Prepare journal entries for the following selected transactions of Deshawn Company: 2004 Dec. 13 Accepted a $10,000,

Question:

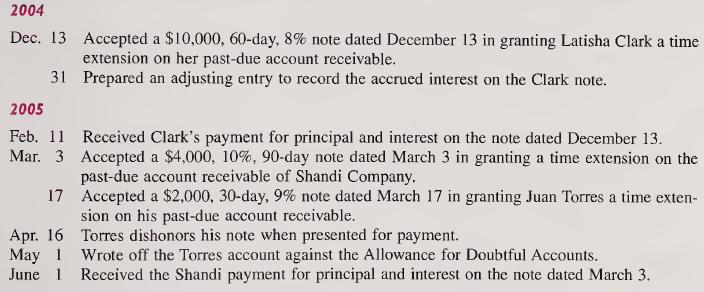

Prepare journal entries for the following selected transactions of Deshawn Company:

Transcribed Image Text:

2004 Dec. 13 Accepted a $10,000, 60-day, 8% note dated December 13 in granting Latisha Clark a time extension on her past-due account receivable. 2005 31 Prepared an adjusting entry to record the accrued interest on the Clark note. Feb. 11 Mar. 3 Received Clark's payment for principal and interest on the note dated December 13. Accepted a $4,000, 10%, 90-day note dated March 3 in granting a time extension on the past-due account receivable of Shandi Company. 17 Accepted a $2,000, 30-day, 9% note dated March 17 in granting Juan Torres a time exten- sion on his past-due account receivable. Apr. 16 Torres dishonors his note when presented for payment. May 1 Wrote off the Torres account against the Allowance for Doubtful Accounts. June 1 Received the Shandi payment for principal and interest on the note dated March 3.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (1 review)

Answered By

Rinki Devi

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions.

Hi there! Are you looking for a committed, reliable, and enthusiastic tutor? Well, teaching and learning are more of a second nature to me, having been raised by parents who are both teachers. I have done plenty of studying and lots of learning on many exciting and challenging topics. All these experiences have influenced my decision to take on the teaching role in various capacities. As a tutor, I am looking forward to getting to understand your needs and helping you achieve your academic goals. I'm highly flexible and contactable. I am available to work on short notice since I only prefer to work with very small and select groups of students.

I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and helped them achieve great subject knowledge.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

Fundamental Accounting Principles

ISBN: 9780072946604

17th Edition

Authors: Kermit D. Larson, John J Wild, Barbara Chiappetta

Question Posted:

Students also viewed these Business questions

-

What part can contributories play in the liquidation of a company

-

D View Policies Current Attempt in Progress Wildhorse Supply Co. has the following transactions: Nov. 1 15 Dec. 1 Loaned $66,000 cash to A. Morgan on a one-year, 8% note. Sold goods to H. Giorgi on...

-

Prepare journal entries for the following selected transactions of Deshawn Company for 2010. 2010 Dec. 13 Accepted a $10,000, 45-day, 8% note dated December 13 in granting Latisha Clark a time...

-

On average, which group of borrowers would have to pay a higher effective rate for its short-term loans, those who are required to put up collateral or those who are not? Explain.

-

Solve the linear programming problem by applying the simplex method to the dual problem. Minimize subject to C = 6x1 + 8x2 + 3x3 -3x1 - 2x2 + x3 4 x1 + x2 - x3 2 x1, x2, x3 0

-

Are the TCP receive buffer and the media player's client buffer the same thing? If not, how do they interact?

-

In addition to the variables used in the Case Study, what other variables do you think are important to consider when studying the distribution of U.S. consumers' attitudes about healthy fast food?

-

In early 20X1, SpaceTel Communications, a U.S.-based international telephone communications company, purchased the controlling interest in Sofia Telecom, Ltd. (STL) in Bulgaria. A key productivity...

-

Question 28 Not yet answered Mr. Firas is the auditor of Hi-Tech Software Solutions Company. He has not yet received the audit fees from the company. The threat that Mr.Firas may face in this...

-

The following information is from the annual financial statements of Waseem Company. Compute its accounts receivable turnover for 2004 and 2005. Compare the two years results and give a possible...

-

Prepare journal entries to record the following selected transactions of Paloma Company: Mar. 21 Accepted a $3,100, 180-day, 10% note dated March 21 from Salma Hernandez in grant- ing a time...

-

What effect does a government budget deficit have on the interest rate? Draw a diagram to illustrate your answer.

-

Piperel Lake Resort's four employees are paid monthly. Assume an income tax rate of 20%. Required: Complete the payroll register below for the month ended January 31, 2021. (Do not round intermediate...

-

4. [Communication network 1] Consider the communication network shown in the figure below and suppose that each link can fail with probability p. Assume that failures of different links are...

-

The 60 deg strain gauge rosette is mounted on the bracket. The following readings are obtained for each gauge a = 100 106, b = 250 106, and c = 150 106. Determine: (a) the strains x, y, and xy for...

-

Assume the ledge has the dimensions shown and is attached to the building with a series of equally spaved pins around the circumference of the building. Design the pins so that the ledge can support...

-

Describe in detail about the arterial supply and venous drainage of heart with its Applied Anatomy?

-

Diagram the court hierarchy, showing the three courts of original jurisdiction on the bottom, two courts in the middle, and the U.S. Supreme Court on top.

-

The Adjusted Trial Balance columns of a 10-column work sheet for Webber Co. follow. Complete the work sheet by extending the account balances into the appropriate financial statement columns and by...

-

Which of the following statements is not true regarding the $500 credit for dependent other than a qualifying child credit. Cannot be claimed on the same tax return if the child tax credit is also...

-

Grind Co. is considering replacing an existing machine. The new machine is expected to reduce labor costs by $127,000 per year for 5 years. Depreciation on the new machine is $57,000 compared with...

-

If John invested $20,000 in a stock paying annual qualifying dividends equal to 4% of his investment, what would the value of his investment be 5 years from now? Assume Johns marginal ordinary tax...

Study smarter with the SolutionInn App