Question:

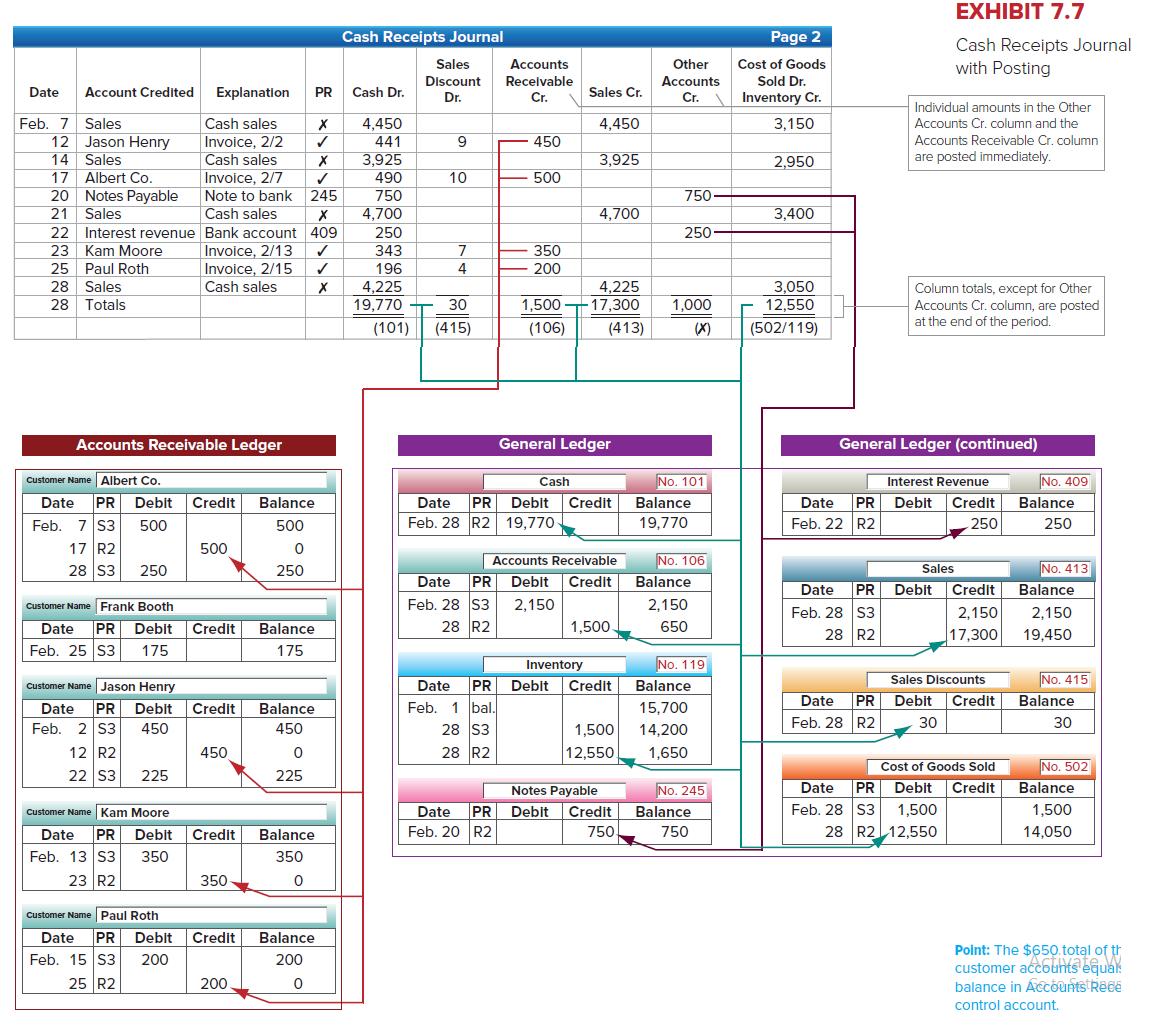

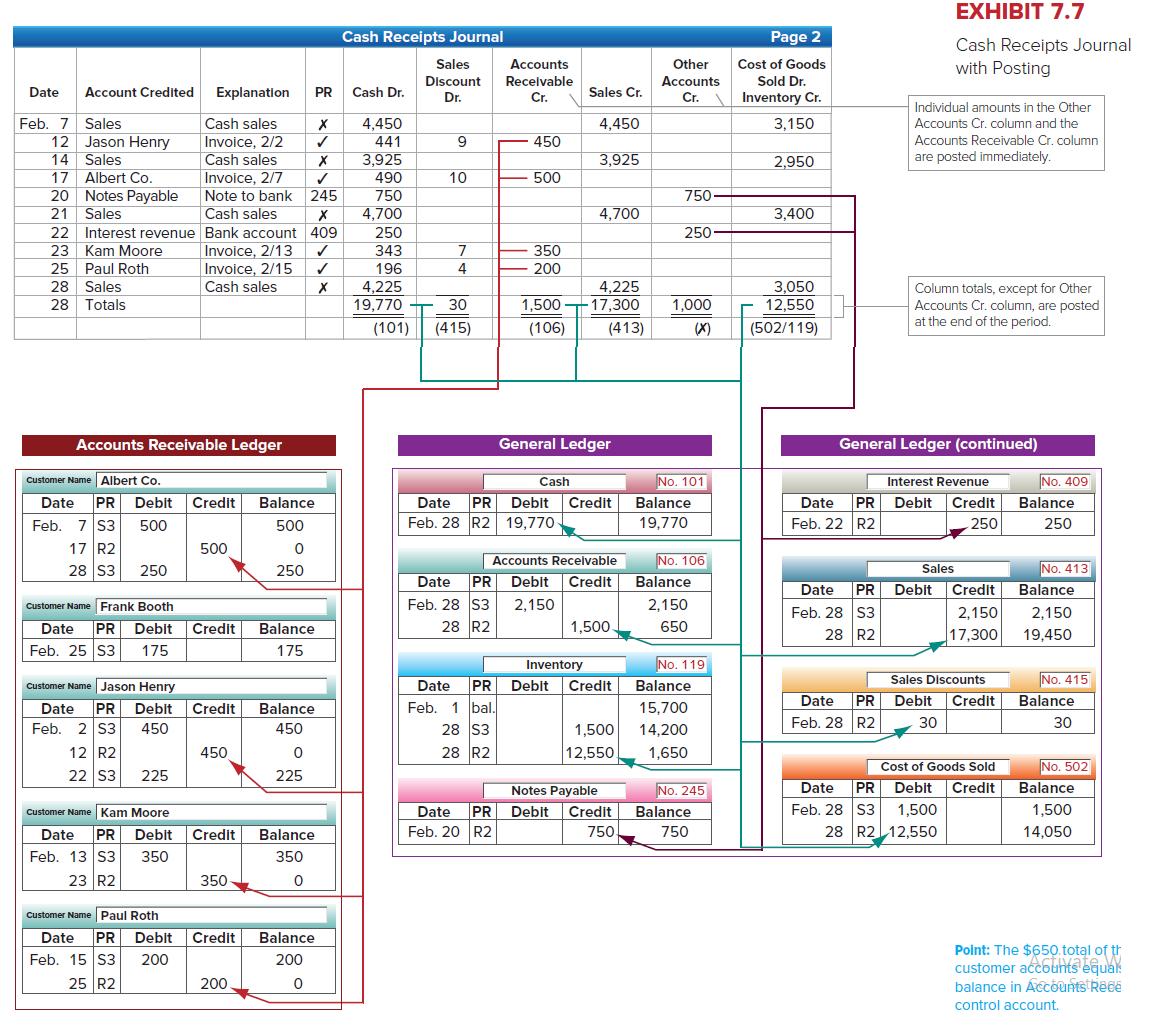

Ali Co. uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. Prepare a cash receipts journal like the one in Exhibit 7.7. Journalize the following transactions that should be recorded in the cash receipts journal.

Nov. 3. The company purchased $3,200 of merchandise on credit from Hart Co., terms n/20.

7. The company sold merchandise costing $840 to J. Than for $1,000 on credit, subject to a $20 sales discount if paid by the end of the month.

9. The company borrowed $3,750 cash by signing a note payable to the bank.

13. J. Ali, the owner, contributed $5,000 cash to the company.

18. The company sold merchandise costing $250 to B. Cox for $330 cash.

22. The company paid Hart Co. $3,200 cash for the merchandise purchased on November 3.

27. The company received $980 cash from J. Than in payment of the November 7 purchase.

30. The company paid salaries of $1,650 in cash.

Data From Exhibit 7.7

Transcribed Image Text:

EXHIBIT 7.7 Cash Receipts Journal Page 2 Cash Receipts Journal with Posting Sales Accounts Other Cost of Goods Discount Recelvable Accounts Sold Dr. Date Account Credited Explanation PR Cash Dr. Sales Cr. Cr. Inventory Cr. Dr. Cr. Individual amounts in the Other Feb. 7 Sales 12 Jason Henry 14 Sales 17 Albert Co. 20 Notes Payable 21 Sales Cash sales 4,450 4,450 3,150 Accounts Cr. oolumn and the Invoice, 2/2 Cash sales Invoice, 2/7 Note to bank 245 Cash sales 441 9. 450 Accounts Receivable Cr. column 3,925 3,925 2,950 are posted immediately. 490 10 500 750 750 4,700 4,700 3,400 22 Interest revenue Bank account 409 250 250 23 Kam Moore 25 Paul Roth 28 Sales 28 Totals 343 Invoice, 2/13 Invoice, 2/15 350 196 4 200 Cash sales 4,225 19,770 4,225 17,300 3.050 Column totals, except for Other Accounts Cr. column, are posted at the end of the period. 30 1,500 - 1,000 12,550 (101) (415) (106) (413) (X) (502/119) Accounts Receivable Ledger General Ledger General Ledger (continued) Customer Name Albert Co. Cash No. 101 Interest Revenue No. 409 Date PR Debit Credit Feb. 7 S3 17 R2 Balance Date PR Debit Credit Balance Date PR Debit Credit Balance 500 500 Feb. 28 R2 19,770 19,770 Feb. 22 R2 250 250 500 Accounts Receivable No. 106 Balance 28 S3 250 250 Sales No. 413 Date PR Debit Credit Date PR Debit Credit Feb. 28 S3 Balance Feb. 28 S3 28 R2 Customer Name Frank Booth 2,150 2,150 2,150 2,150 Date PR Debit Credit Balance 1,500 650 28 R2 17,300 19,450 Feb. 25 S3 175 175 Inventory No. 119 Sales Discounts Credit Customer Name Jason Henry PR Debit Credit No. 415 Date Balance Date PR Debit Balance Date PR Debit Credit Feb. 2 S3 Balance Feb. 1 bal 15,700 28 S3 Feb. 28 R2 30 30 450 450 1,500 14,200 12 R2 450 28 R2 12,550 1,650 Cost of Goods Sold No. 502 22 S3 225 225 No. 245 Date PR Debit Credit Balance Notes Payable PR Deblt Feb. 28 S3 28 R2 12,550 Customer Name Kam Moore Date Credit Balance 1,500 1,500 Date PR Debit Credit Balance Feb. 20 R2 750 750 14,050 Feb. 13 S3 350 350 23 R2 350 Customer Name Paul Roth Date PR Deblt Feb. 15 S3 Credit Balance Point: The $650.total of th customer accounts equal balance in Áccounts Rece control account. 200 200 25 R2 200