Refer to Googles statement of cash flows in Appendix A. What are its cash flows from financing

Question:

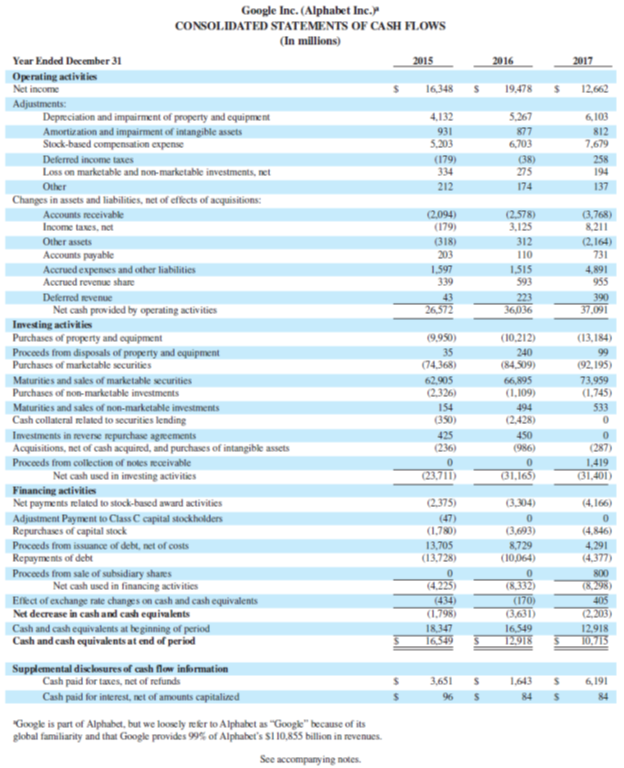

Refer to Google’s statement of cash flows in Appendix A. What are its cash flows from financing activities for the year ended December 31, 2017? List the items and amounts.

Data from Google's

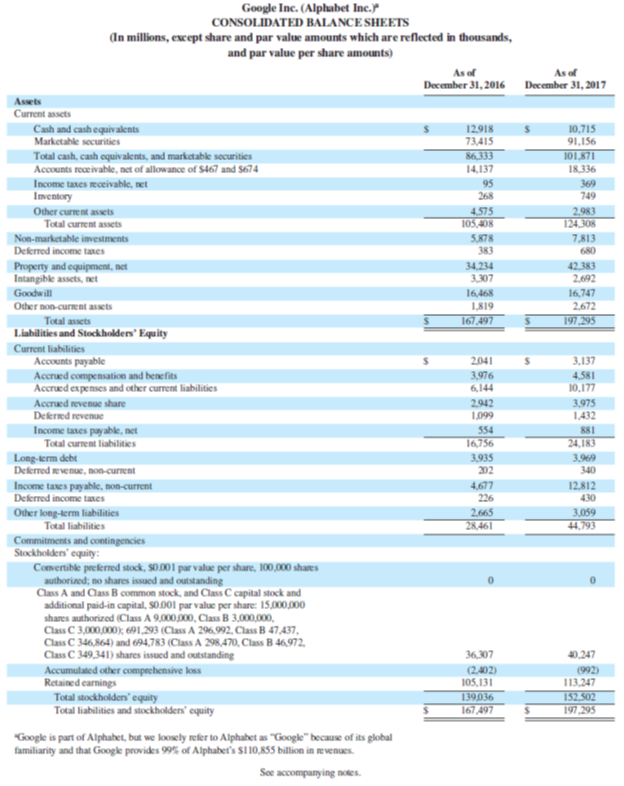

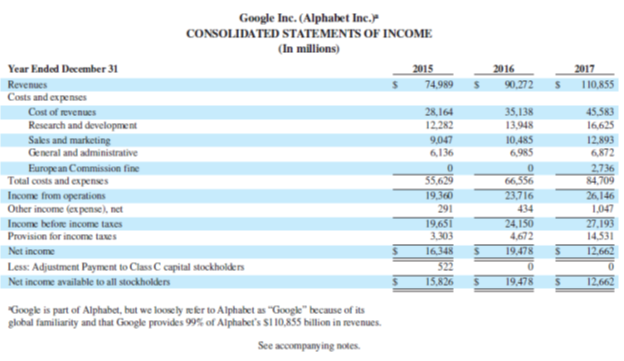

Google Inc. (Alphabet Inc.) CONSOLIDATED BALANCE SHEETS (In millions, except share and par value amounts which are reflected in thousands, and par value per share amounts) As of As of December 31, 2016 December 31, 2017 Assets Current assets 10,715 91,156 Cash and cash equivalents Marketable securities 12,918 73,415 101,871 Total cash, cash cquivalents, and marketable securities Accounts receivable, net of allowance of $467 and $674 Income taxes receivable, net ఒ6333 14,137 18,336 95 369 749 Imentory Other curre nt assets Total current assets 268 2.983 124,308 4,575 105,408 Non-marketable investments 5,878 383 7,813 680 Deferred income taxes 34,234 3,307 Property and equipment, net Intangible assets, net Goodwill Other non-curent assets 42,383 2,692 16,747 2,672 16,468 1,819 Total assets Liabilities and Stockholders' Equity 167,497 197,295 Current liabilities 2041 3,137 Accounts payable Accrued compensation and benefits Accrued expenses and other current liabilities 3,976 6,144 4,581 10,177 2,942 1,099 3,975 1,432 Accrued revenue share Dekred revenue Income taxes payable, net Total current liabilities 554 881 16,756 24,183 3,935 202 Long-kerm debt Dekrred evenue, non-current 3,969 340 Income tases payable, non-current Deferred income taxes 4,677 12,812 430 226 Other long-term liabilities Total liabilities 2,665 28,461 3,059 44,793 Commitments and contingencies Stockholders' equity: Comertible preferred stock, $O D0 1 par value per share, 100,000 shares authorized; no shares issued and outstanding Class A and Class B common stock, and Class C capital stock and additional paid-in capital, S0.001 par value per share: 15,000.000 shares authorized (Class A 9,000,000, Class B 3,000,000, Class C 3,000,000); 691,293 (Class A 296,992, Class B 47,437, Class C 346,864) and 694,783 (Class A 298,470, Class B 46,972, Class C 349,341) shares issued and outstanding Accumulated other comprehensive loss Retained carnings Total stockholders" equity Total liabilities and stockholders' equity 36,307 40,247 (2,402) (992) 105,131 113,247 139,036 152,502 197,295 167,497 "Google is part of Alphabet, but we loosely refer to Alphabet as "Google" because of its global familiarity and that Google provides 99% of Alphabet's S1 10,855 billion in revenues. Soe accompanying notes. Google Inc. (Alphabet Inc. CONSOLIDATED STATEMENTS OF INCOME (In millions) Year Ended December 31 2015 2016 90,272 2017 Revenues 74,989 110,855 Costs and expenses Cost of revenues Research and development Sakes and marketing General and administrative Europe an Commission fine Total costs and expenses Income from operations Other income (ex pense), net 28,164 35,138 45,583 12,282 13,948 16625 9,047 10,485 12,893 6,872 6,136 6,985 55,629 19.360 291 2,736 84,709 26,146 ఈ656 23,716 434 1,047 19.651 3,303 16348 24,150 4,672 27,193 14,531 Income before income taxes Provision for income taxes Net income 19,478 12,662 Less: Adjustment Payment to Class C capital stockholders Net income available to als 522 15,826 19,478 12,662 Google is part of Alphabet, but we loosely eer to Alphabet as "Google" because of its global familiarity and that Google provides 99% of Alphabet's $1 10,85S billion in revenues. See accompanying notes.

Step by Step Answer:

Googles statement of cash flows shows several major financing activities millions Ne...View the full answer

Related Video

Financial statements of a business having numerous divisions or subsidiaries are called consolidated financial statements. Companies frequently refer to the aggregated reporting of their entire firm together when using the term \"consolidated\" in financial statement reporting. Consolidated financial statement reporting, on the other hand, is defined by the Financial Accounting Standards Board as the reporting of an entity that is organized with a parent company and subsidiaries.

