Question:

WestJet is a a Canadian company with clear focus on its employees and customers. Reference the financial statements in Appendix II, particularly the link to the notes, referring to Note 11 and 12. Below are selected sections presented for your review:

Required

Using the information provided above, answer the following questions.

1. Identify the total dollar value of dividends declared and paid by West Jet Corporation in fiscal 2017 and 2016.

2. How many common shares are authorized?

3. What is the difference between WestJet common shares and variable voting shares?

4. How many variable voting shares did WestJet have outstanding at the end of 2017, and how many common shares outstanding at the end of 2017.

5. What are dividends? Be sure to include as part of your answer the effect of dividends on equity.

6. How many shares can employees purchase?

7. Why might WestJet offer the shares for employees?

8. On January 1, 2017 Tina owns 1,000 shares that she has accumulated through the employee share purchase plan. Identify WestJet?s quarterly dividend rate in their financial statement note 12 and calculate her total dividends received for fiscal 2017, assuming she has not accumulated any further shares over the year.

Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Transcribed Image Text:

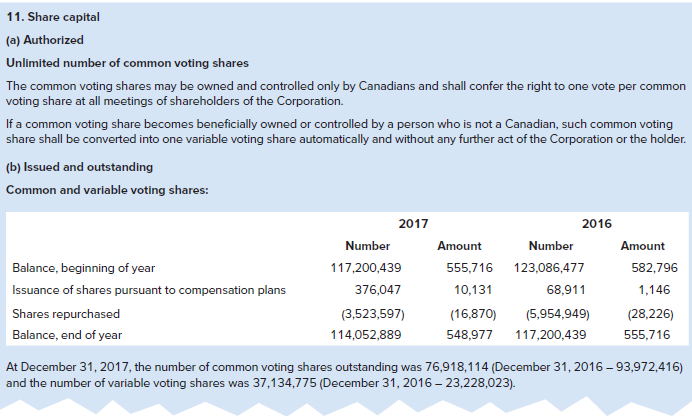

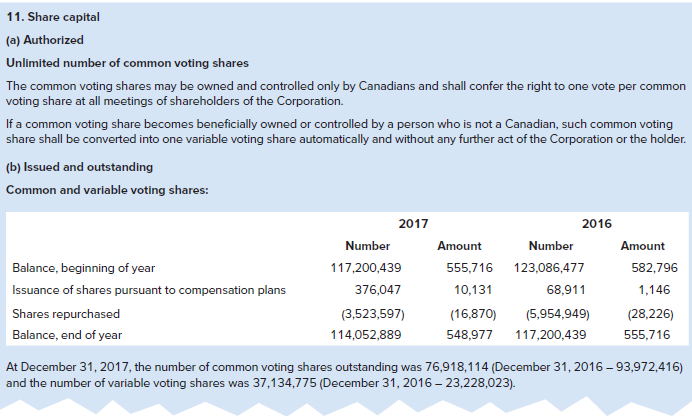

11. Share capital (a) Authorized Unlimited number of common voting shares The common voting shares may be owned and controlled only by Canadians and shall confer the right to one vote per common voting share at all meetings of shareholders of the Corporation. If a common voting share becomes beneficially owned or controlled by a person who is not a Canadian, such common voting share shall be converted into one variable voting share automatically and without any further act of the Corporation or the holder. (b) Issued and outstanding Common and variable voting shares: 2016 2017 Number Amount Number Amount 117,200,439 Balance, beginning of year 555,716 123,086,477 582,796 10,131 1,146 Issuance of shares pursuant to compensation plans 376,047 68,911 (28,226) Shares repurchased (3,523,597) (16,870) (5,954,949) Balance, end of year 114,052,889 548,977 117,200,439 555,716 At December 31, 2017, the number of common voting shares outstanding was 76,918,114 (December 31, 2016 – 93,972,416) and the number of variable voting shares was 37,134,775 (December 31, 2016 – 23,228,023). (h) Employee share purchase planwned and controlled only by Canadians and shall confor the right to one vote per common The Corporation has an employee share purchase plan (ESPP), whereby the Corporation matches the contributions made by employees. Under the terms of the ESPP, employees may, dependent on their employment agreement, contribute up to a maximum of 10%, 15% or 20% of their gross salary to acquire voting shares of the Corporation at the current fair market value. The contributions are matched by the Corporation and are required to be held within the ESPP for a period of one year. Employees may offer to sell ESPP shares, which have not been held for at least one year, to the Corporation, at a purchase price equal to 50% of the weighted average trading price of the Corporation's voting shares for the five trading days immediately preceding the employee's notice to the Corporation, to a maximum of four times per year. 12. Dividends orporation 2016 Number Number Amount Amount During the year ended December 31, 2017, the Corporation's Board of Directors declared quarterly cash dividends of $0.14 per common voting share and variable voting share. For the year ended December 31, 2017, the Corporation paid dividends totaling $64,886 (2016 – $66,967).