ZedCon Inc. intends to raise $10,000,000 for the purpose of expanding operations internationally. Two options are available:

Question:

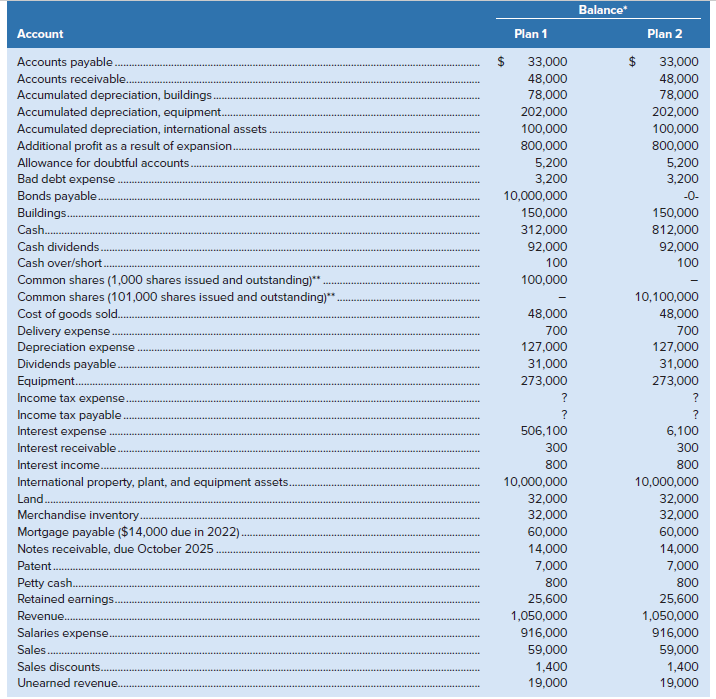

ZedCon Inc. intends to raise $10,000,000 for the purpose of expanding operations internationally. Two options are available:

? Plan 1: Issue $10,000,000 of 5% bonds payable due in 2030, or

? Plan 2: Issue 100,000 common shares at $100 per share.

The expansion is expected to generate additional annual profit before interest and tax of $800,000. ZedCon?s tax rate is 35%. The assumed adjusted trial balance at December 31, 2021, one year after the expansion under each of Plan 1 and Plan 2, is shown below:

Required

Preparation Component:

1. Prepare a single-step income statement for 2021 (showing salaries expense, depreciation expense, cost of goods sold, interest expense, and other expenses) and a classified balance sheet at December 31, 2021, assuming:

a. Plan 1, and then

b. Plan 2.

Analysis Component:

Which financing plan should ZedCon Inc. choose assuming its goal is to:

a. Maximize earnings per share, or

b. Maximize profit.

Explain your answers showing any relevant calculations (rounded to the nearest whole cent).

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Fundamental Accounting Principles Volume II

ISBN: 978-1260305838

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann