Special Order Hi-Speed Electronics manufactures low-cost, consumer-grade computers. It sells these computers to various electronics retailers to

Question:

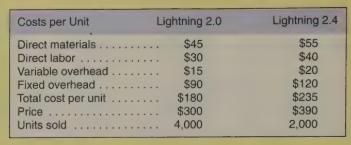

Special Order Hi-Speed Electronics manufactures low-cost, consumer-grade computers. It sells these computers to various electronics retailers to market under store brand names. It manufactures two computers, the Lightning 2.0 and the Lightning 2.4, which differ in terms of speed, included memory, and included hard drive capacity. The following information is available:

The average wage rate is $20 per hour. The plant has a capacity of 18,000 direct labor-hours, but current production uses only 10,000 direct labor-hours.

Required

a. Anationwide discount chain has approached Hi-Speed with an offer to buy 2,000 Lightning 2.0 computers and 2,000 Lightning 2.4 computers if the price is lowered to $200 and $250, respectively, per unit. If Hi-Speed accepts the offer, how many direct labor-hours will be required to produce the additional computers? How much will the profit increase (or decrease) if Hi-Speed accepts this proposal? Prices on regular sales will remain the same.

b. Suppose that the customer has offered instead to buy 3,000 each of the two models at $200 and $250, respectively. How much will the profits change if the order is accepted? Assume that the company cannot increase its production capacity to meet the extra demand.

c. Answer the question in requirement (b), assuming instead that the plant can work overtime. Direct labor costs for the overtime production increase to $30 per hour. Variable overhead costs for overtime production are 50 percent more than for normal production.

Step by Step Answer:

Fundamentals Of Cost Accounting

ISBN: 9780073018379

1st Edition

Authors: Michael W Maher, William N. Lanen, Madhav V. Rajan