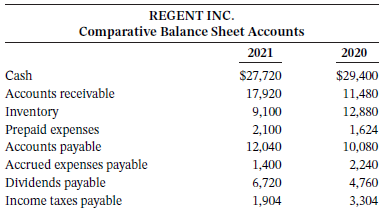

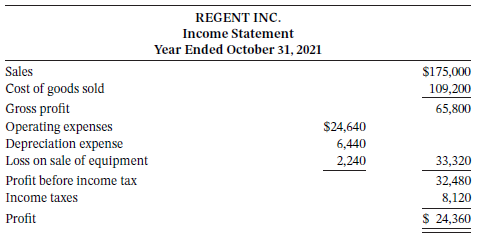

The current assets and liabilities sections of the comparative balance sheets of Regent Inc., a private entity

Question:

The current assets and liabilities sections of the comparative balance sheets of Regent Inc., a private entity reporting under ASPE, at December 31 are presented below, along with the income statement:

Instructions

Prepare the operating section of the cash fl ow statement using the direct method.

Transcribed Image Text:

REGENT INC. Comparative Balance Sheet Accounts 2021 2020 Cash $27,720 $29,400 Accounts receivable 17,920 11,480 Inventory Prepaid expenses Accounts payable Accrued expenses payable Dividends payable Income taxes payable 9,100 12,880 2,100 12,040 1,624 10,080 1,400 2,240 6,720 4,760 1,904 3,304 REGENT INC. Income Statement Year Ended October 31, 2021 Sales $175,000 Cost of goods sold 109,200 Gross profit 65,800 Operating expenses Depreciation expense Loss on sale of equipment $24,640 6,440 2,240 33,320 Profit before income tax 32,480 Income taxes 8,120 Profit $ 24,360

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (12 reviews)

REGENT INC Cash Flow Statement partial x Direct Method Year Ended December 31 2021 Operating activit...View the full answer

Answered By

Jacob Festus

I am a professional Statistician and Project Research writer. I am looking forward to getting mostly statistical work including data management that is analysis, data entry using all the statistical software’s such as R Gui, R Studio, SPSS, STATA, and excel. I also have excellent knowledge of research and essay writing. I have previously worked in other Freelancing sites such as Uvocorp, Essay shark, Bluecorp and finally, decided to join the solution inn team to continue with my explicit work of helping dear clients and students achieve their Academic dreams. I deliver, quality and exceptional projects on time and capable of working under high pressure.

4.90+

1262+ Reviews

2857+ Question Solved

Related Book For

Accounting Principles Volume 2

ISBN: 978-1119502555

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Question Posted:

Students also viewed these Business questions

-

The current assets and liabilities sections of the comparative balance sheet of Charron Inc., a private company reporting under ASPE, at October 31 are presented below, along with the income...

-

The current assets and liabilities sections of the balance sheet of Allessandro Scarlatti Company appear as follows. The following errors in the corporations accounting have been discovered: 1....

-

Presented below is a condensed version of the comparative balance sheets for Garcia Corporation for the last two years at December 31. Additional information: Investments were sold at a loss (not...

-

What types of costs should be considered in deriving the economic order quantity?

-

Consider a group of documents that has been selected from a much larger set of diverse documents so that the selected documents are as dissimilar from one another as possible. If we consider...

-

Do you think that Botnia executives should accept the suspension of the works or continue with the original plan?

-

The following transactions were entered into by Eds Lawn Service during 1997, its first year of operations. 1. Collected $12,000 in cash from stockholders. 2. Borrowed $5,000 from a bank. 3....

-

Jenkins Health Care Center, Inc., has three clinics servicing the Seattle metropolitan area. The companys legal services department supports the clinics. Moreover, its computer services department...

-

Luke Company has three divisions: Peak, View, and Grand. The company has a hurdle rate of 6.01 percent. Selected operating data for the three divisions follow:

-

On April 18, 2011, Eli Lilly and Co. reported first- quarter profits for 2011 of $.95 per share. Analysts projected earnings to be $1.16 or $1.17 per share. However, Lilly reported non- GAAP earnings...

-

Angus Meat Corporation reported the following information for the year ended December 31: Calculate the net cash provided (used) by operating activities using the direct method. Balance sheet...

-

Home Grocery Corporation reported the following in its 2021 financial statements. Calculate the cash payments for income tax. 2021 2020 Income tax payable Income tax expense $17,000 90,000 $8,000

-

(a) What is the probability that a t random variable with 40 degrees of freedom lies between -1.303 and 2.021? (b) Use Table III to put bounds on the probability that a t random variable with 17...

-

An employer has calculated the following amounts for an employee during the last week of June 2021. Gross Wages $1,800.00 Income Taxes $414.00 Canada Pension Plan $94.00 Employment Insurance $28.00...

-

Section Two: CASE ANALYSIS (Marks: 5) Please read the following case and answer the two questions given at the end of the case. Zara's Competitive Advantage Fashion houses such as Armani and Gucci...

-

The activity of carbon in liquid iron-carbon alloys is determined by equilibration of CO/CO2 gas mixtures with the melt. Experimentally at PT = 1 atm, and 1560C (1833 K) the equilibrated gas...

-

Apply knowledge of concepts and theories covered in the course to leader - the leader can either be themselves if they lead a team, someone real and personally known to them (such as a boss or leader...

-

A resistor in a dc circuit R = 1.2 2. The power dissipated P is a second-degree function of the voltage V. Graph P versus V from V = 0.0 V to V = 3.0 V.

-

Woodinville Cement uses a process costing system. In 2020, the company produced and sold 100,000 bags of cement and incurred the following costs: The current selling price is $4 per unit, and the...

-

Calculate the electrical conductivity of a fiber-reinforced polyethylene part that is reinforced with 20 vol % of continuous, aligned nickel fibers.

-

Kate Gough?s regular hourly wage rate is $22.05, and she receives a wage of 1.5 times the regular hourly rate for work over 40 hours per week. For the weekly pay period ended June 15, 2018, Kate...

-

In 2018, Viktor Petska was paid a gross salary of $1,000 on a weekly basis. For the week ended May 12, 2018: (a) Calculate his CPP and EI deductions (b) Use the excerpts in Illustration 10A.5 to...

-

Medlen Models has the following account balances at December 31, 2021: Notes payable ($60,000 due after 12/31/22) ............................. $100,000 Unearned service revenue...

-

Use the future value formula to find the indicated value. n=20; i = 0.03; PMT = $80; FV = ? FV=$1 (Round to the nearest cent.)

-

An unlevered firm has an EBIT = $250,000, aftertax net income = $165,000, and a cost of capital of 12%. A levered firm with the same assets and operations has $1.25 million in face value debt paying...

-

Suppose Mike Inc. has 100 shares outstanding. It receives a constant net income of $1,000 annually and will pay all of it as dividends. What is the stock price today? Assuming the required rate of...

Study smarter with the SolutionInn App