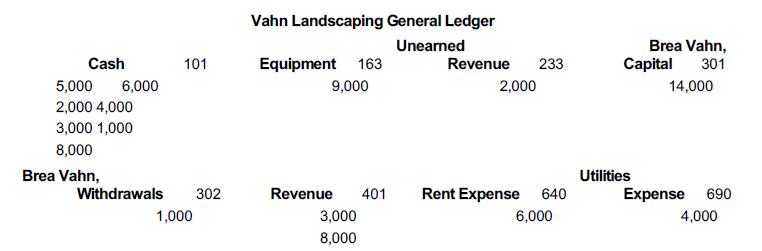

Using the account information shown below, prepare a trial balance at January 31, 2023. Cash 5,000 6,000

Question:

Using the account information shown below, prepare a trial balance at January 31, 2023.

Transcribed Image Text:

Cash 5,000 6,000 2,000 4,000 3,000 1,000 8,000 Brea Vahn, 101 Withdrawals 302 1,000 Vahn Landscaping General Ledger Unearned Equipment 163 9,000 Revenue 401 3,000 8,000 Revenue 233 2,000 Rent Expense 640 6,000 Brea Vahn, 301 14,000 Capital Utilities Expense 690 4,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (7 reviews)

Acct No 101 Cash 163 233 301 302 401 640 690 Equipment U...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Fundamental Accounting Principles Volume 1

ISBN: 9781260881325

17th Canadian Edition

Authors: Kermit D. Larson, Heidi Dieckmann, John Harris

Question Posted:

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

Koto Merchants uses a perpetual inventory system and both an accounts receivable and an accounts payable subsidiary ledger. Balances related to both the general ledger and the subsidiary ledgers for...

-

Jeter Co. uses a perpetual inventory system and both an accounts receivable and an accounts payable subsidiary ledger. Balances related to both the general ledger and the subsidiary ledgers for Jeter...

-

You will need the working papers that accompany this textbook in order to work this mini practice set. Bluma Co. uses a perpetual inventory system and both an accounts receivable and an accounts...

-

Ethelbert.com is a young software company owned by two entrepreneurs. It currently needs to raise $400,000 to support its expansion plans. A venture capitalist is prepared to provide the cash in...

-

Big Daddys BBQ, Inc. (Big Daddys), franchises restaurants. The company currently has approximately 215 franchisees operating Big Daddys restaurants in 22 states. Big Daddys standard franchise...

-

Johnson & Johnson have been able to establish strong brand equity for its line of baby products. What benefits does J&J have because of its brand equity for these products?

-

Will the confidence interval for the slope parameter include zero or not? Explain.

-

You want to estimate the average SAT score for all students who took the Ethan-Davies SAT Preparation course during the past 2 years. You select a simple random sample of 100 such students from a...

-

Sheridan Manufacturing Company currer of its products. The annual production Material cost Labor cost Overhead Batch-level set-up costs for the yea Product-level manager's salary Allocated...

-

Get It Right, CPAs, has been retained to review its client's corporate formation calculations for 20XX. Maria, Roger, and Novak created Grassroots Tennis, Inc. (GTI), which began operations on March...

-

Wilm Schmidt, the owner of Wilms Window Washing Services, had difficulty getting the debits to equal credits on the January 31, 2023, trial balance. The following errors were discovered: 1. Schmidt...

-

Prepare journal entries to record the following August 2023 transactions of a new business called For the Love of Pixels. Aug. 1 Joseph Eagle, the owner, invested $20,000 cash and photography...

-

A palindrome is a string that reads the same in both directions. For example, mom, kayak, and avid diva are all palindromes. Write a recursive method named isPalindrome that determines whether a...

-

Q Proprietorinc (the lessee) enters into a 10 year lease of a property with an option to extend the contract for 5 years. Lease payments are $50,000 per year, payable at the beginning of each year....

-

1.Think about your investment Possibility for 3 years holding period in real investment environment? A.What could be your investment objectives? B. What amount of fund you could invest for three...

-

3- The student council normally sells 1500 school T-shirts for $12 each. This year they plan to decrease the price of the T-shirts. Based on student feedback, they know that for every $0.50 decrease...

-

2. The notation {f(x): x S} means "the set of all values that can be produced by substituting an element x of set S into f(x)." For example, the set of all odd integers can be expressed as {2k+1kZ}....

-

Implementation guidance for IFRS 2 indicates that it "accompanies, but is not part of, IFRS 2." In other words, this implementation guidance is considered mandatory. integral to the standard. not...

-

Some people consider the Hackman-Oldham job characteristics model outdated. Do you feel it still has application in organizations? Why or why not?

-

Funds are separate fiscal and accounting entities, each with its own self-balancing set of accounts. The newly established Society for Ethical Teachings maintains two funds-a general fund for...

-

Organic Market, a grocery store, purchased supplies for $12,000 cash on July 1, 2017. As of December 31, 2017, $7,000 had been used and $5,000 of supplies had not been used. Organic Market prepares...

-

Kiss the Chef Co., a cooking school, purchased a two-year insurance policy on April 1, 2017, paying cash of $7,680. Its year-end is December 31. a) Record the journal entry on April 1, 2017. b) How...

-

On January 1, 2017, Taco Taqueria, a Mexican restaurant, purchased equipment for $12,000 cash. Taco Taqueria estimates that the equipment will last five years (useful life). The restaurant expects to...

-

The payroll register of Ruggerio Co. indicates $13,800 of social security withheld and $3,450 of Medicare tax withheld on total salaries of $230,000 for the period. Federal withholding for the period...

-

All of the following are included on Form 1040, page 1, EXCEPT: The determination of filing status. The Presidential Election Campaign check box. The income section. The paid preparer signature line.

-

Question One: (25 marks) (X) Inc. purchased 80% of the outstanding voting shares of (Y) for $360,000 on July 1, 2017. On that date, (Y) had common shares and retained earnings worth $180,000 and...

Study smarter with the SolutionInn App