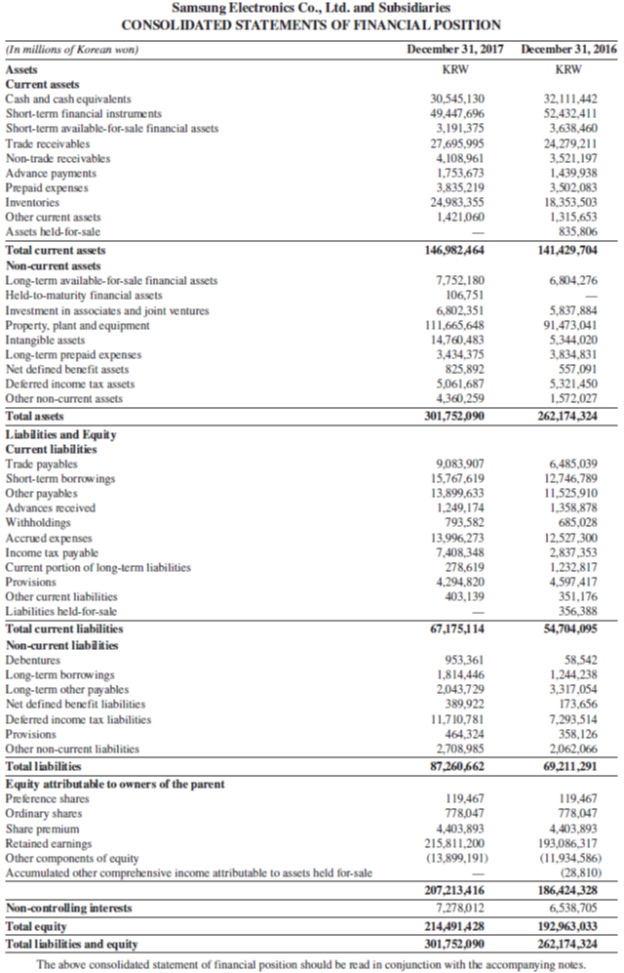

Refer to Samsungs balance sheet in Appendix A. List Samsungs current liabilities as of December 31, 2017.

Question:

Refer to Samsung’s balance sheet in Appendix A. List Samsung’s current liabilities as of December 31, 2017.

Data from Samsung

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Transcribed Image Text:

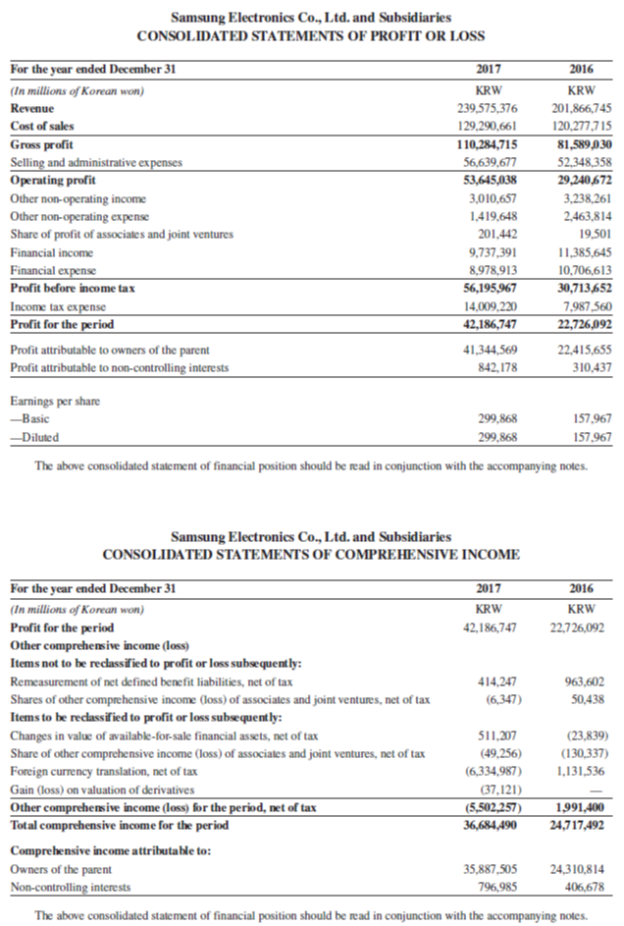

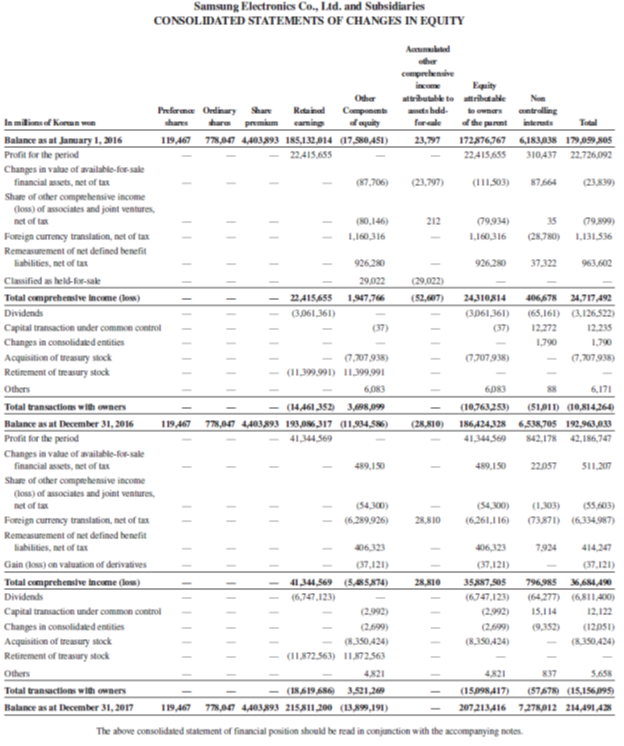

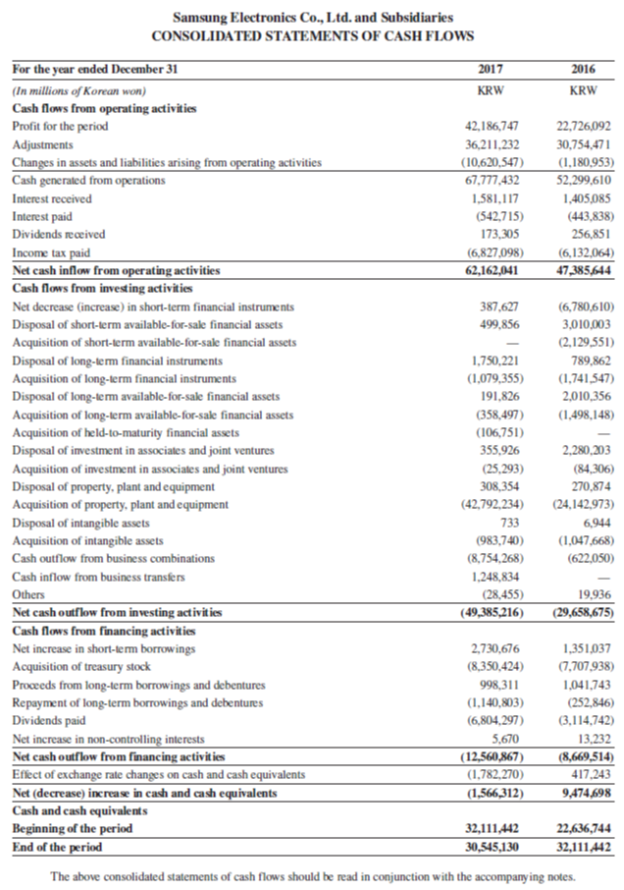

Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF FINANCIAL POSITION December 31, 2017 December 31, 2016 (In millions of Korean won) Assets KRW KRW Current assets 30,545,130 49,447,696 3,191,375 27,695,995 4,108,961 1,753,673 3,835,219 24.983.355 1,421,060 Cash and cash equivalents Short-term financial instruments Short-term available-for-sale financial assets Trade receivables Non-trade receivables Advance payments Prepaid expenses Inventories 32,111,442 52,432,411 3,638,460 24,279,211 3,521,197 1,439,938 3,502,083 18,353,503 1,315,653 835,806 Other current assets Assets held-for-sale Total current assets 146,982,464 141,429,704 Non-current assets 7,752,180 106,751 6,802.351 111,665,648 14,760,483 3,434.375 Long-term available-for-sale financial assets Held-to-maturity financial assets Investment in associates and joint ventures Property, plant and equipment Intangible assets Long-term prepaid expenses Net defined benefit assets 6,804,276 5,837,884 91,473,041 5,344,020 3,834,831 557,091 5,321,450 1,572,027 825,892 5,061,687 4,360,259 301,752,090 Deferred income tax assets Other non-current assets Total assets 262,174,324 Liabilities and Equity Current liabilities Trade payables Short-term borrow ings Other payables Advances received 9,083,907 15,767,619 13,899,633 1,249,174 793,582 6,485,039 12,746,789 11,525,910 1,358,878 685,028 12,527,300 2,837,353 1,232,817 4,597,417 351,176 356,388 54,704,095 Withholdings Accrued expenses Income tax payable Current portion of long-term liabilities Provisions 13,996,273 7,408,348 278,619 4,294,820 403,139 Other current liabilities Liabilities held-for-sake Total current liabilities 67,175,1 14 Non-current liablities Debentures 58,542 1,244,238 3,317,054 173,656 7,293,514 358,126 2,062,066 69,211,291 953,361 1,814,446 2,043,729 389,922 Long-term borrowings Long-term other payables Net defined benefit liabilities 11,710,781 464324 2,708,985 87,260,662 Deferred income tax liabilities Provisions Other non-current liabilities Total liabilities Equity attribut able to owners of the parent Prekrence shares Ordinary shares Share premium Retained earnings Other components of equity Accumulated other comprehensive income attributable to assets held for-sale 119,467 778,047 4,403,893 215,811,200 (13,899,191) 119,467 778,047 4,403,893 193,086,317 (11,934,586) (28,810) 207,213416 186,424,328 Non-controlling interests Total equity Total linbilities and equity 7,278,012 214,491,428 6,538,705 192.963,033 301.752,090 262,174,324 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. ||||| Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF PROFIT OR LOSS For the year ended December 31 (In millions of Korean won) 2017 2016 KRW KRW Revenue 239,575,376 201,866,745 Cost of sales 129,290,661 120,277,715 81,589 030 52,348,358 29,240672 Gross profit Selling and administrative ex penses Operating profit Other non-operating income Other non-operating expense Share of profit of associates and joint ventures 110,284,715 56,639,677 53,645,038 3,010,657 3,238,261 1,419,648 2,463,814 201,442 19,501 Financial income 9,737,391 11,385,645 Financial expense Profit before income tax Income tax expense Profit for the period 8,978,913 56,195,967 10,706,613 30,713652 14,009,220 42,186,747 7,987,560 22,726,092 Profit attributable to owners of the parent 41,344,569 22,415,655 Profit attributable to non-controlling interests 842,178 310,437 Earnings per share --Basic 299,868 157,967 -Diluted 299,868 157,967 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. Samsung Electronies Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME For the year ended December 31 (In millions of Korean won) 2017 KRW 2016 KRW Profit for the period 42,186,747 22,726,092 Other comprehensive income (loss) Items not to be reclassified to profit or loss subsequently: Remeasurement of net defined benefit liabilities, net of tax 414,247 963,602 Shares of other comprehensive income (loss) of associates and joint ventures, net of tax Items to be reclassified to profit or loss subsequently: (6,347) 50,438 511,207 (23,839) Changes in value of available-for-sale financial assets, net of tax Share of other comprehensive income (loss) of associates and joint ventures, net of tax Foreign currency translation, net of tax Gain (loss) on valuation of derivatives Other comprehensive income (loss) for the period, net of tax Total comprehensive income for the period (49,256) (6,334,987) (130,337) 1,131,536 (37,121) (5,502,257) 36,684,490 1,991,400 24,717,492 Comprehensive income attributable to: Owners of the parent 35,887,505 24,310,814 Non-controlling interests 796,985 406,678 The above consolidated statement of financial position should be read in conjunction with the accompanying notes.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (8 reviews)

Samsung reports the following current liabilities Trad...View the full answer

Answered By

Anurag Agrawal

I am a highly enthusiastic person who likes to explain concepts in simplified language. Be it in my job role as a manager of 4 people or when I used to take classes for specially able kids at our university. I did this continuously for 3 years and my god, that was so fulfilling. Sometimes I've skipped my own classes just to teach these kids and help them get their fair share of opportunities, which they would have missed out on. This was the key driver for me during that time. But since I've joined my job I wasn't able to make time for my passion of teaching due to hectic schedules. But now I've made a commitment to teach for at least an hour a day.

I am highly proficient in school level math and science and reasonably good for college level. In addition to this I am especially interested in courses related to finance and economics. In quest to learn I recently gave the CFA level 1 in Dec 19, hopefully I'll clear it. Finger's crossed :)

4.80+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Related Video

Financial statements of a business having numerous divisions or subsidiaries are called consolidated financial statements. Companies frequently refer to the aggregated reporting of their entire firm together when using the term \"consolidated\" in financial statement reporting. Consolidated financial statement reporting, on the other hand, is defined by the Financial Accounting Standards Board as the reporting of an entity that is organized with a parent company and subsidiaries.

Students also viewed these Business questions

-

Refer to Samsung's balance sheet in Appendix A. What does it Samsung title its plant assets? What is the book value of its plant assets at December 31, 2013?