Students also viewed these Business questions

-

Refer to Samsungs 2017 statement of cash flows in Appendix A. List its cash flows from operating activities,investing activities, and financing activities. Data from Samsung Samsung Electronics Co.,...

-

For each of the following separate transactions, (a) prepare the reconstructed journal entry and (b) identify the effect it has, if any, on the investing section or financing section of the statement...

-

Finer Shoes Company recorded book income of $120,000 in 2016. It does not have any permanent differences. and the only temporary difference relates to a $60,000 installment sale that it recorded for...

-

What are the different relays that employed for protection of apparatus and transmission lines?

-

Imagine that 501 people are present in a movie theater of volume 8.00 103 m3 that is sealed shut so no air can escape. Each person gives off heat at an average rate of 110 W. By how much will the...

-

What do you mean by Calls-in-Arrear and Calls-in-Advance? What are the provisions of Companies Act, 2013 in this regard?

-

Do our organizational rewards/benefits motivate and engage employees?

-

Lenox Manufacturing Co. produces and sells specialized equipment used in the petroleum industry. The company is organized into three separate operating branches: Division A, which manufactures and...

-

Issuing bonds at a discount On the first day of the fiscal year, a company issues a $1,900,000, 11%, 7-year bond that pays semiannual interest of $104,500 ($1,900,000 11% ), receiving cash of...

-

The market for a particular chemical, called Negext, is described by the following equations. Demand is given by QD = 100 - 5P Supply is given by QS = 5P where Q is measured as units of Negext and P...

-

Refer to Apples statement of cash flows in Appendix A. (a) Which method is used to compute its net cash provided by operating activities? (b) Its balance sheet shows an increase in accounts...

-

Refer to Samsungs statement of cash flows in Appendix A. What investing activities result in cash outflows for the year ended December 31, 2017? List items and amounts. Data from Samsung Samsung...

-

Waskowski Company sells three products (A, B, and C) with a sales mix of 3:2:1. Unit sales price are shown. What is the sales price per composite unit? A. $17.00 B. $25.00 C. $35.00 D. $20.00 Product...

-

Analysis of the Volkswagen Scandal Possible Solutions for Recovery The Volkswagen scandal is a notorious example of how corporations can shape the ethical and political issues of the environment. The...

-

Shelby isn't sure if her forklift can safely handle the pallet she is being asked to move. What can she check to be sure

-

If schedule acceleration increases costs, how could schedule elongation reduce costs? If schedule acceleration increases costs, how could schedule elongation reduce costs? For the same total...

-

Laser Care Hospital is looking to raise tax-exempt municipal funds in the bond market. As an issuer of the bond, which of the following is not a part of the bond process that Laser Care Hospital will...

-

Find the critical value t a/2 corresponding to a 95% confidence level. (13.046, 22.15) X= 17.598 Sx= 16.01712719 n=50

-

In Problem construct a mathematical model in the form of a linear programming problem. (The answers in the back of the book for these application problems include the model.) Then solve the problem...

-

A genetically engineered strain of Escherichia coli (E. coli) is used to synthesize human insulin for people suffering from type I diabetes mellitus. In the following simplified reaction scheme,...

-

Chip Company produces three products, Kin, Ike, and Bix. Each product uses the same direct material. Kin uses 4 pounds of the material, Ike uses 3 pounds of the material, and Bix uses 6 pounds of the...

-

What is an out-of-pocket cost? What is an opportunity cost? Are opportunity costs recorded in the accounting records?

-

MAX produces and sells power adapters. Its contribution margin income statement follows. A potential customer offers to buy 10,000 units for $5.80 each. These sales would not affect the companys...

-

A project with an initial cost of $32,000 is expected to provide cash flows of $12,900, $13,100, $16,200, and $10,700 over the next four years, respectively. If the required return is 8.1 percent,...

-

A company that is expecting to receive EUR 500,000 in 60 days is considering entering into an FX futures contract to lock an exchange rate to USD for the transaction. The FX rate on the contract is...

-

Suppose you bought a bon with an annual coupon rate of 6.5 percent one year ago for $1,032. The bond sells for $1,020 today. a. Assuming a $1,000 face value, what was your total dollar return on this...

Study smarter with the SolutionInn App