Refer to E4-16. Required: Using the adjusted balances in E4-16, give the closing journal entry for the

Question:

Refer to E4-16.

Required:

Using the adjusted balances in E4-16, give the closing journal entry for the year ended December 31.

Data From Exercise 4-16:

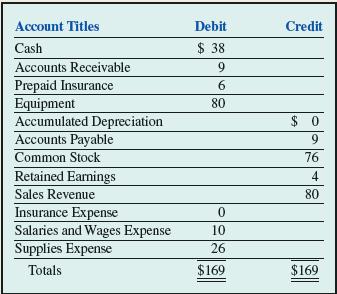

Mint Cleaning Inc. prepared the following unadjusted trial balance at the end of its second year of operations ending December 31.

Other data not yet recorded at December 31:

a. Insurance expired during the year, $5.

b. Depreciation expense for the year, $4.

c. Salaries and wages payable, $7.

d. Income tax expense, $9.

Required:

1. Prepare the adjusting journal entries for the year ended December 31.

2. Using T-accounts, determine the adjusted balances in each account and prepare an adjusted trial balance as of December 31.

3. By what amount would net income have been understated or overstated had the adjusting journal entries not been recorded?

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-0078025914

5th edition

Authors: Fred Phillips, Robert Libby, Patricia Libby