At December 31, 2023, Halifax Servicings balance sheet showed capital asset information as detailed in the schedule

Question:

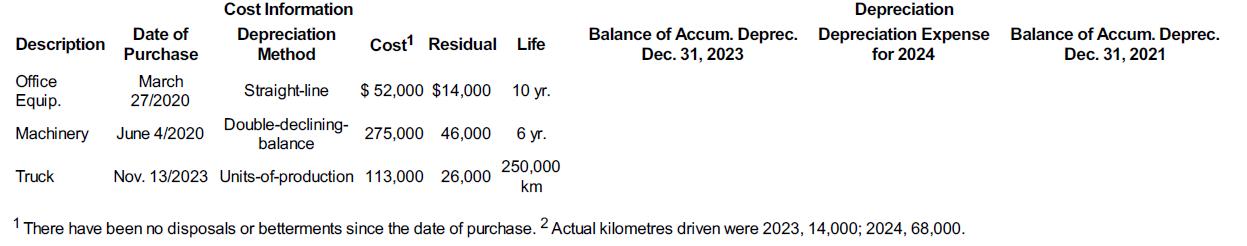

At December 31, 2023, Halifax Servicing’s balance sheet showed capital asset information as detailed in the schedule below. Halifax calculates depreciation to the nearest whole month.

RequiredComplete the schedule.

Transcribed Image Text:

Description Date of Purchase Office Equip. Machinery June 4/2020 March 27/2020 Truck Cost Information Depreciation Method Cost¹ Residual Life Straight-line Double-declining- balance Nov. 13/2023 Units-of-production 113,000 26,000 $ 52,000 $14,000 10 yr. Balance of Accum. Deprec. Dec. 31, 2023 275,000 46,000 6 yr. 250,000 km 1 There have been no disposals or betterments since the date of purchase. 2 Actual kilometres driven were 2023, 14,000; 2024, 68,000. Depreciation Depreciation Expense for 2024 Balance of Accum. Deprec. Dec. 31, 2021

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 77% (9 reviews)

Description Date of Purchase Office Equipment Machinery June 420 Truck March 2720 Nov 132...View the full answer

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

Fundamental Accounting Principles Volume 2

ISBN: 9781260881332

17th Canadian Edition

Authors: Kermit D. Larson, Heidi Dieckmann, John Harris

Question Posted:

Students also viewed these Business questions

-

At December 31, 2014, Halifax Servicings balance sheet showed capital asset information as detailed in the schedule below. Halifax calculates depreciation to the nearest whole month. 1 There have...

-

At December 31, 2020, Halifax Servicing?s balance sheet showed capital asset information as detailed in the schedule below. Halifax calculates depreciation to the nearest whole month. Required...

-

At December 31, 2013, Oroplata Explorations balance sheet showed total PPE assets of $802,000 and total accumulated depreciation of $339,980 as detailed in the PPE Subledger below. Oroplata...

-

Taft Corporation operates primarily in the United States. However, a few years ago it opened a plant in Spain to produce merchandise to sell there. This foreign operation has been so successful that...

-

What do BFS contain? Discuss.

-

Journal entries, T-accounts and source documents. Production Company produces gadgets for the coveted small appliance market. The following data reflects activity for the year 2008. Production Co....

-

5. What is goodwill? How is goodwill treated under current GAAP/IFRS?

-

Through process measuring a number of pizza delivery times, Mary Janes Pizzeria finds the mean of all samples to be 27.4 minutes, with an average sample range of 5.2 minutes. They tracked four...

-

For each of the following scenarios, list the purpose(s) of the visualization and the type(s) of visualization that would best fulfill the purpose(s). Justify your choice. (a) A stock analyst is...

-

Edmonton Ice Rink purchased a Zamboni ice-resurfacing machine for $28,000, terms 1/10, n/60, FOB shipping point. Edmonton Ice received a freight invoice from On-time Delivery for $450. Edmonton Ice...

-

At April 30, 2023, Hackney Building Products year-end, the balance sheet showed PPE information as detailed in the schedule below. The company calculates depreciation for partial periods using the...

-

A fair coin has probability 0.5 of coming up heads. a. If you toss a fair coin twice, are you certain to get one head and one tail? b. If you toss a fair coin 100 times, are you certain to get 50...

-

Assume that John wants to annuitize the annuity and is told that he can receive a straight life annuity for $600 a month for life. If the actuarial number of payments is 300, how much of the first...

-

An epidemiologist plans to conduct a survey to estimate the percentage of women who give birth. How many women must be surveyed in order to be 90% confident that the estimated percentage is in error...

-

Your homework for this week is to watch the first lecture on Financial Accounting and at the end of the outline there are several problems for you to do. The problems begin with parts A-D for you to...

-

Sheril Rose was a brilliant but penniless material scientist. She had designed a new type of solar panel she believed had great commercial potential. On January 15, she approached Felda Higgins, a...

-

IAS 23 requires companies to capitalize borrowing costs directly attributable to the acquisition, construction or production of an asset into the cost of an asset.Previously, accounting standard...

-

Create a corporate policy designed to minimize inventory shrinkage related to theft, stocking errors, shipping errors, etc., indicating how the policy will be enforced and procedures that may need to...

-

Complete problem P10-21 using ASPE. Data from P10-21 Original cost ................................................................. $7,000,000 Accumulated depreciation...

-

Mogul Ltd., a ski boot manufacturer, showed the following amounts for its year just ended October 31, 2017. Prepare a multi-step income statement assuming a tax rate of 25%. Cost of goods sold Gain...

-

The equity sections from the 2017 and 2018 balance sheets of Fab-Form Industries Inc. appeared as follows: On March 16, June 15, September 5, and November 22, 2018, the board of directors declared...

-

Benson Inc. had a credit balance in Retained Earnings on December 31, 2017, of $48,000. During 2018, Benson recorded profit of $146,000 and declared and paid dividends of $47,000. During 2019, the...

-

Each week you must submit an annotated bibliography. Entries of current events relating to the economic concepts and the impact on the company or the industry of your company. You must use acceptable...

-

Fluffy Toys Ltd produces stuffed toys and provided you with the following information for the month ended August 2020 Opening WIP Units 5,393 units Units Started and Completed 24,731 units Closing...

-

Part A Equipment 1,035,328 is incorrect Installation 44,672 is incorrect Anything boxed in red is incorrect sents 043/1 Question 9 View Policies Show Attempt History Current Attempt in Progress...

Study smarter with the SolutionInn App