Refer to Samsungs statement of cash flows in Appendix A. What investing activities result in cash outflows

Question:

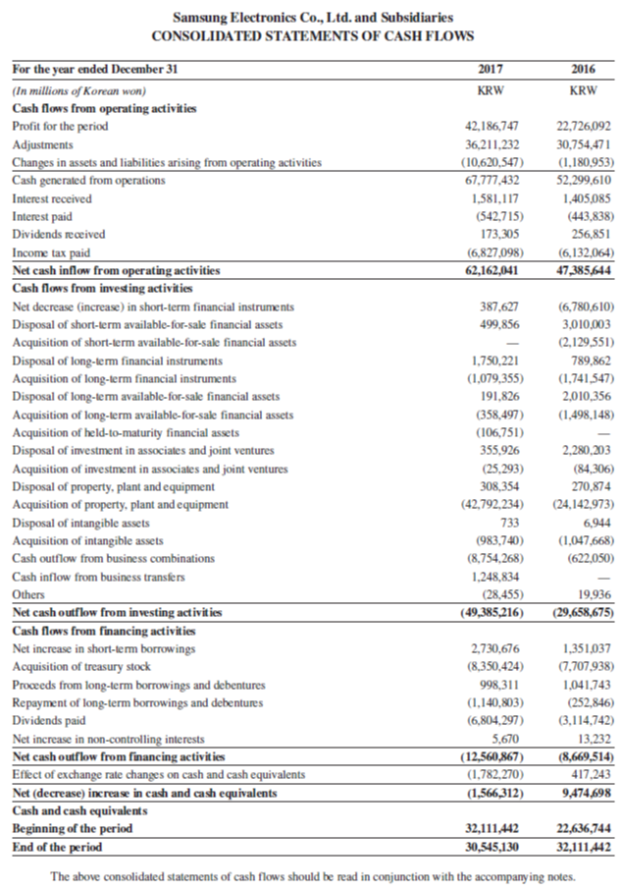

Refer to Samsung’s statement of cash flows in Appendix A. What investing activities result in cash outflows for the year ended December 31, 2017? List items and amounts.

Data from Samsung

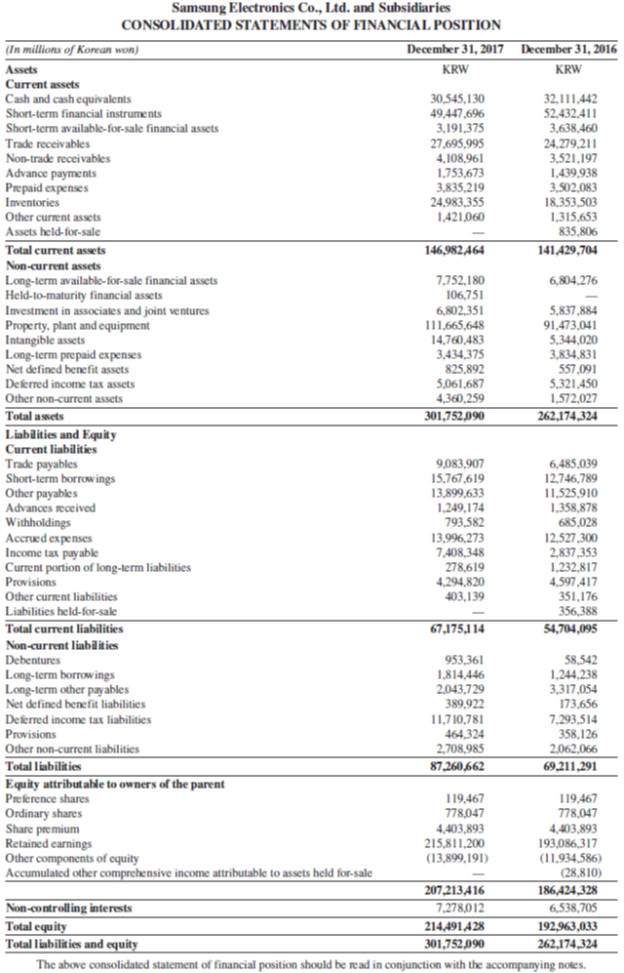

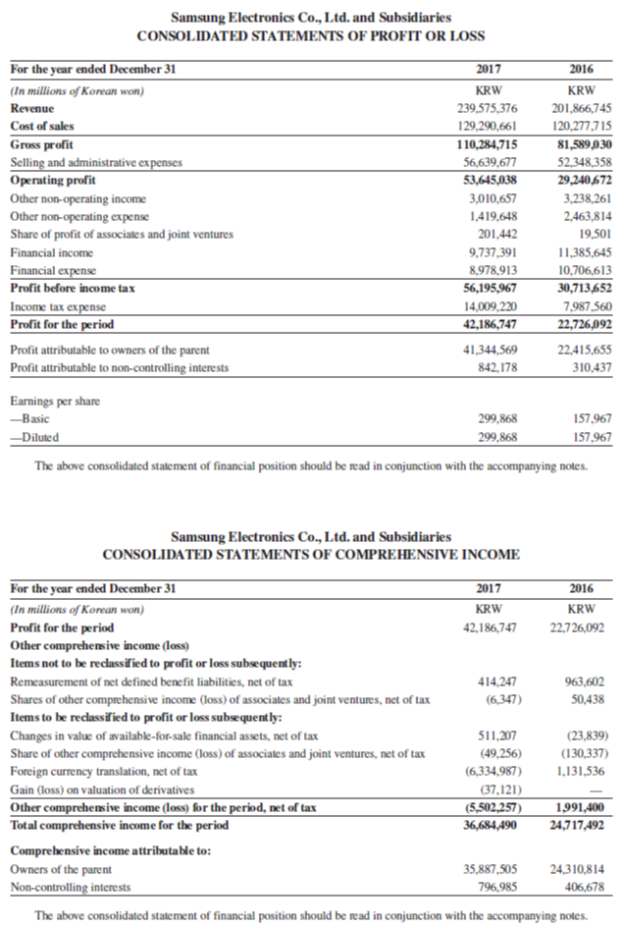

Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF FINANCIAL POSITION December 31, 2017 December 31, 2016 (In millions of Korean won) Assets KRW KRW Current assets 30,545,130 49,447,696 3,191,375 27,695,995 4,108,961 1,753,673 3,835,219 24.983.355 1,421,060 Cash and cash equivalents Short-term financial instruments Short-term available-for-sale financial assets Trade receivables Non-trade receivables Advance payments Prepaid expenses Inventories 32,111,442 52,432,411 3,638,460 24,279,211 3,521,197 1,439,938 3,502,083 18,353,503 1,315,653 835,806 Other current assets Assets held-for-sale Total current assets 146,982,464 141,429,704 Non-current assets 7,752,180 106,751 6,802.351 111,665,648 14,760,483 3,434.375 Long-term available-for-sale financial assets Held-to-maturity financial assets Investment in associates and joint ventures Property, plant and equipment Intangible assets Long-term prepaid expenses Net defined benefit assets 6,804,276 5,837,884 91,473,041 5,344,020 3,834,831 557,091 5,321,450 1,572,027 825,892 5,061,687 4,360,259 301,752,090 Deferred income tax assets Other non-current assets Total assets 262,174,324 Liabilities and Equity Current liabilities Trade payables Short-term borrow ings Other payables Advances received 9,083,907 15,767,619 13,899,633 1,249,174 793,582 6,485,039 12,746,789 11,525,910 1,358,878 685,028 12,527,300 2,837,353 1,232,817 4,597,417 351,176 356,388 54,704,095 Withholdings Accrued expenses Income tax payable Current portion of long-term liabilities Provisions 13,996,273 7,408,348 278,619 4,294,820 403,139 Other current liabilities Liabilities held-for-sake Total current liabilities 67,175,1 14 Non-current liablities Debentures 58,542 1,244,238 3,317,054 173,656 7,293,514 358,126 2,062,066 69,211,291 953,361 1,814,446 2,043,729 389,922 Long-term borrowings Long-term other payables Net defined benefit liabilities 11,710,781 464324 2,708,985 87,260,662 Deferred income tax liabilities Provisions Other non-current liabilities Total liabilities Equity attribut able to owners of the parent Prekrence shares Ordinary shares Share premium Retained earnings Other components of equity Accumulated other comprehensive income attributable to assets held for-sale 119,467 778,047 4,403,893 215,811,200 (13,899,191) 119,467 778,047 4,403,893 193,086,317 (11,934,586) (28,810) 207,213416 186,424,328 Non-controlling interests Total equity Total linbilities and equity 7,278,012 214,491,428 6,538,705 192.963,033 301.752,090 262,174,324 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. ||||| Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF PROFIT OR LOSS For the year ended December 31 (In millions of Korean won) 2017 2016 KRW KRW Revenue 239,575,376 201,866,745 Cost of sales 129,290,661 120,277,715 81,589 030 52,348,358 29,240672 Gross profit Selling and administrative ex penses Operating profit Other non-operating income Other non-operating expense Share of profit of associates and joint ventures 110,284,715 56,639,677 53,645,038 3,010,657 3,238,261 1,419,648 2,463,814 201,442 19,501 Financial income 9,737,391 11,385,645 Financial expense Profit before income tax Income tax expense Profit for the period 8,978,913 56,195,967 10,706,613 30,713652 14,009,220 42,186,747 7,987,560 22,726,092 Profit attributable to owners of the parent 41,344,569 22,415,655 Profit attributable to non-controlling interests 842,178 310,437 Earnings per share --Basic 299,868 157,967 -Diluted 299,868 157,967 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. Samsung Electronies Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME For the year ended December 31 (In millions of Korean won) 2017 KRW 2016 KRW Profit for the period 42,186,747 22,726,092 Other comprehensive income (loss) Items not to be reclassified to profit or loss subsequently: Remeasurement of net defined benefit liabilities, net of tax 414,247 963,602 Shares of other comprehensive income (loss) of associates and joint ventures, net of tax Items to be reclassified to profit or loss subsequently: (6,347) 50,438 511,207 (23,839) Changes in value of available-for-sale financial assets, net of tax Share of other comprehensive income (loss) of associates and joint ventures, net of tax Foreign currency translation, net of tax Gain (loss) on valuation of derivatives Other comprehensive income (loss) for the period, net of tax Total comprehensive income for the period (49,256) (6,334,987) (130,337) 1,131,536 (37,121) (5,502,257) 36,684,490 1,991,400 24,717,492 Comprehensive income attributable to: Owners of the parent 35,887,505 24,310,814 Non-controlling interests 796,985 406,678 The above consolidated statement of financial position should be read in conjunction with the accompanying notes.

Step by Step Answer:

Samsungs investing activities yielding cash outflows and inflows follow Its cash outflows are listed ...View the full answer

Related Video

Financial statements of a business having numerous divisions or subsidiaries are called consolidated financial statements. Companies frequently refer to the aggregated reporting of their entire firm together when using the term \"consolidated\" in financial statement reporting. Consolidated financial statement reporting, on the other hand, is defined by the Financial Accounting Standards Board as the reporting of an entity that is organized with a parent company and subsidiaries.

Students also viewed these Business questions

-

For each separate case, compute the required cash flow information for BioClean. Case A: Compute cash interest received Case B: Compute cash paid for wages Interest revenue... Wages expense... Wages...

-

Use Samsungs financial statements in Appendix A to compute its return on total assets for fiscal year ended December 31, 2017. Data from Samsung Samsung Electronics Co., Ltd. and Subsidiaries...

-

Early in 2018, Bicycle Messenger Service Corporation (BMSC) purchased a multi-line/multi-function telephone system at a cost of $50,000. At that time, BMSC estimated that the system had a useful life...

-

Please do this two questions, please step by step 9. 11. 0/1 points | Previous Answers SEssCalcET1 12.1.020. Calculate the iterated integral. SS 5xyx + y dy dr = || Need Help? Read It Submit Answer...

