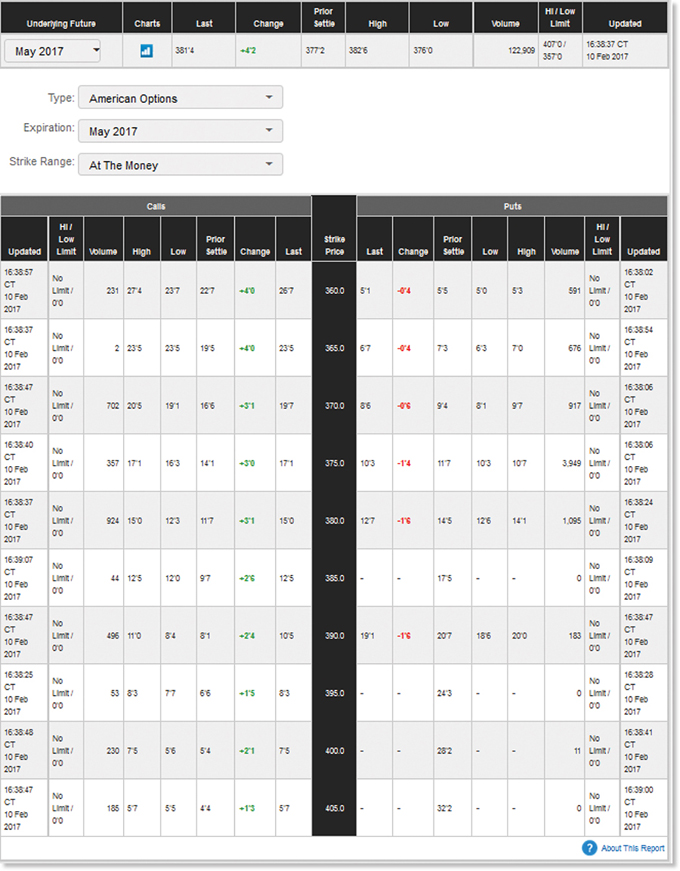

Refer to Table 23.2 in the text to answer this question. Suppose you purchase the May 2017

Question:

Refer to Table 23.2 in the text to answer this question. Suppose you purchase the May 2017 call option on corn futures with a strike price of $3.85. Assume you purchased the option at the last price. How much does your option cost per bushel of corn? What is the total cost? Suppose the price of corn futures is $3.74 per bushel at expiration of the option contract. What is your net profit or loss from this position? What if corn futures prices are $4.13 per bushel at expiration?

Table 23.2

In finance, the strike price of an option is the fixed price at which the owner of the option can buy, or sell, the underlying security or commodity.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Corporate Finance

ISBN: 978-1260153590

12th edition

Authors: Stephen M. Ross, Randolph W Westerfield, Robert R. Dockson, Bradford D Jordan

Question Posted: