Using the information in Problem 3-9B, complete the following: 1. Set up balance column accounts for Hallmark

Question:

Using the information in Problem 3-9B, complete the following:

1. Set up balance column accounts for Hallmark Surveying Services and enter the balances listed in the unadjusted trial balance.

2. Post the adjusting entries prepared in Problem 3-9B to the balance column accounts.

3. Prepare an adjusted trial balance.

4. Use the adjusted trial balance to prepare an income statement, a statement of changes in equity, and a balance sheet. Assume that the owner, Ben Hallmark, made owner investments of $4,000 during the month.

Analysis Component: At December 31, 2020, how much of the business’s assets are financed by the owner? by debt? Assuming total assets at the end of the previous month totalled $84,200, did equity financing increase or decrease during December? Generally speaking, is this a favourable or unfavourable change?

For Part 1, your instructor may ask you to set up T-accounts instead of balance column accounts. The solution is available in both formats.

Problem 3-9

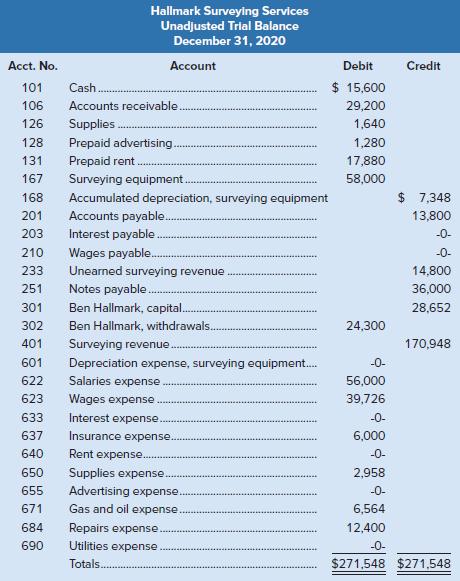

Ben Hallmark, the owner of Hallmark Surveying Services, has been in business for two years. The unadjusted trial balance at December 31, regarding the month just ended, follows.

Step by Step Answer:

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann