William Curtis is a personal finance expert and owns Much Money Consulting. This is his first month

Question:

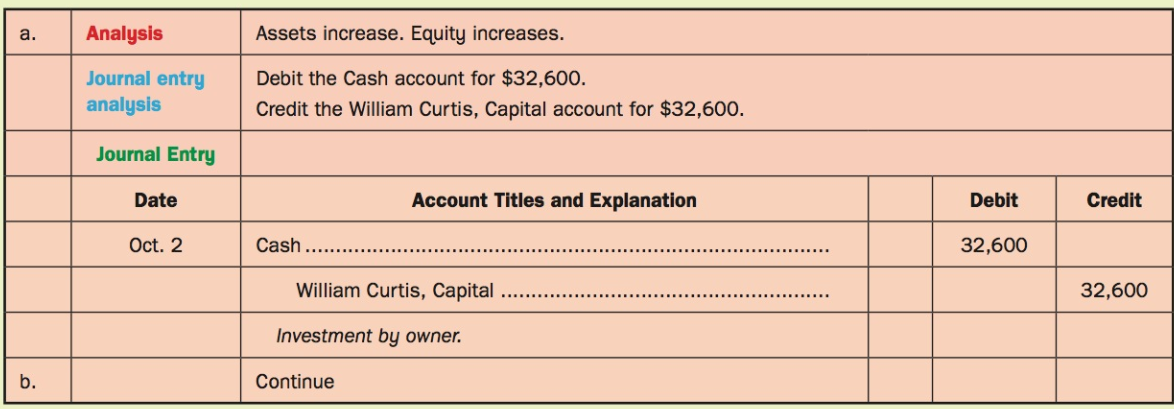

a. On October 2, William Curtis invested $32,600 cash into his business.

b. On October 4, purchased $925 of office supplies for cash.

c. On October 6, purchased $13,600 of office equipment on credit.

d. On October 10, received $3,000 cash as revenue for being a guest on the TV show CityTalk.

e. On October 12, paid for the office equipment purchased in transaction (c).

f. On October 16, billed a customer $5,400 for delivering a corporate workshop on smart investing.

g. On October 18, paid October€™s rent for the downtown office with $3,500 cash.

h. On October 26, collected cash for all of the account receivable created in transaction (f).

i. On October 31, withdrew $5,000 cash from the business for a trip to Hawaii.

Required

For each transaction,

(1) complete the analysis,

(2) determine the journal entry analysis

(3) record the journal entry. Use the template below. Transaction a. has been completed for you.

Step by Step Answer:

Fundamental Accounting Principles Volume 1

ISBN: 9781259259807

15th Canadian Edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann