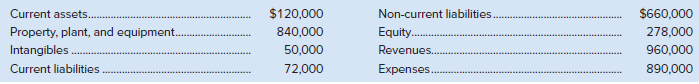

Selected information taken from the December 31, 2020, financial statements for Mesa Company is shown below for

Question:

Selected information taken from the December 31, 2020, financial statements for Mesa Company is shown below for the year just ended:

The accountant was not sure about how to handle a few transactions and has listed the details here.

Inventory

Purchased $34,000 of merchandise inventory on December 28, 2020, shipped FOB destination on December 28, and received on January 5, 2021. (Recorded as a debit to Merchandise Inventory and a credit to Accounts Payable.) Because this liability was not due until 2021, it was listed as a non-current liability on the December 31, 2020, balance sheet.

Revenue

On December 15, 2020, $80,000 was collected for services to be provided in February and March 2021 and was recorded as a debit to Cash and a credit to Revenue.

On December 31, 2020, $50,000 of revenue earned but not collected or recorded was recorded as a debit to Accounts Receivable and a credit to Revenue.

LiabilitiesOn January 5, 2021, $5,000 of interest accrued on a note payable during December and was recorded when it was paid as a debit to Interest Expense and a credit to Interest Payable.

Payroll liabilities of $40,000 had accrued as of December 31, 2020, but had not been recorded.

Of the total non-current liabilities only $430,000 is due after December 31, 2021 and the balance is due before December 31, 2021.

Required

Using the elements of critical thinking described on the inside front cover, discuss the impact on the current ratio, and specifically calculate the ratio before and after the changes you determine are needed.

For each item, determine what the correct balance should be. What should the profit really be? Comment on the reliability of the financial statements. Who are the financial statement users that might be significantly impacted by these errors?

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Fundamental Accounting Principles Volume II

ISBN: 978-1260305838

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann