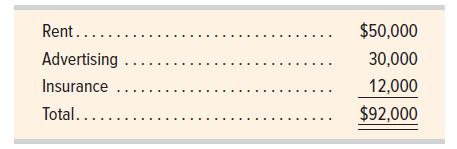

Harmons has two operating departments, Clothing and Shoes. Indirect expenses for the period follow. The company occupies

Question:

Harmon’s has two operating departments, Clothing and Shoes. Indirect expenses for the period follow.

The company occupies 4,000 square feet of a rented building. In prior periods, the company divided the $92,000 of indirect expenses by 4,000 square feet to find an average cost of $23 per square foot, and then allocated indirect expenses to each department based on the square feet it occupied.

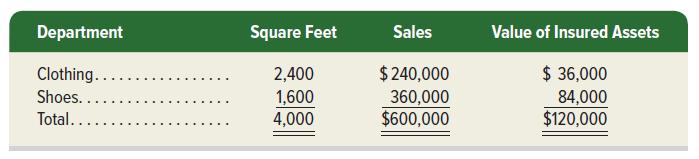

The company now wants to allocate indirect expenses using the allocation bases shown below.

Required

1. Allocate indirect expenses to the two departments using the allocation method used in prior periods.

2. Allocate indirect expenses to the two departments. Rent expense is allocated based on square feet occupied. Advertising expense is allocated based on total sales. Insurance expense is allocated based on the value of insured assets.

Step by Step Answer: