Yardworx reconciled its book balance of Cash with its bank statement balance on April 30 and showed

Question:

Yardworx reconciled its book balance of Cash with its bank statement balance on April 30 and showed two cheques outstanding at that time, #1771 for $15,463.10 and #1780 for $955.65.

The following information is available for the May 31, 2020, reconciliation:

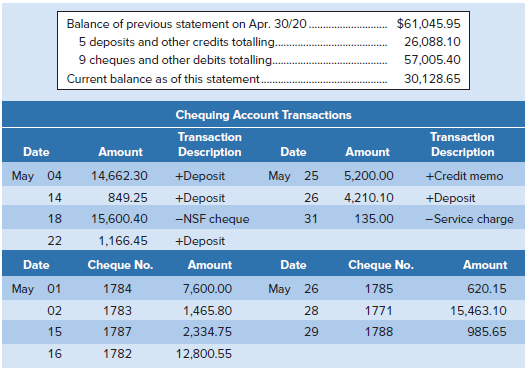

From the May 31, 2020, bank statement:

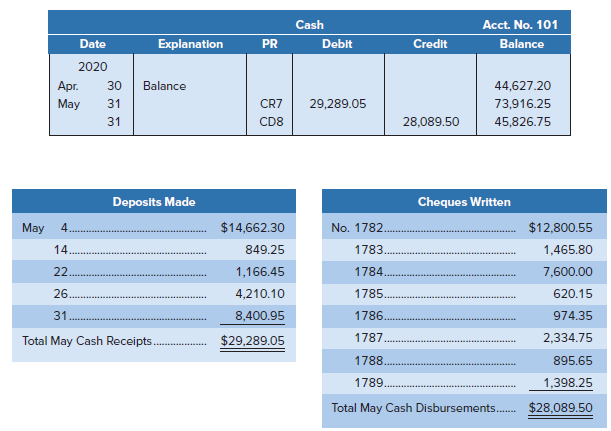

From Yardworx?s accounting records:

? Cheque #1788 was correctly written for $985.65 to pay for May utilities; however, the bookkeeper misread the amount and entered it in the accounting records with a debit to Utilities Expense and a credit to Cash as though it were for $895.65. The bank paid and deducted the correct amount.

? The NSF cheque was originally received from a customer, Gertie Mayer, in payment of her account. Its return was unrecorded.

? The credit memo resulted from a $5,300 electronic fund transfer for the collection of a customer payment. The bank had deducted a $100 bank service charge fee. The collection has not been recorded in the company?s books.

Required

1. Prepare a bank reconciliation for Yardworx.

2. Prepare the general journal entries needed to adjust the book balance of Cash to the reconciled balance.

Analysis Component: The preceding bank statement discloses two places where the cancelled cheques returned with the bank statement are not numbered sequentially. In other words, some of the prenumbered cheques in the sequence are missing. Several possible situations would explain why the cancelled cheques returned with a bank statement might not be numbered sequentially. Describe three possible reasons that this might occur.

Step by Step Answer:

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann