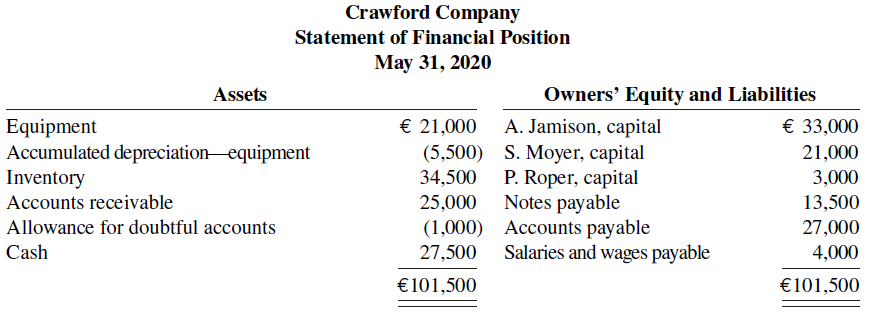

The partners in Crawford Company decide to liquidate the firm when the statement of financial position shows

Question:

The partners in Crawford Company decide to liquidate the firm when the statement of financial position shows the following.

The partners share income and loss 5:3:2. During the process of liquidation, the following transactions were completed in the following sequence.

1. A total of €51,000 was received from converting non-cash assets into cash.

2. Gain or loss on realization was allocated to partners.

3. Liabilities were paid in full.

4. P. Roper paid his capital deficiency.

5. Cash was paid to the partners with credit balances.

Instructions

a. Prepare the entries to record the transactions.

b. Post to the cash and capital accounts.

c. Assume that Roper is unable to pay the capital deficiency.

1. Prepare the entry to allocate Roper’s debit balance to Jamison and Moyer.

2. Prepare the entry to record the final distribution of cash.

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer:

Accounting Principles

ISBN: 978-1119419617

IFRS global edition

Authors: Paul D Kimmel, Donald E Kieso Jerry J Weygandt