Assumed data for Samsung and Apple follow. Required 1. Compute the degree of operating leverage for each

Question:

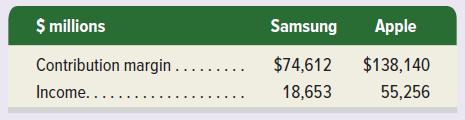

Assumed data for Samsung and Apple follow.

Required

1. Compute the degree of operating leverage for each company.

2. Based on the degree of operating leverage, which company’s income will increase more from an increase in unit sales?

Transcribed Image Text:

$ millions Samsung Apple Contribution margin ..... $74,612 $138,140 Income.... 18,653 55,256

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 54% (11 reviews)

1 2 Samsung Samsung has a higher degree of operati...View the full answer

Answered By

Muhammad Ahtsham Shabbir

I am a professional freelance writer with more than 7 years’ experience in academic writing. I have a Bachelor`s Degree in Commerce and Master's Degree in Computer Science. I can provide my services in various subjects.

I have professional excellent skills in Microsoft ® Office packages such as Microsoft ® Word, Microsoft ® Excel, and Microsoft ® PowerPoint. Moreover, I have excellent research skills and outstanding analytical and critical thinking skills; a combination that I apply in every paper I handle.

I am conversant with the various citation styles, among them; APA, MLA, Chicago, Havard, and AMA. I also strive to deliver the best to my clients and in a timely manner.My work is always 100% original. I honestly understand the concern of plagiarism and its consequences. As such, I ensure that I check the assignment for any plagiarism before submission.

4.80+

392+ Reviews

587+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Information for two companies follows. (1) Compute the degree of operating leverage (DOL) for each company. (2) Which company is expected to produce a greater percent increase in income from a 20%...

-

The degree of operating leverage for Dousmann Corp. and PCB Co. are 1.4 and 5.6, respectively. Both have net incomes of $50,000. Determine their respective contribution margin s.

-

The degree of operating leverage for Montana Corp. and APK Co. are 1.6 and 5.4, respectively. Both have net incomes of $50,000. Determine their respective contribution margin s. Discuss.

-

A company acquires the assets and liabilities of another company. The fair value of the acquired companys identifiable net assets is $5,000,000. The acquisition transaction includes the following:...

-

We want to find the change in u for carbon dioxide between 600 K and 1200 K. a) Find it from a constant Cvo from table A.5 b) Find it from a Cvo evaluated from equation in A.6 at the average T. c)...

-

What are the steps necessary for success of nations? Support your argument with examples where possible.

-

Are you aware of having your own behaviour conditioned in this way? 101-1

-

Sam Nix owns Nix Estate Planning and Investments. The trial balance of the firm for June 30, 2016, the first month of operations, is shown below. INSTRUCTIONS 1. Complete the worksheet for the month....

-

Kid Trax located in Madison, Wisconsin manufactures electric riding vehicles for children. There is highest demand for these products in December. The following labor standards have been established...

-

Via Gelato is a popular neighborhood gelato shop. The company has provided the following cost formulas and actual results for the month of June: Revenue Raw materials Wages Utilities Rent Insurance...

-

SmartSweets, launched by entrepreneur Tara Bosch as described in this chapters opener, makes gummy candy without sugar and from all-natural ingredients. Required 1. Identify at least two fixed costs...

-

Following are four series of costs measured at various volume levels. Identify each series as either fixed, variable, mixed, or step-wise. A D E Volume (Units) Series A Series B Series C Series D $...

-

For these items, rewrite the sentences so that they use active voice instead of passive. The damaged equipment was returned by the customer before we even located a repair facility.

-

Winston Electronics reported the following information at its annual meetings. The company had cash and marketable securities worth $1,235,740, accounts payables worth $4,160,391, inventory of...

-

Hooray Company has been manufacturing 12,000 units of Part A which is used to manufacture one of its products. At this level of production, the cost per unit is as follows: Direct materials P 4.80...

-

At the beginning of the period, the Grinding Department budgeted direct labor of $171,200 and property tax of $57,000 for 10,700 hours of production. The department actually completed 12,800 hours of...

-

The following information is available for Shamrock Corporation for the year ended December 31, 2025. Beginning cash balance $ 58,500 Accounts payable decrease 4,810 Depreciation expense 210,600...

-

In today's stock market, compounding is the key to making money in the future for one's investments. However, with decentralized currency growing rapidly (Crypto), how can one rely on TVM for FV...

-

Manitoba Manufacturing Inc. (MMI) has a loan from the Canadian National Bank to help finance its working capital. The terms of the loan are that the bank will lend MMI an amount up to 33% of its...

-

The manager of a local convenience store is expanding his line of small toy items. To price these new items, the manager is looking at the prices being charged by competing retailers in his area. For...

-

Compare and contrast an operating lease with a capital lease.

-

Describe the two basic types of pension plans.

-

Describe the two basic types of pension plans.

-

There is a credit rating agency for businesses that gives out various amounts of information based on the subscription level. This company is called a. Business Credit Scoring b. Fair Issue c. Dun...

-

Current Attempt in Progress On July 3 1 , 2 0 2 2 , Crane Compary had a cash balance per books of $ 6 , 2 4 5 . 0 0 . The statement from Dakata State Bark on that date showed a balance of $ 7 , 7 9 5...

-

Cede & Co. expects its EBIT to be $89,000 every year forever. The firm can borrow at 5 percent. Cede currently has no debt, and its cost of equity is 10 percent. If the tax rate is 35 percent, what...

Study smarter with the SolutionInn App