Use Samsungs financial statements in Appendix A to compute its return on total assets for fiscal year

Question:

Use Samsung’s financial statements in Appendix A to compute its return on total assets for fiscal year ended December 31, 2017.

Data from Samsung

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Transcribed Image Text:

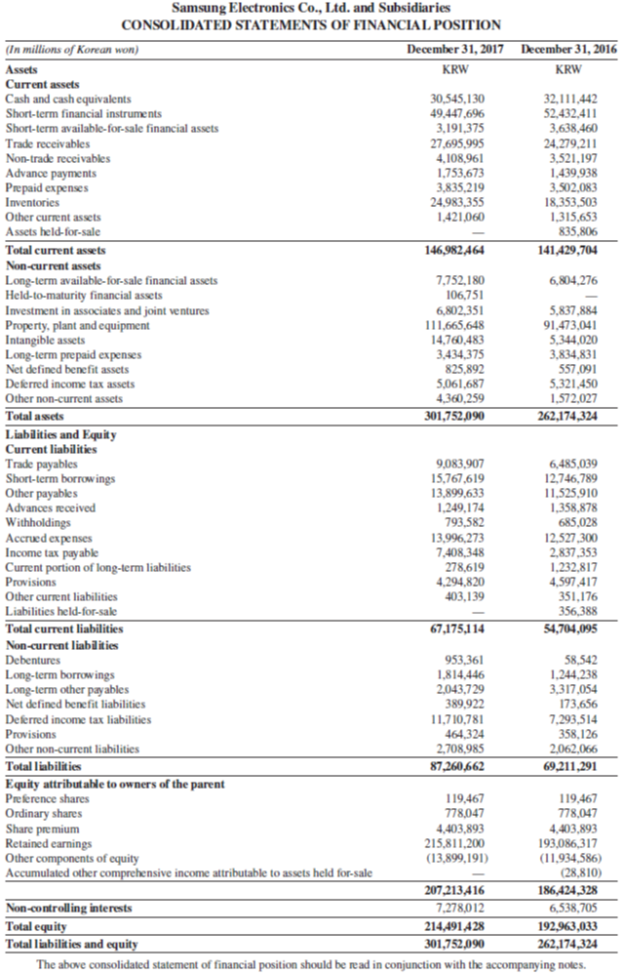

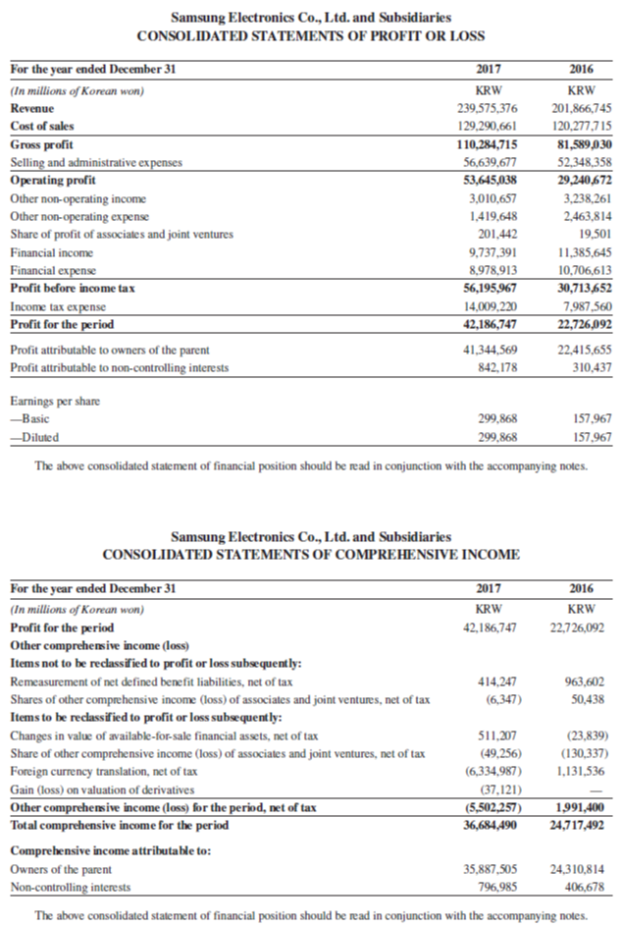

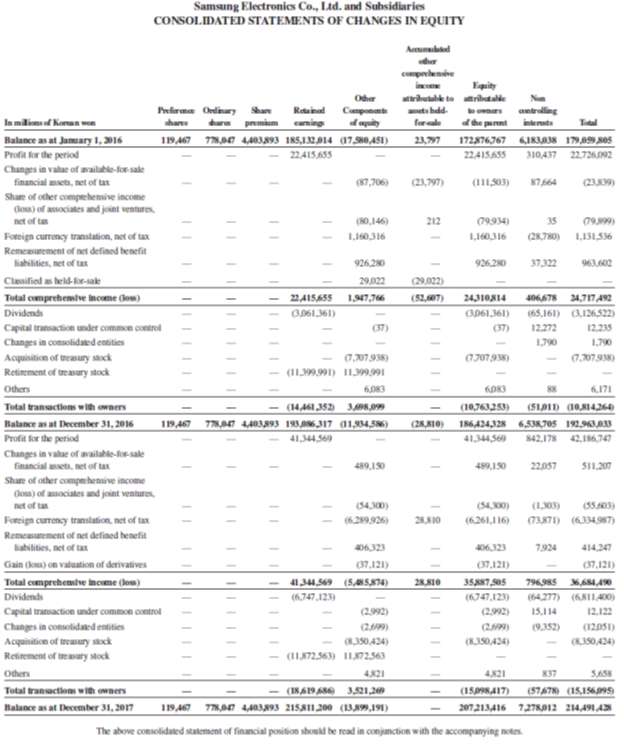

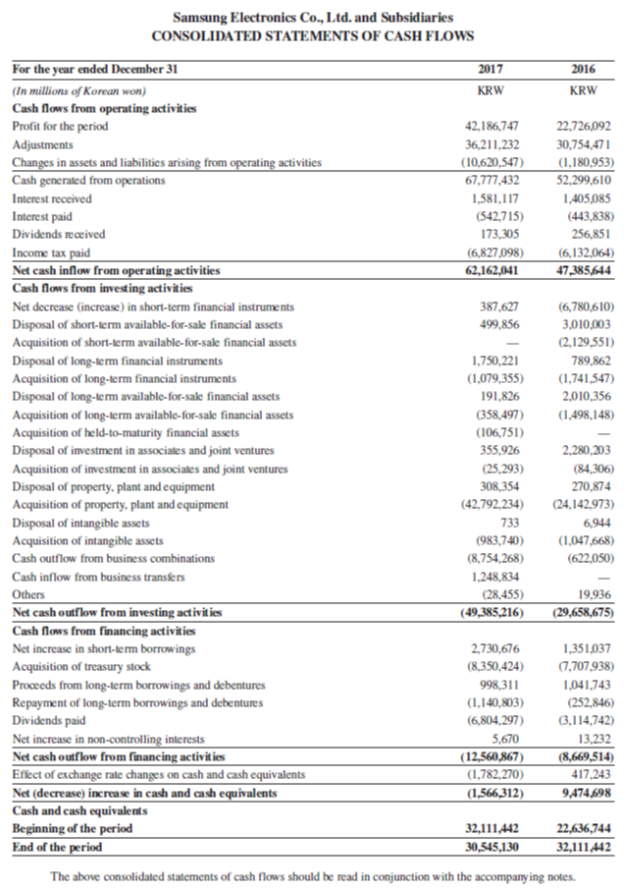

Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF FINANCIAL POSITION December 31, 2017 December 31, 2016 (In millions of Korean won) Assets KRW KRW Current assets 30,545,130 49,447,696 3,191,375 27,695,995 4,108,961 1,753,673 3,835,219 24.983.355 1,421,060 Cash and cash equivalents Short-term financial instruments Short-term available-for-sale financial assets Trade receivables Non-trade receivables Advance payments Prepaid expenses Inventories 32,111,442 52,432,411 3,638,460 24,279,211 3,521,197 1,439,938 3,502,083 18,353,503 1,315,653 835,806 Other current assets Assets held-for-sale Total current assets 146,982,464 141,429,704 Non-current assets 7,752,180 106,751 6,802.351 111,665,648 14,760,483 3,434.375 Long-term available-for-sale financial assets Held-to-maturity financial assets Investment in associates and joint ventures Property, plant and equipment Intangible assets Long-term prepaid expenses Net defined benefit assets 6,804,276 5,837,884 91,473,041 5,344,020 3,834,831 557,091 5,321,450 1,572,027 825,892 5,061,687 4,360,259 301,752,090 Deferred income tax assets Other non-current assets Total assets 262,174,324 Liabilities and Equity Current liabilities Trade payables Short-term borrow ings Other payables Advances received 9,083,907 15,767,619 13,899,633 1,249,174 793,582 6,485,039 12,746,789 11,525,910 1,358,878 685,028 12,527,300 2,837,353 1,232,817 4,597,417 351,176 356,388 54,704,095 Withholdings Accrued expenses Income tax payable Current portion of long-term liabilities Provisions 13,996,273 7,408,348 278,619 4,294,820 403,139 Other current liabilities Liabilities held-for-sake Total current liabilities 67,175,1 14 Non-current liablities Debentures 58,542 1,244,238 3,317,054 173,656 7,293,514 358,126 2,062,066 69,211,291 953,361 1,814,446 2,043,729 389,922 Long-term borrowings Long-term other payables Net defined benefit liabilities 11,710,781 464324 2,708,985 87,260,662 Deferred income tax liabilities Provisions Other non-current liabilities Total liabilities Equity attribut able to owners of the parent Prekrence shares Ordinary shares Share premium Retained earnings Other components of equity Accumulated other comprehensive income attributable to assets held for-sale 119,467 778,047 4,403,893 215,811,200 (13,899,191) 119,467 778,047 4,403,893 193,086,317 (11,934,586) (28,810) 207,213416 186,424,328 Non-controlling interests Total equity Total linbilities and equity 7,278,012 214,491,428 6,538,705 192.963,033 301.752,090 262,174,324 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. ||||| Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF PROFIT OR LOSS For the year ended December 31 (In millions of Korean won) 2017 2016 KRW KRW Revenue 239,575,376 201,866,745 Cost of sales 129,290,661 120,277,715 81,589 030 52,348,358 29,240672 Gross profit Selling and administrative ex penses Operating profit Other non-operating income Other non-operating expense Share of profit of associates and joint ventures 110,284,715 56,639,677 53,645,038 3,010,657 3,238,261 1,419,648 2,463,814 201,442 19,501 Financial income 9,737,391 11,385,645 Financial expense Profit before income tax Income tax expense Profit for the period 8,978,913 56,195,967 10,706,613 30,713652 14,009,220 42,186,747 7,987,560 22,726,092 Profit