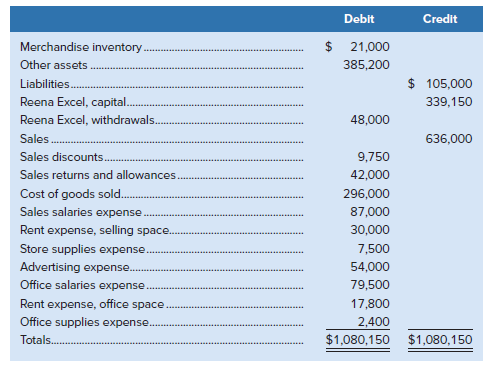

The following amounts appeared on Excel Company?s adjusted trial balance as of May 31, 2020, the end

Question:

The following amounts appeared on Excel Company?s adjusted trial balance as of May 31, 2020, the end of its fiscal year:

Required

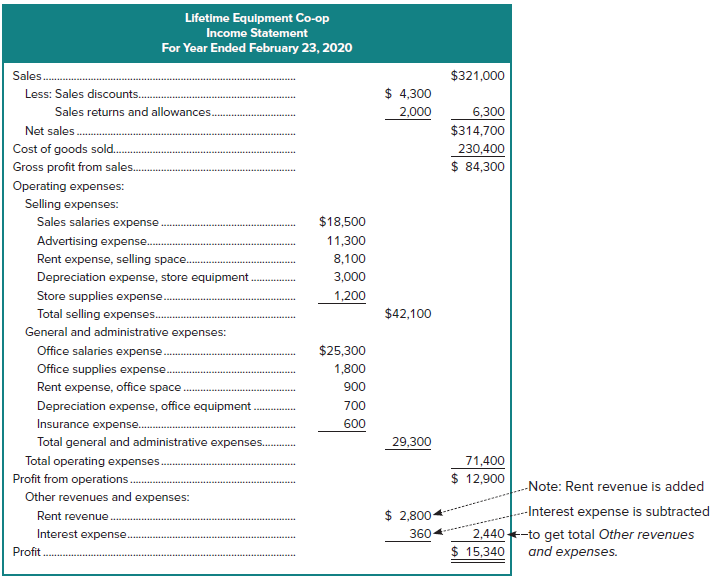

1. Present a classified multiple-step income statement for internal users (see Exhibit 5.13) that lists the company?s net sales, cost of goods sold, and gross profit, as well as the components and amounts of selling expenses and general and administrative expenses.

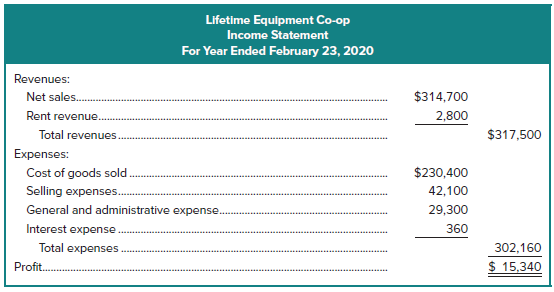

2. Present a condensed single-step income statement (see Exhibit 5.15) that lists these costs: cost of goods sold, selling expenses, and general and administrative expenses.

Exhibition 5.13

Exhibition 5.15

Credit Debit Merchandise inventory 21,000 Other assets 385,200 $ 105,000 Liabilities. Reena Excel, capital. 339,150 Reena Excel, withdrawals. 48,000 636,000 Sales. 9,750 Sales discounts. Sales returns and allowances. 42,000 Cost of goods sold. 296,000 Sales salaries expense 87,000 Rent expense, selling space. 30,000 Store supplies expense. 7,500 54,000 Advertising expense. Office salaries expense. 79,500 Rent expense, office space. Office supplies expense. 17,800 2,400 $1,080,150 $1,080,150 Totals. %24 Lifetime Equipment Co-op Income Statement For Year Ended February 23, 2020 Sales $321,000 $ 4,300 2,000 Less: Sales discounts.. Sales returns and allowances. 6,300 Net sales. $314,700 Cost of goods sold. Gross profit from sales. 230,400 $ 84,300 Operating expenses: Selling expenses: Sales salaries expense $18,500 Advertising expense. 11,300 Rent expense, selling space. 8,100 Depreciation expense, store equipment. Store supplies expense. 3,000 1,200 Total selling expenses. $42,100 General and administrative expenses: Office salaries expense. $25,300 Office supplies expense. 1,800 Rent expense, office space 900 Depreciation expense, office equipment 700 Insurance expense. 600 Total general and administrative expenses.. 29,300 Total operating expenses. 71,400 $ 12,900 Profit from operations. Other revenues and expenses: -- Note: Rent revenue is added Interest expense is subtracted 2,440 -to get total Other revenues $ 15,340 $ 2,800 Rent revenue. Interest expense. 360 Profit and expenses.

Step by Step Answer:

1 Classified multiplestep income statement EXCEL COMPANY Income Statement For Year Ended May 31 2020 ...View the full answer

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

The following amounts appeared on Excel Company's adjusted trial balance as of May 31, 2014, the end of its fiscal year: Required 1. Present a classified multiple-step income statement for internal...

-

The following amounts appeared on Davison Company's adjusted trial balance as of October 31, 2014, the end of its fiscal year: Required 1. Prepare a classified, multiple-step income statement for...

-

The following amounts appeared on the Mendelstein Company's adjusted trial balance as of October 31, 2014, the end of its fiscal year: A physical count shows that the cost of the ending inventory is...

-

The following data are for four independent process-costing departments. Inputs are added uniformly. Required: Compute the equivalent units of production for each of the preceding departments using...

-

Two inputs are said to complementary if their cross-partial derivative D2xixjf(x) is positive, since this means that increasing the quantity of one input increases the marginal productivity of the...

-

A recent Wall Street Journal poll found that 70% of Americans felt the U.S. government was not working well. If seven people were randomly selected, what is the probability that all seven felt the...

-

*24.7 A company has the following results for the 14 months to 31 December 2009: Adjusted trading profit, before deduction of capital allowances 1,413,508 Capital allowances claimed: Year to 31...

-

While examining cash receipts information, the accounting department determined the following information: opening cash balance $150, cash on hand $1,125.74, and cash sales per register tape $988.62....

-

A company receives $400, of which $40 is for sales tax. The journal entry to record the sale would include a debit to Cash for $360. credit to Sales Revenue for $400. debit to Sales Taxes Payable for...

-

A drive has the following parameters: J=10 (kg-m 2 ), T=100-0.1N (N-m), Passive load torque T l =0.05N (N-m), where N is the speed in rpm. Initially the drive is operating in steady-state. Now it is...

-

The following information is from the unadjusted trial balance for Journey?s End Company prepared at October 31, 2020, the end of the fiscal year: Rent and salaries expense are equally divided...

-

Urban Glam Cosmetics made purchases of lipstick in the current year as follows: Urban Glam Cosmetics made sales on the following dates at a selling price of $35 per unit: Jan. 10...

-

List the elements a plaintiff must prove in a negligence case. Which would often be the most difficult to prove? Which is usually the easiest to prove?

-

At the beginning of the year, Azuza's Parking Lots had the following balance sheet: a. At the end of the year, Azuza had the following assets and liabilities: Cash, \(\$ 7,800\); Accounts Receivable,...

-

The following information appears in the records of Stern Corporation at the end of the year: a. Calculate the amount of retained earnings at the end of the year. b. Using your answer from part...

-

The purchase of \(\$ 500\) of supplies on account will: a. Increase both assets and stockholders' equity by \(\$ 500\) b. Increase assets and decrease liabilities by \(\$ 500\) c. Increase assets and...

-

Venus Company owned a service truck that was purchased at the beginning of 2011 for \(\$ 20,000\). It had an estimated life of three years and an estimated salvage value of \(\$ 2,000\). Venus uses...

-

You are observing the sales department staff using exponential smoothing to fore- cast monthly sales. Their forecast for January's sales was 12,000 units. January's actual sales figure became...

-

In 2019, Gloria, a single taxpayer, receives a Schedule K-1 from a partnership she is invested in. The K-1 reports ordinary business income of $40,000, dividend income of $500, tax-exempt interest of...

-

The rate at which the temperature of an object changes is proportional to the difference between its own temperature and the temperature of the surrounding medium. Express this rate as a function of...

-

What is the decision rule under the net present value method?

-

What is the decision rule under the net present value method?

-

In the fourth year of an assets 5-year useful life, the company decides that the asset will have a 6-year service life. How should the revision of depreciation be recorded? Why?

-

True or False: Capitalization rate is used in valuing companies and ignores the effect of debt

-

Question 9 The following information is available for Astrid Ltd and Duncast Ltd. Astrid 15 000 Duncast 15 000 Units produced and sold Rm Rm Revenues 112.5 112.5 55.0 15.0 Variable costs Fixed costs...

-

What is the quoted price of a bond maturing in 12 years with a coupon rate of 9 percent, paid semiannually, that has a YTM of 13 percent? (Please round to the nearest hundredth)

Study smarter with the SolutionInn App