-

A cylinder contains 250 L of hydrogen gas (H2) at 0.0C and a pressure of 10.0 atm. How much energy is required to raise the temperature of this gas to 25.0C?

-

Bijon Trading Co. Ltd was registered on 2nd January, 2017, with 10,000 equity shares of 10 each. The Company offered 8,000 shares for subscription to public. The condition was that 3 per share is...

-

Do we have a good relationship with our employee unions?

-

Engineering Associates billed clients for 10,000 hours of engineering work for the month. Actual fixed overhead costs for the month were $1,450,000. At the beginning of the year, a fixed overhead...

-

Journal Entries Jan 1 Equipment with a historical cost of $10,000 and an accumulated depreciation of $3,000 was sold for $6,000 Jan 2 Equipment with a historical cost of $20,000 and an accumulated...

-

Calculate (72530 - 13250) using tens complement arithmetic. Assume rules similar to those for twos complement arithmetic.

-

Refer to Samsungs 2017 statement of cash flows in Appendix A. List its cash flows from operating activities,investing activities, and financing activities. Data from Samsung Samsung Electronics Co.,...

-

Bryant Co. reports net income of $20,000. For the year, depreciation expense is $7,000 and the company reports a gain of $3,000 from sale of machinery. It also had a $2,000 loss from retirement of...

-

For each of the following, does the description indicate the use of random sampling or random assignment? 1. Randler, Demirhan, Wst-Ackermann, and Desch (2016) were interested in reducing the...

-

2. (10 points) Two suppliers of products are available to supply the needs of four supermarkets. Each supplier can provide 90 units per day. Each supermarket would like to receive 60 units per day....

-

QUESTION 3 (11 marks) Midrand Ltd acquired a 90% interest in Bramely Ltd on 2 December 20.21 for R2 million. The consideration was settled as follows: Cash payment, Issue of 100 000 shares to the...

-

1. Prepare a Proforma Income Statement for ACCO 295 Corp. (30 points) Use the same Excel table provided to do the calculations with the class explanation. 1. Selling and administrative expenses were...

-

Sandy Foot Hospital expanded their cardiovascular unit to include more operating rooms. They negotiated a 20-year loan with monthly payments and a large sum of $250,000 due at the end of the loan....

-

Oscillations and Resonance Name Lab Procedure Answer questions in red. Download and run the HTMLS application \"resonance\". Driving force: 30 N Driving equency: 5 rad. '5 Spring constant: 5 - 'Irn...

-

Solve the linear programming problems in Problem Maximize P = 3x + 4y x + 2y s 12 x + ys 7 subject to 2x + ys 10 X, y 2 0

-

Find the market equilibrium point for the following demand and supply functions. Demand: 2p = - q + 56 Supply: 3p - q = 34

-

Ace produces and sells energy drinks. Its contribution margin income statement follows. A potential customer offers to buy 50,000 units for $3.00 each. These sales would not affect the companys sales...

-

JART manufactures and sells underwater markers. Its contribution margin income statement follows. A potential customer offers to buy 50,000 units for $3.20 each. These sales would not affect the...

-

Kando Company currently pays $7 per unit to buy a part for a product it manufactures. Instead, Kando could make the part for per unit costs of $3 for direct materials, $2 for direct labor, and $1 for...

-

Q2R. on account for each depreciable asset. During 2024, Jane VIIS nsactions.) i More Info Apr. 1 Purchased office equipment. 5111,000. Paid 581,000 cash and financed the remainder Jan. 1 with a note...

-

The rate of return on Cherry Jalopies, Inc., stock over the last five years was 14 percent, 11 percent, 4 percent, 3 percent, and 7 percent. What is the geometric return for Cherry Jalopies, Inc.?

-

U.S. GAAP specifies all of the following characteristics of variable interest entities except: A. Equity holders hold less than 5% of the entitys voting stock. B. Equity holders do not have voting...

Study smarter with the SolutionInn App