attributable to owners of the parent 41,344,569 22,415,655 Profit attributable to non-controlling interests 842,178 310,437 Earnings per share --Basic 299,868 157,967 -Diluted 299,868 157,967 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. Samsung Electronies Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME For the year ended December 31 (In millions of Korean won) 2017 KRW 2016 KRW Profit for the period 42,186,747 22,726,092 Other comprehensive income (loss) Items not to be reclassified to profit or loss subsequently: Remeasurement of net defined benefit liabilities, net of tax 414,247 963,602 Shares of other comprehensive income (loss) of associates and joint ventures, net of tax Items to be reclassified to profit or loss subsequently: (6,347) 50,438 511,207 (23,839) Changes in value of available-for-sale financial assets, net of tax Share of other comprehensive income (loss) of associates and joint ventures, net of tax Foreign currency translation, net of tax Gain (loss) on valuation of derivatives Other comprehensive income (loss) for the period, net of tax Total comprehensive income for the period (49,256) (6,334,987) (130,337) 1,131,536 (37,121) (5,502,257) 36,684,490 1,991,400 24,717,492 Comprehensive income attributable to: Owners of the parent 35,887,505 24,310,814 Non-controlling interests 796,985 406,678 The above consolidated statement of financial position should be read in conjunction with the accompanying notes.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 63% (11 reviews)

Return on total asset...View the full answer

Answered By

S Mwaura

A quality-driven writer with special technical skills and vast experience in various disciplines. A plagiarism-free paper and impeccable quality content are what I deliver. Timely delivery and originality are guaranteed. Kindly allow me to do any work for you and I guarantee you an A-worthy paper.

