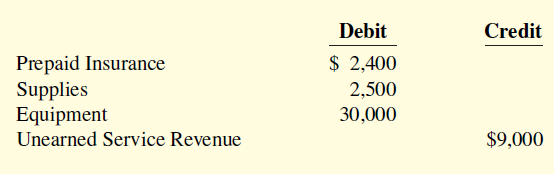

The ledger of Milton, Inc. on March 31, 2020, includes the following selected accounts before adjusting entries.

Question:

An analysis of the accounts shows the following.

1. Insurance expires at the rate of $400 per month.

2. Supplies on hand total $1,600.

3. The equipment depreciates $480 per month.

4. During March, services were performed for two-fifths of the unearned service revenue.

Prepare the adjusting entries for the month of March.

Debit Credit $ 2,400 Prepaid Insurance Supplies Equipment 2,500 30,000 $9,000 Unearned Service Revenue

Step by Step Answer:

1 Insurance Expense 400 Prepaid Insurance 400 To record insur...View the full answer

Accounting Principles

ISBN: 978-1119411482

13th edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Related Video

Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. It can be thought of as a \"prepayment\" for goods or services that a person or company is expected to supply to the purchaser at a later date. As a result of this prepayment, the seller has a liability equal to the revenue earned until the good or service is delivered. This liability is noted under current liabilities, as it is expected to be settled within a year.

Students also viewed these Business questions

-

The ledger of Piper Rental Agency on March 31 of the current year includes the following selected accounts before adjusting entries have been prepared. An analysis of the accounts shows the...

-

The ledger of Chopin Rental Agency on March 31 of the current year includes the following selected accounts before adjusting entries have been prepared. An analysis of the accounts shows the...

-

The ledger of Buerhle, Inc. on March 31, 2010, includes the following selected accounts before adjusting entries.An analysis of the accounts shows the following:1. Insurance expires at the rate of...

-

1. As a policy maker you should never worry much about those are eligible for Medicaid benefits and do not enroll. This is because they will enroll in public insurance if they need it. True or False?...

-

The adjusted trial balance of the Jee, Moe, and Ole partnership at December 31, 2016, is as follows: Cash ........................................ $ 50,000 Accounts receivable-net ...................

-

a) Distinguish between internal users of accounting information and external users. b) List three decisions that might be made by internal users and three decisions that might be made by external...

-

Suppose you have selected a random sample of n = 5 measurements from a normal distribution. Compare the standard normal z-values with the corresponding t-values if you were forming the following...

-

A firm has net sales of $3,000, cash expenses (including taxes) of $1,400, and depreciation of $500. If accounts receivable increase over the period by $400, what would be cash flow from operations?

-

Speed Racer in Victoria makes bicycles for people of all ages. The frames division makes and paints the frames and supplies them to the assembly division where the bicycles are assembled. Speed Racer...

-

Consider the following cash flow diagram. What value of C makes the inflow series equivalent to the outflow series at an interest rate of 12% compounded annually? $1,200 $1,200 $1,200 $1,200 $800...

-

The trial balance of Beowulf Company includes the following balance sheet accounts, which may require adjustment. For each account that requires adjustment, indicate (a) The type of adjusting entry...

-

Fiske Computer Services began operations in July 2020. At the end of the month, the company prepares monthly financial statements. It has the following information for the month. 1. At July 31, the...

-

If you draw 2 tiles with replacement, what is the probability of drawing a consonant first and then a vowel? Involve drawing a Scrabble tile from a bag. These tiles are labeled with a letter and a...

-

! Required information [The following information applies to the questions displayed below.] Littleton Books has the following transactions during May. May 2 Purchases books on account from Readers...

-

4) Consider the table to the right that shows the number of free samples () and number of protein shakes sold (y). a)Complete the table [3 marks] b) Find the equation of the line of best fit X x y 8...

-

Determine the mean number of credit cards based on the raw data. (b) Determine the standard deviation number of credit cards based on the raw data. (c) Determine a probability distribution for the...

-

B Harry is a county Department of Social Services worker whose clients consist primarily of poor, female-headed families receiving public assistance. During one of his meetings with Dora, a single...

-

1 A, Weakly coupled carts (20 points) m m2 Figure 1: A system of two masses and three springs. A symmetric two degree of freedom system consists of two identical rigid masses m = m = m pictured in...

-

The city of Carlsbad in California is considering building a $300 million water-desalination plant. The facility would be the largest in the Western Hemisphere. producing 50 million gallons of...

-

Design a circuit which negative the content of any register and store it in the same register.

-

Yadier Corporation has income from continuing operations of $290,000 for the year ended December 31, 2010. It also has the following items (before considering income taxes). 1. An extraordinary loss...

-

Comparative statement data for Douglas Company and Maulder Company, two competitors, appear below. All balance sheet data are as of December 31, 2011, and December 31, 2010. Instructions (a) Prepare...

-

The comparative statements of Villa Tool Company are presented below. All sales were on account. The allowance for doubtful accounts was $3,200 on December 31, 2011, and $3,000 on December 31, 2010....

-

You plan to buy a house for $325,000 today. If the house is expected to appreciate in value 8% each year, what will its value be seven years from now?

-

A designated beneficiary of an ABLE account must be ___________ in order to meet the special rules that apply to the increased contribution limit authorized under the Tax Cuts and Jobs Act? a. an...

-

Stans wholesale buys canned tomatoes from canneries and sells them to retail markets Stan uses the perpetual inventory

Study smarter with the SolutionInn App