-

Refer to Samsung's balance sheet in Appendix A. How does its cash (titled "Cash and cash equivalents") compare with its other current assets (in both amount and percent) as of December 31, 2015?...

-

Refer to Samsung's balance sheet in Appendix A. How does its cash (titled "Cash and cash equivalents") compare with its other current assets (both in amount and percent) as of December 31, 2012?...

-

TCP: the client sends only 1 message to the server hello from TCP Client and the server responds with the uppercase message. Update the program / make a simple chat program so that The client can...

-

Three point charges are placed on the corners of an equilateral triangle having sides of 0.150 m. What is the total electric force on the 2.50-μC charge? 2.50 HC 5.00 C -7.00 C

-

In Experiment 1, at a 30 angle, flow rate would most likely have been approximately 6.0 ft/s for which new pipe diameter? A. 0.4 in B. 0.6 in C. 0.8 in D. 1.2 in Experiment 1 In Experiment 1,...

-

Should CMC expect to receive a pay-for-performance (P4P) bonus for its quality scores?

-

Kim Rhode is a university graduate who was a pre-veterinarian major with a CIS minor. She is a six- time Olympian from 1996 through 2016 and has won three gold medals, one silver and two bronze...

-

please help me with this Accounting Extra Credit Problem Adjusting Entries, Closing Entries, Reversing Entries, and Effects on Individual Accounts, Income Statement, and Balance Sheet Note: Miracle...

-

A current problem in the U.S. Army is the neck/shoulder fatigue experienced by helicopter pilots. To be able to fly missions at night, the pilots wear night vision goggles, which are attached to the...

-

Refer to Googles balance sheet in Appendix A. What accrued expenses (liabilities) does Google report at December 31, 2017? Data from Google's Google Inc. (Alphabet Inc.) CONSOLIDATED BALANCE SHEETS...

-

Chavez Co.s salaried employees earn four weeks vacation per year. Chavez estimated and must expense $8,000 of accrued vacation benefits for the year. (a) Prepare the December 31 year-end adjusting...

-

Consider a thin 16-cm-long and 20-cm-wide horizontal plate suspended in air at 20°C. The plate is equipped with electric resistance heating elements with a rating of 20 W. Now the heater is...

-

An employer has calculated the following amounts for an employee during the last week of June 2021. Gross Wages $1,800.00 Income Taxes $414.00 Canada Pension Plan $94.00 Employment Insurance $28.00...

-

Section Two: CASE ANALYSIS (Marks: 5) Please read the following case and answer the two questions given at the end of the case. Zara's Competitive Advantage Fashion houses such as Armani and Gucci...

-

The activity of carbon in liquid iron-carbon alloys is determined by equilibration of CO/CO2 gas mixtures with the melt. Experimentally at PT = 1 atm, and 1560C (1833 K) the equilibrated gas...

-

Apply knowledge of concepts and theories covered in the course to leader - the leader can either be themselves if they lead a team, someone real and personally known to them (such as a boss or leader...

-

A resistor in a dc circuit R = 1.2 2. The power dissipated P is a second-degree function of the voltage V. Graph P versus V from V = 0.0 V to V = 3.0 V.

-

Roulette wheels in Nevada generally have 38 equally spaced slots numbered 00, 0, 1, 2, . . . , 36. A player who bets $1 on any given number wins $35 (and gets the bet back) if the ball comes to rest...

-

What is the expected payoff of an investment that yields $5,000 with a probability of 0.15 and $500 with a probability of 0.85? Select one: O a. $325 O b. $5,500 O c. $2,750 O d. $1,175

-

On January 1, $50,000 cash is borrowed from a bank in return for a 6% installment note with 24 monthly payments of $2,216 each. Prepare the journal entry to record (1) The issuance of the note and...

-

On January 1, $30,000 cash is borrowed from a bank in return for a 12% installment note with 36 monthly payments of $996 each. (1) Prepare an amortization table for the first three months of this...

-

Refer to the lease details in Problem 14-12B. Assume that this lease is classified as an operating lease instead of a finance lease. Required 1. Prepare the January 1 journal entry at the start of...

-

Horizontal Analysis The comparative accounts payable and long-term debt balances of a company are provided below. Current Year Previous Year Accounts payable $47,286 $63,900 Long-term debt 85,492...

-

On January 1, Year 1, Price Company issued $140,000 of five-year, 7 percent bonds at 97. Interest is payable annually on December 31. The discount is amortized using the straight-line method. Record...

-

Logistics Solutions provides order fulfillment services for dot.com merchants. The company maintains warehouses that stock items carried by its dot.com clients. When a client receives an order from a...

Study smarter with the SolutionInn App