4.80+

27+ Reviews

73+ Question Solved

Related Book For

Question Posted:

Related Video

Financial statements of a business having numerous divisions or subsidiaries are called consolidated financial statements. Companies frequently refer to the aggregated reporting of their entire firm together when using the term \"consolidated\" in financial statement reporting. Consolidated financial statement reporting, on the other hand, is defined by the Financial Accounting Standards Board as the reporting of an entity that is organized with a parent company and subsidiaries.

Students also viewed these Business questions

-

Mifflin Co. reported the following for the current year: net sales of $60,000; cost of goods sold of $38,000; beginning balance in accounts receivable of $14,000; and ending balance in accounts...

-

How would your answer to BE17-20 change if Year 1 income were equal to $100,000? Data from BE17-20 W. Pickett Fence Company incurred a net loss for Year 3. The firm does not have any book-tax...

-

At January 1, 2019, the credit balance in Master Companys Allowance for Doubtful Accounts was $400,000. For 2019, the provision for doubtful accounts is based on a percentage of credit sales. Credit...

-

Explain these points in detail w.r.t application of control in auditing with examples. 1: Relate data capture control with internal control in auditing with example 2: Relate validation control with...

-

Why are vineyards planted along lakeshores or riverbanks in cold climates?

-

At the start of this millennium, Brooks Brothers, a retailer of mens business apparel, was on shaky ground. The company had sold classic suits to most of the American presidents and was considered a...

-

Does the production-operations process work smoothly and with little disruption?

-

Consider the following program: Note that the scheduler in a uniprocessor system would implement pseudo parallel execution of these two concurrent processes by interleaving their instructions,...

-

What would be the current yield of a 4% coupon bond priced at $950? (Keep 4 decimal places in your answer)

-

On April 1, A. C. Corporation, a calendar-year U.S. electronics manufacturer, buys 32.5 million yen worth of computer chips from the Hidachi Company paying 10 percent down, the balance to be paid in...

-

Refer to Samsungs financial statements in Appendix A. Compute its debt ratio as of December 31, 2017,and December 31, 2016. Data from Samsung Samsung Electronics Co., Ltd. and Subsidiaries...

-

Pritchett Co. reported the following year-end data: cash of $15,000; short-term investments of $5,000; accounts receivable (current) of $8,000; inventory of $20,000; prepaid (current) assets of...

-

Let m denote the statement "The Magna Carta was signed in 1995," and let p denote "The Parthenon is located in Italy." Determine the truth value of each of the following: (a) m p (b) ( m ( p (c) (...

-

5. Consider the classes below and determine what is printed out by the client code. public class V { public void one(){ System.out.print("it"); } public void two(){ System.out.print("go"); } } public...

-

Consider the following closed economy short-run IS-LM model with income taxation. The economy is described by equations (1) through (6): (1) C = 200 + 0.8(Y -T); (2) T = 800+0.25Y;(3) G = 500; (4) 1...

-

(30 pts) A binary search tree is given, write a method to delete a node from the tree. Assume the successor and predecessor methods are provided, partial code is provided below. Finish the reset of...

-

Reminder: Formatting is always important in your code (comments, indentation, variable names, etc.) And please always start your Java code file with a multi-line comment listing the name of the...

-

An element is the majority of a size-n array A [1...n] if it occurs more than 1 times in the array. Design a O(log n) time algorithm to find the majority of A in the EREW PRAM model using n...

-

In Problem find A -1 and A 2 . -1 3 0 1

-

Which of the ocean zones shown would be home to each of the following organisms: lobster, coral, mussel, porpoise, and dragonfish? For those organisms you identify as living in the pelagic...

-

Atlas Co. allows select customers to make purchases on credit. Its other customers can use either of two credit cards: Zisa or Access. Zisa deducts a 3% service charge for sales on its credit card,...

-

Describe the direct method of reporting cash flows from operating activities.

-

Describe the indirect method of reporting cash flows from operating activities.

-

On April 1, year 1, Mary borrowed $200,000 to refinance the original mortgage on her principal residence. Mary paid 3 points to reduce her interest rate from 6 percent to 5 percent. The loan is for a...

-

Give a numerical example of: A) Current liabilities. B) Long-term liabilities?

-

Question Wonder Works Pte Ltd ( ' WW ' ) produces ceramic hair curlers to sell to department stores. The production equipment costs WW $ 7 0 , 0 0 0 four years ago. Currently, the net book value...

Study smarter with the SolutionInn App