Refer to Exhibit 17.14 and calculate Tia?s Trampolines Inc.?s profitability ratios for 2020 (round calculations to two

Question:

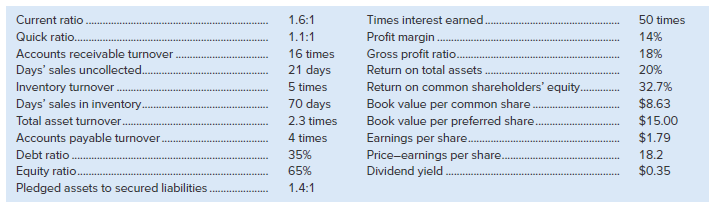

Refer to Exhibit 17.14 and calculate Tia?s Trampolines Inc.?s profitability ratios for 2020 (round calculations to two decimal places). Also identify whether each of Tia?s Trampolines Inc.?s profitability ratios compares favourably (F) or unfavourably (U) to the industry average by referring to Exhibit 17.11.

Analysis Component: Comment on the trend in sales, accounts receivable, cost of goods sold, and accounts payable for the three years 2020, 2019, and 2018.

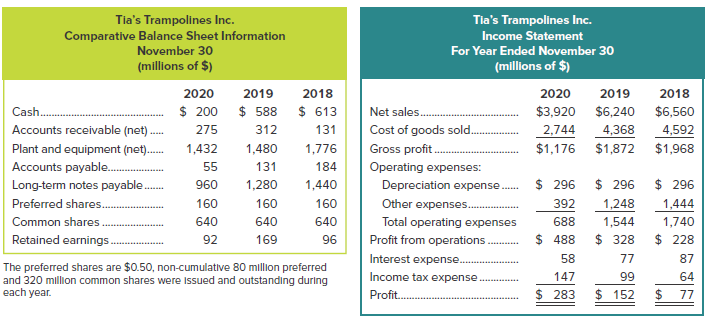

Exhibit 17.14

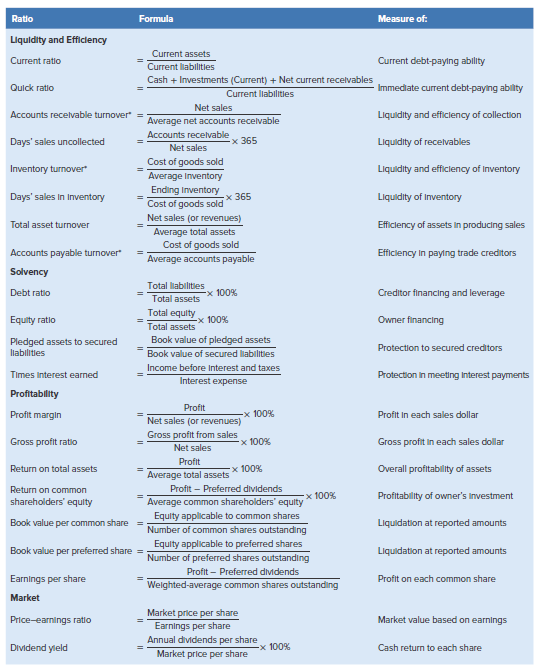

Exhibit 17.11

Tia's Trampolines Inc. Comparative Balance Sheet Information Tia's Trampolines Inc. Income Statement November 30 For Year Ended November 30 (millions of $) (millions of $) 2020 2019 2018 2020 2019 2018 $ 613 $ 200 $ 588 Cash. $3,920 $6,240 $6,560 4,592 Net sales. Accounts receivable (net) . 4,368 275 312 131 Cost of goods sold. 2,744 Gross profit. Plant and equipment (net). $1,176 $1,872 $1,968 1,432 1,480 1,776 Accounts payable. 55 131 184 Operating expenses: $ 296 1,440 $ 296 $ 296 Long-term notes payable. 960 1,280 Depreciation expense. 160 160 160 1,444 Preferred shares. Other expenses. 392 1,248 640 Total operating expenses Common shares. 640 640 688 1,544 1,740 Retained earnings. $ 328 $ 228 Profit from operations $ 488 92 169 96 Interest expense. 58 77 87 The preferred shares are $0.50, non-cumulative 80 million preferred and 320 million common shares were Issued and outstanding during each year. Income tax expense 147 99 64 $ 283 $ 152 24 Profit. 77 Ratio Formula Measure of: Liquldity and Efficlency Current assets Current ratio Current labilitles Current debt-paylng ability Cash + Investments (Current) + Net current recelvables Quick ratio Immedlate current debt-paying ability Current labilities Net sales Accounts recelvable turnover Liquidity and efficlency of collection Average net accounts recelvable Accounts recelvable Days' sales uncollected x 365 Liquidity of recelvables Net sales Cost of goods sold Inventory turnover Liquidity and efficlency of Inventory Average Inventory Ending Inventory Days' sales in Inventory x 365 Cost of goods sold Liquidity of Inventory Net sales (or revenues) Total asset turnover Efficlency of assets in producing sales Average total assets Cost of goods sold Accounts payable turnover Efficiency in paylng trade creditors Average accounts payable Solvency Total liabilities Debt ratio x 100% Creditor financing and leverage Total assets Total equity Equity ratio -x 100% Owner financing Total assets Book value of pledged assets Pledged assets to secured liabilitles Protection to secured creditors Book value of secured liabilities Income before Interest and taxes Times Interest earned Protection in meeting Interest payments Interest expense Profitability Profit Profit margin -x 100% Profit in each sales dollar Net sales (or revenues) Gross profit from sales Net sales Gross profit ratio x 100% Gross profit in each sales dollar Profit Return on total assets x 100% Overall profitability of assets Average total assets Profit – Preferred dividends Return on common shareholders' equity x 100% Profitability of owner's Investment Average common shareholders' equlty Equity applicable to common shares Book value per common share Liquidation at reported amounts Number of common shares outstanding Equity applicable to preferred shares Book value per preferred share = Liquidation at reported amounts Number of preferred shares outstanding Profit - Preferred dividends Earnings per share Profit on each common share Weighted-average common shares outstanding Market Market price per share Earnings per share Price-earnings ratio Market value based on earnings Annual dividends per share Market price per share Dividend yleld -x 100% Cash return to each share

Step by Step Answer:

2020 Industry Average FU 1 Profit margin 722 14 U 2 Gross profit ratio 30 18 F 3 Return on total ass...View the full answer

Fundamental Accounting Principles Volume II

ISBN: 978-1260305838

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

Related Video

Constant Growth Dividend Discount Model – This dividend discount model assumes dividends grow at a fixed percentage. They are not variable and are consistent throughout. Variable Growth Dividend Discount Model or Non-Constant Growth model

Students also viewed these Business questions

-

Refer to Exhibit 17.14 and calculate Focus Metals? solvency ratios for 2019 and 2020 (round answers to two decimal places). Analysis Component: Identify whether the change in each ratio from 2019 to...

-

The standard direct labor cost per reservation for Harrys Hotel is $3 (= $12 per labor hour ÷ 4 reservations per hour). Actual direct labor costs during the period totaled $45,240....

-

Peach Corporation (a calendar year company) recorded the following transactions. Taxable income ...................... $5,000,000 Regular tax depreciation on realty in excess of ADS (placed in...

-

After assembly, a finished TV is left turned on for one full day (24 h) to determine whether the product is reliable. On average, two TVs break down each day. Yesterday 500 TVs were produced. What is...

-

Prove that 12 22 + 32 - + ( 1)n1n2 = ( 1)n1 n(n + 1)/2 whenever n is a positive integer.

-

What are moods and emotions, and what specific forms do they take? LO3

-

During 1996 Seagul Outboards sold 200 outboard engines for $250 each. The engines are under a one-year warranty for parts and labor, and from past experience, the company esti mates that, on average,...

-

Determine the necessary end-of-June adjustments for Brown Company. 1. On June 1, 2016, Brown Company, a new firm, paid $7,000 rent in advance for a seven-month period. The $7,000 was debited to the...

-

Based on the bond information provided in Table 1, calculate the missing zero rate Z 1.5 and the 6-month forward rates R 0.5,1 and R 1.0,1.5 Table 1 Time to Maturity (years) Coupon Rate (p.a.) Face...

-

A certain type of tomato seed germinates 90% of the time. A backyard farmer planted 25 seeds. a. What is the probability that exactly 20 germinate? b. What is the probability that 20 or more...

-

Sustainable Seafood Inc. processes and markets frozen seafood products. Continental Pipelines Limited is in the oil and gas industry in Canada and abroad. Both companies are being considered as...

-

The following information is available from the financial statements of Landscape Enhancements Inc.: Calculate Landscape Enhancements? return on total assets for 2019 and 2020. (Round answers to one...

-

The PA system at North High School requires 400 watts when it is switched on. How much would it cost to run for 3 hours, at a cost of $0.10 per kilowatt-hour?

-

1. Allen Young has always been proud of his personal investment strategies and has done very well over the past several years. He invests primarily in the stock market. Over the past several months,...

-

The waiting times between a subway departure schedule and the arrival of a passenger are uniformly distributed between 0 and 9 minutes. Find the probability that a randomly selected passenger has a...

-

Greenview Dairies produces a line of organic yogurts for sale at supermarkets and specialty markets in the Southeast. Economic conditions and changing tastes have resulted in slowing demand growth....

-

Rudy Gandolfi owns and operates Rudy's Furniture Emporium Inc. The balance sheet totals for assets, liabilities, and stockholders' equity at August 1, 2019, are as indicated. Described here are...

-

If you were team leader how would you break up this assignment for 4 people to complete? Group Case Analysis Parts 4, 5, and 6 IV. STRATEGY IMPLEMENTATION. (How are you going to do what you want to...

-

1. What is a will? 2. Why is it important for a young, healthy family to have a will? 3. What can happen to an estate when no will exists? 4. Why should an individual consider hiring an attorney when...

-

The activities listed in lines 2125 serve primarily as examples of A) Underappreciated dangers B) Intolerable risks C) Medical priorities D) Policy failures

-

Contrast the effects of a cash dividend and a stock dividend on a corporations balance sheet.

-

What is the formula for the payout ratio? What does it indicate?

-

Indicate whether each of the following statements is true or false. ______1. The corporation is an entity separate and distinct from its owners. ______2. The liability of stockholders is normally...

-

must show work for all questions (either calculation with detailed explanation or bond premium/discount amortization schedule with calculation) On 1/1/2019, Allie Company issued bonds payable of...

-

The principal amount of a bond is $65,000 its stated rate is 7%, and the term of the bond is 6 years. The bond pays interest semiannually. At the time of issue, the market rate is 8%. Determine the...

-

4) You make a deposit of $780 at 6% interest compounded annually. How much will be in the account in 3 years

Study smarter with the SolutionInn App