeans and processes them into other soy products. Each ton of soybeans that ISP purchases for $ 340 can be converted for an additional $ 190 into 575 pounds of soy...

-

Archer Contracting repaved 50 miles of two-lane county roadway with a crew of six employees. This crew worked 8 days and used \($7,000\) worth of paving material. Nearby, Bronson Construction repaved...

-

An insurance company has the following profitability analysis of its services: The fixed costs are distributed equally among the services and are not avoidable if one of the services is dropped. What...

-

The Scantron Company makes bar-code scanners for major supermarkets. The sales staff estimates that the company will sell 500 units next year for 10,000 each. The production manager estimates that...

-

Determine the following: a. The stockholders equity of a company that has assets of \(\$ 625,000\) and liabilities of \(\$ 310,000\). b. The retained earnings of a company that has assets of \(\$...

-

You are the manager of internal audit for Do-It-All, Ltd., a large, diversified, decentralized manufacturing company. Over the past two years, the information systems function in Do-It-All has...

-

In this exercise, you will modify the tip program shown earlier in Figure 7-31. Follow the instructions for starting C++ and viewing the ModifyThis16.cpp file, which is contained in either the...

-

Independent random samples of sizes n1 = 30 and n2 = 50 are taken from two normal populations having the means 1 = 78 and 2 = 75 and the variances 21 = 150 and 22 = 200. Use the results of Exercise...

-

Interest payments received on a bond held with the business objective of actively trading should be recorded as: a. Dr. Cash XXX Cr. Interest Income XXX Cr. Interest Receivable XXX b. Dr. Interest...

-

When share investments are accounted for using the equity method, when should investment income be recognized? What accounts are debited and credited?

-

On January 1, 2020, Nickle Entertainment Inc. purchased a 4%, $50,000 Imax bond for $46,490. Interest is to be paid semiannually each June 30 and December 31. Nickle Inc. is planning to hold the bond...

-

Lacy is a single taxpayer. In 2020, her taxable income is $42,000. What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule, Dividends and Capital Gains Tax...

-

PR 13-3A Selected Stock Transactions OBJ. 3 - Describe and illustrate the characteristics of stock, classes of stock, and entries for issuing stock., 4 - Describe and illustrate the accounting for...

-

The following sales and cost data (in thousands) are for two companies in the transportation industry: Company A Company B Amount Percent of Sales Amount Percent of Sales Sales $ 130,000 100 % $...

Study smarter with the SolutionInn App