Extension of Basic CVP Model-Multiple Products and Taxes Assume that Ocean King Products sells three varieties of

Question:

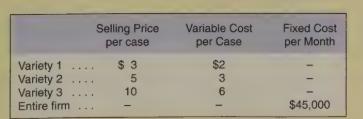

Extension of Basic CVP Model-Multiple Products and Taxes Assume that Ocean King Products sells three varieties of canned seafood with the following prices (L.O. 1)

and costs:

The sales mix (in cases) is 50 percent variety 1, 35 percent variety 2, and 15 percent variety 3.

Required

a. At what sales revenue does the company break even?

b. Suppose the company is subject to a 35 percent tax rate on income. At what sales revenue will the company earn $35,100 after taxes assuming the same sales mix?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Cost Accounting

ISBN: 9780073018379

1st Edition

Authors: Michael W Maher, William N. Lanen, Madhav V. Rajan

Question Posted: