Refer to Exhibit 17.14 and calculate Focus Metals? solvency ratios for 2019 and 2020 (round answers to

Question:

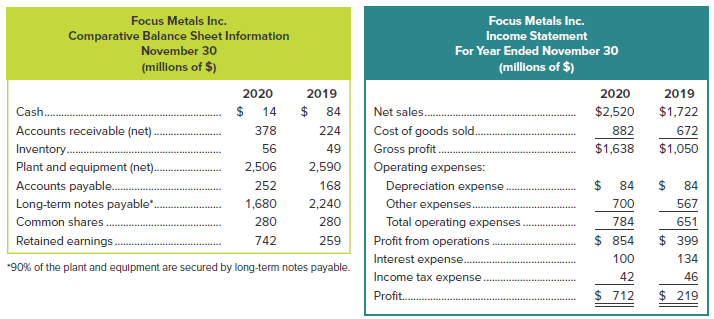

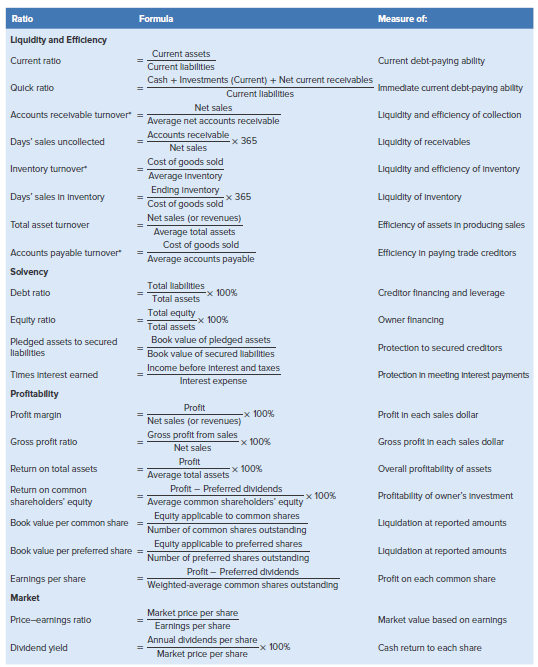

Refer to Exhibit 17.14 and calculate Focus Metals? solvency ratios for 2019 and 2020 (round answers to two decimal places).

Analysis Component: Identify whether the change in each ratio from 2019 to 2020 was favourable (F) or unfavourable (U) and why.

Exhibit 17.14

Transcribed Image Text:

Focus Metals Inc. Focus Metals Inc. Comparative Balance Sheet Information Income Statement November 30 For Year Ended November 30 (millions of $) (millions of $) 2020 2019 2020 2019 Cash $2,520 $1,722 14 84 Net sales.. Cost of goods sold. Gross profit. Accounts receivable (net) 378 224 882 672 Inventory. Plant and equipment (net). $1,638 $1,050 56 49 2,590 2,506 Operating expenses: Depreciation expense Accounts payable. 252 168 84 84 1,680 2,240 Other expenses. 700 Long-term notes payable". 567 Common shares. Retained earnings. 280 Total operating expenses. 280 784 651 $ 854 $ 399 Profit from operations 742 259 Interest expense. 100 134 *90% of the plant and equipment are secured by long-term notes payable. Income tax expense 42 46 $ 712 $ 219 Profit. %24 Ratio Formula Measure of: Liquldity and Efficlency Current assets Current ratio Current labilitles Current debt-paylng ability Cash + Investments (Current) + Net current recelvables Quick ratio Immedlate current debt-paying ability Current labilities Net sales Accounts recelvable turnover Liquidity and efficlency of collection Average net accounts recelvable Accounts recelvable Days' sales uncollected x 365 Liquidity of recelvables Net sales Cost of goods sold Inventory turnover Liquidity and efficlency of Inventory Average Inventory Ending Inventory Days' sales in Inventory x 365 Cost of goods sold Liquidity of Inventory Net sales (or revenues) Total asset turnover Efficlency of assets in producing sales Average total assets Cost of goods sold Accounts payable turnover Efficiency in paylng trade creditors Average accounts payable Solvency Total liabilities Debt ratio x 100% Creditor financing and leverage Total assets Total equity Equity ratio -x 100% Owner financing Total assets Book value of pledged assets Pledged assets to secured liabilitles Protection to secured creditors Book value of secured liabilities Income before Interest and taxes Times Interest earned Protection in meeting Interest payments Interest expense Profitability Profit Profit margin -x 100% Profit in each sales dollar Net sales (or revenues) Gross profit from sales Net sales Gross profit ratio x 100% Gross profit in each sales dollar Profit Return on total assets x 100% Overall profitability of assets Average total assets Profit – Preferred dividends Return on common shareholders' equity x 100% Profitability of owner's Investment Average common shareholders' equlty Equity applicable to common shares Book value per common share Liquidation at reported amounts Number of common shares outstanding Equity applicable to preferred shares Book value per preferred share = Liquidation at reported amounts Number of preferred shares outstanding Profit - Preferred dividends Earnings per share Profit on each common share Weighted-average common shares outstanding Market Market price per share Earnings per share Price-earnings ratio Market value based on earnings Annual dividends per share Market price per share Dividend yleld -x 100% Cash return to each share

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (10 reviews)

Ratio Calculations FU and Why 2020 2019 Debt ratio 6540 1 8171 2 F because a decrease in debt de...View the full answer

Answered By

Ashok Kumar Malhotra

Chartered Accountant - Accounting and Management Accounting for 15 years.

QuickBooks Online - Certified ProAdvisor (Advance - QuickBooks Online for 3 years.

5.00+

3+ Reviews

10+ Question Solved

Related Book For

Fundamental Accounting Principles Volume II

ISBN: 978-1260305838

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

Question Posted:

Related Video

Constant Growth Dividend Discount Model – This dividend discount model assumes dividends grow at a fixed percentage. They are not variable and are consistent throughout. Variable Growth Dividend Discount Model or Non-Constant Growth model

Students also viewed these Business questions

-

Required Refer to Exhibit 18.14 and calculate Focus Metals solvency ratios for 2013 and 2014 (round answers to two decimal places). Analysis Component: Identify whether the change in each ratio from...

-

Refer to Exhibit 17.14 and calculate Tia?s Trampolines Inc.?s profitability ratios for 2020 (round calculations to two decimal places). Also identify whether each of Tia?s Trampolines Inc.?s...

-

The standard direct labor cost per reservation for Harrys Hotel is $3 (= $12 per labor hour ÷ 4 reservations per hour). Actual direct labor costs during the period totaled $45,240....

-

There are 38 numbers in the game of roulette. They are 00, 0, 1, 2, . . ., 36. Each number has an equal chance of being selected. In the game, the winning number is found by a spin of the wheel. Say...

-

Prove that nj =1 j4 = n(n+1) (2n+1) (3n2 +3n1)/30 whenever n is a positive integer.

-

What steps can organizations take to assess and manage job satisfaction? LO3

-

The information below was taken from the annual report of Busytown Industries. 1996 1995 Balance Sheet Deferred income tax liability Income Statement $ 9,700 $8,300 Income before taxes $ 68,000...

-

1. Construct an aggregate project plan for USP. 2. What criteria would you recommend USP use in selecting its projects this year? 3. Based on your recommended criteria and the aggregate project plan,...

-

Haribo has manufactured gummy bears, since 1920. Those bears are currently made in 16 plants around the world. Starting in 2020, those gummy bears will also be made in the US when Haribo opens a new...

-

Please solve this problem using C language Hacker Industries has a number of employees. The company assigns each employee a numeric evaluation score and stores these scores in a list. A manager is...

-

Silver Bullet Slide Company calculated the ratios shown below for 2020 and 2019: Required 1. Identify whether the change in the ratios from 2019 to 2020 is favourable (F) or unfavourable (U). 2....

-

Sustainable Seafood Inc. processes and markets frozen seafood products. Continental Pipelines Limited is in the oil and gas industry in Canada and abroad. Both companies are being considered as...

-

The Valuation of Balance Sheet Elements a. The balance sheet of Model Company is presented in Exhibit 6-2. For each of the assets and liabilities listed in Model Companys balance sheet, indicate...

-

5 28 its Jay Oullette, CEO of Bumper to Bumper Incorporated, anticipates that his company's year-end balance sheet will show current assets of $12,801 and current liabilities of $7,540. Oullette has...

-

Test the given claim. Assume that a simple random sample is selected from a normally distributed population. Use either the P-value method or the traditional method of testing hypotheses. Company A...

-

Trojan Technologies As Joyce Guo, senior buyer at Trojan Technologies Inc. in London, Ontario, Canada, finished her presentation, Randy Haill, materials manager, Made the following comments to her:...

-

In 2022, Andrew, who is single, has a comfortable salary from his job as well as income from his investment portfolio. However, he is habitually late in filing his federal income tax return. He did...

-

Express the confidence interval (0.045,0.123) in the form of p^ - E < p < p^+ E.

-

Describe a transaction where a principal creates apparent authority. Describe a transaction where an agent acts outside the scope of authority.

-

Separate variables and use partial fractions to solve the initial value problems in Problems 18. Use either the exact solution or a computer-generated slope field to sketch the graphs of several...

-

Briefly describe some of the similarities and differences between GAAP and IFRS with respect to the accounting for liabilities.

-

What are the basic ownership rights of common stockholders in the absence of restrictive provisions? Discuss.

-

What are the basic ownership rights of common stockholders in the absence of restrictive provisions? Discuss.

-

Use the future value formula to find the indicated value. n=20; i = 0.03; PMT = $80; FV = ? FV=$1 (Round to the nearest cent.)

-

An unlevered firm has an EBIT = $250,000, aftertax net income = $165,000, and a cost of capital of 12%. A levered firm with the same assets and operations has $1.25 million in face value debt paying...

-

Suppose Mike Inc. has 100 shares outstanding. It receives a constant net income of $1,000 annually and will pay all of it as dividends. What is the stock price today? Assuming the required rate of...

Study smarter with the SolutionInn App