The following information was available to reconcile Shanghai Companys book balance of Cash with its bank statement

Question:

The following information was available to reconcile Shanghai Company’s book balance of Cash with its bank statement balance as of February 28, 2023.

1. The bank statement at February 28 indicated a balance of $23,620. The general ledger account for Cash showed a balance at February 28 of $9,400.

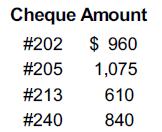

- Of the cheques issued in February, the following were still outstanding:

2. Two cheques, #136 for $1,036 and #200 for $2,600, were outstanding on Jan. 31 when the bank and book balances were last reconciled. Cheque #136 was returned with the February cancelled cheques but cheque #200 was not.

3. Included with the February bank statement was an NSF cheque for $6,250 that had been received from a customer, Mrs. Loni Fung, in payment of her account.

4. Cheque #219 was correctly written for $1,910 in payment for office supplies but was erroneously entered as $9,110 in the cash payments journal.

5. A debit memo for $35 was enclosed with the bank statement. This charge was for printing the chequebook for Shanghai Company.

6. Included with the bank statement was a $120 credit memo for interest earned on the bank account in February.

7. The February 28 cash receipts amounting to $6,835 had been placed in the bank’s night depository after banking hours on that date and did not appear among the deposits on the February bank statement.

8. Included with the bank statement was a credit memo for an electronic fund transfer of $14,000 for the collection of a customer payment. A bank service charge of $65 was deducted.

Required

1. Prepare a bank reconciliation for the Shanghai Company as of February 28, 2023.

2. Prepare the entries needed to adjust the book balance of Cash to the reconciled balance.

Step by Step Answer:

Fundamental Accounting Principles Volume 1

ISBN: 9781260881325

17th Canadian Edition

Authors: Kermit D. Larson, Heidi Dieckmann, John Harris