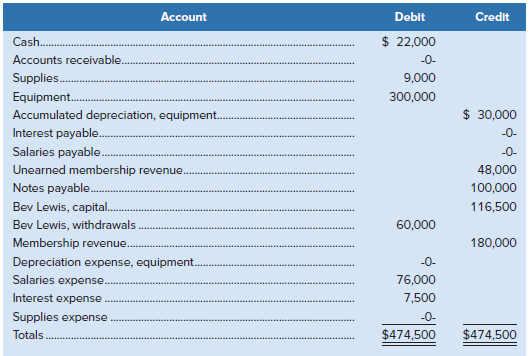

The unadjusted trial balance for Lewis Fitness Centre as of December 31, 2020, follows: Information necessary to

Question:

The unadjusted trial balance for Lewis Fitness Centre as of December 31, 2020, follows:

Information necessary to prepare adjusting entries is as follows:

a. As of December 31, employees have earned $1,600 of unpaid and unrecorded wages. The next payday is January 8, and the total wages to be paid will be $2,400.

b. The cost of supplies on hand at December 31 is $3,600.

c. The note payable requires an interest payment to be made every three months. The amount of unrecorded accrued interest at December 31 is $2,500, and the next payment is due on January 15. This payment will be $3,000.

d. An analysis of the unearned membership revenue shows that $32,000 remains unearned at December 31.

e. In addition to the membership revenue included in the revenue account, the company has earned another $24,000 in revenue that will be collected on January 21. The company is also expected to collect $14,000 on the same day for new revenue during January.

f. Depreciation expense for the year is $30,000.

Required

1. Prepare adjusting journal entries.

2. Prepare journal entries to reverse the effects of the adjusting entries that involve accruals.

3. Prepare journal entries to record the cash payments and collections that are described for January.

Step by Step Answer:

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann